Resource Library

Download and view expert resources on all things HRAs, small business, and human resources.

2025 QSEHRA Report

Download our report to see proprietary data from PeopleKeep customers on how they designed and used their qualified small employer HRA (QSEHRA) in 2024.

Resource library

Download and view expert resources on all things HRAs, small business, and human resources.

Special Report | October 1, 2024

2024 ICHRA Report

Download our report to see proprietary data from PeopleKeep and Remodel Health customers on how they used their individual coverage HRA (ICHRA) in 2024.

Filter

-

Webpage | January 16, 2025

Small business health insurance in Virginia

Explore small business health insurance options in Virginia. Learn...

Topics: State-Specific Health Benefits -

Webpage | January 15, 2025

Small business health insurance in North Carolina

Discover small business health insurance options in North...

Topics: State-Specific Health Benefits -

Webpage | December 16, 2024

Small business health insurance in New Jersey

Discover small business health insurance options in New Jersey....

Topics: State-Specific Health Benefits -

Webpage | December 16, 2024

Small business health insurance in Washington

Explore small business health insurance options in Washington...

Topics: State-Specific Health Benefits -

Downloadable Guide | December 13, 2024

ACA employer mandate penalties flowchart

Download our ACA employer mandate penalties flowchart to see if...

Topics: Applicable Large Employers Compliance ICHRA -

Downloadable Guide | December 6, 2024

2025 HR compliance calendar

Download our 2025 HR compliance calendar to see the important IRS...

Topics: Compliance Human Resources -

Special Report | December 3, 2024

2024 ICHRA Report

Download our report to see proprietary data from PeopleKeep and...

Topics: ICHRA Health Benefits HRA -

Webpage | November 20, 2024

Small business health insurance in Pennsylvania

Learn about plans, coverage, and benefits tailored to Pennsylvania...

Topics: State-Specific Health Benefits -

Webpage | November 20, 2024

Small business health insurance in Colorado

Find the right coverage and benefits for your Colorado-based...

Topics: State-Specific Health Benefits -

Comparison Chart | November 13, 2024

ICHRA vs. group health insurance comparison chart

See how the ICHRA and group health insurance compare.

Topics: ICHRA Health Benefits -

Comparison Chart | November 6, 2024

QSEHRA vs. group health insurance comparison chart

See how the QSEHRA and group health insurance compare.

Topics: QSEHRA Health Benefits -

Webpage | October 17, 2024

Small business health insurance in Minnesota

Learn about plans, coverage, and benefits tailored to Minnesota...

Topics: State-Specific Health Benefits -

Webpage | October 16, 2024

Small business health insurance in Massachusetts

Find the right coverage and benefits for your Massachusetts-based...

Topics: State-Specific Health Benefits -

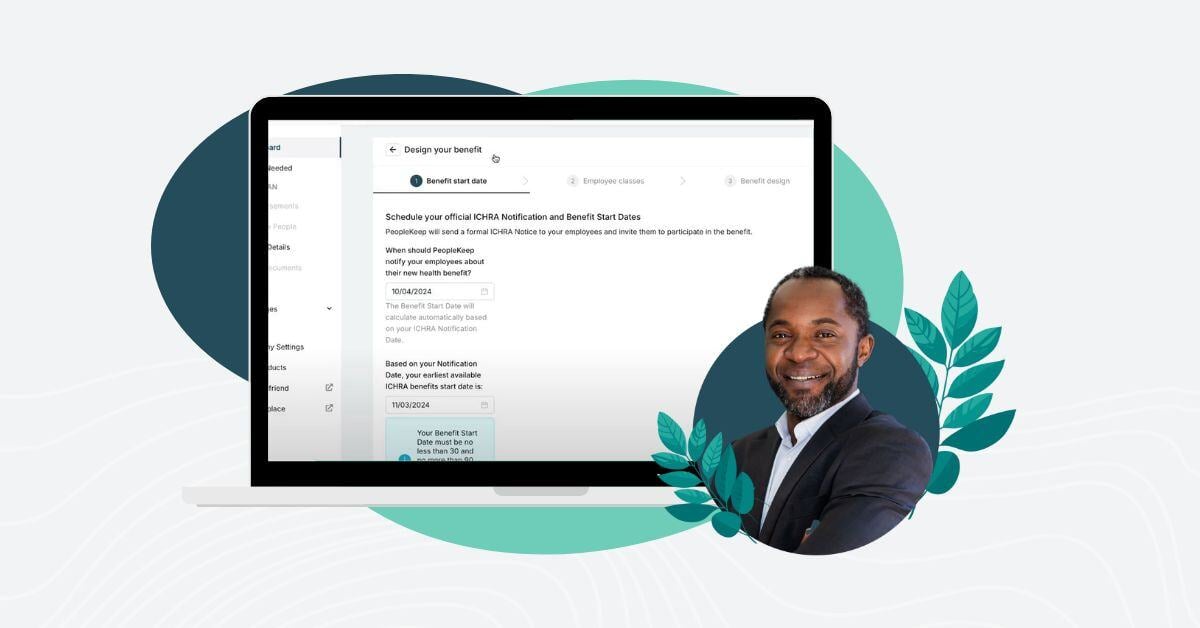

Demo | October 15, 2024

ICHRA administration software demo

Watch our ICHRA product demo to see how you can offer better...

Topics: ICHRA -

Webpage | October 14, 2024

State-by-state guide to open enrollment 2025

A one-stop shop for everything you need to know to enroll in...

Topics: Open Enrollment State-Specific -

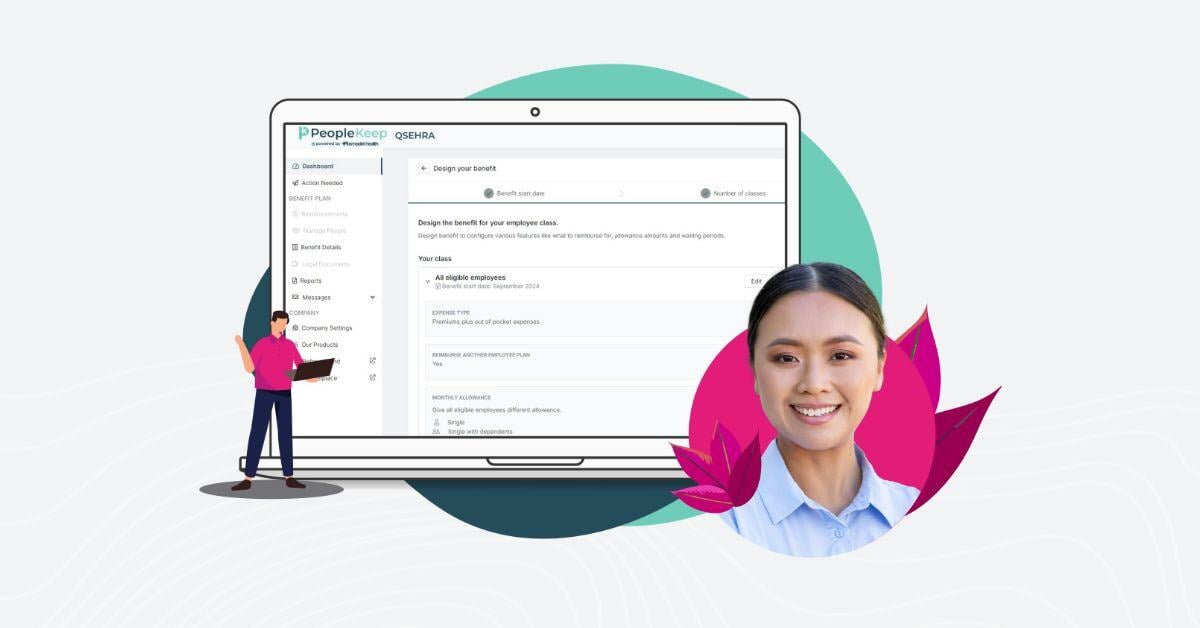

Demo | September 30, 2024

QSEHRA administration software demo

We offer the #1 HRA administration software that empowers...

Topics: QSEHRA -

Webpage | September 25, 2024

Small business health insurance in Ohio

Discover the best small business health insurance options in Ohio....

Topics: State-Specific Health Benefits -

Downloadable Guide | September 19, 2024

The dental office's guide to offering health benefits

In this guide, we cover how dental practices can offer...

Topics: HRA -

Webpage | August 15, 2024

Small business health insurance in Oregon

Find the best health insurance options for your small business in...

Topics: State-Specific Health Benefits -

Webpage | August 14, 2024

Small business health insurance in Tennessee

Looking for affordable small business health insurance in...

Topics: State-Specific Health Benefits -

Webpage | July 18, 2024

Small business health insurance in Texas

Finding health insurance for your small business in Texas doesn't...

Topics: State-Specific Health Benefits -

Webpage | July 12, 2024

State-by-state resources

Looking for HR and health benefits resources specific to your...

Topics: State-Specific Health Benefits Human Resources -

Webpage | June 20, 2024

Guide to Delaware employee benefits and HR rules

Understanding Delaware's employment laws is key for any HR...

Topics: State-Specific Human Resources -

Webpage | May 30, 2024

Small business health insurance in California

Learn what your health benefits options are and how PeopleKeep can...

Topics: Health Benefits State-Specific -

Webpage | May 2, 2024

Small business health insurance in Georgia

Understand your health benefits options in Georgia and how...

Topics: Health Benefits State-Specific -

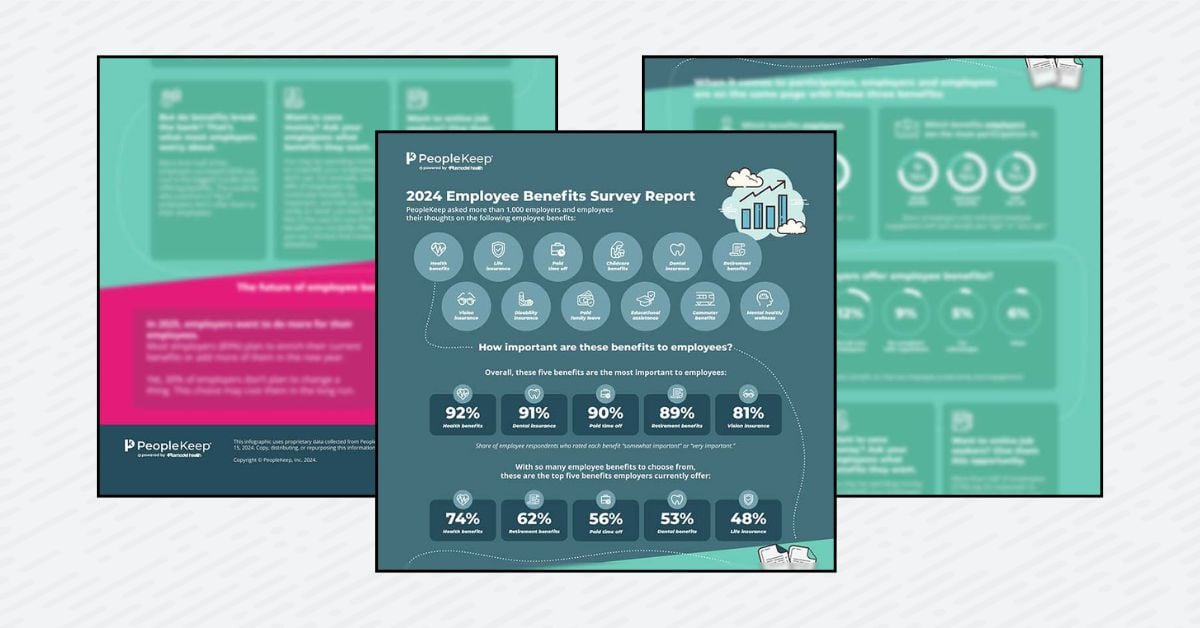

Webpage | April 30, 2024

2024 Employee Benefits Survey Report

See the results from our 2024 Employee Benefits Survey to find out...

Topics: Employee Benefits Small Business -

Webpage | April 24, 2024

Guide to Washington, D.C. employee benefits and HR rules

Navigating Washington, D.C. employee benefits and HR rules can be...

Topics: Human Resources State-Specific -

Webpage | March 28, 2024

Guide to health reimbursement arrangements (HRAs)

A health reimbursement arrangement (HRA) is an IRS-approved health...

Topics: HRA Health Benefits -

Webpage | March 20, 2024

Guide to Connecticut employee benefits and HR rules

Navigating Connecticut's employment laws can be challenging, but...

Topics: Human Resources State-Specific -

Webpage | March 20, 2024

Guide to Wisconsin employee benefits and HR rules

This comprehensive guide provides an overview of Wisconsin...

Topics: Human Resources State-Specific -

Webpage | February 28, 2024

Guide to Illinois employee benefits and HR rules

Navigating Illinois employee benefits and HR rules can be...

Topics: Human Resources State-Specific -

Webpage | February 28, 2024

Guide to Maryland employee benefits and HR rules

Stay compliant with Maryland employment laws and ensure your...

Topics: Human Resources State-Specific -

Special Report | February 13, 2024

2024 QSEHRA Annual Report

Download our report to see proprietary data from PeopleKeep...

Topics: HRA QSEHRA Small Business -

Webpage | January 10, 2024

Small business employee benefits

Small business employee benefits are vital for employee...

Topics: Employee Benefits Small Business -

Webpage | December 28, 2023

HRA eligible expense tool

Use our interactive eligible expense tool to determine how you can...

Topics: Compliance HRA Health Benefits -

Downloadable Guide | December 15, 2023

Employee benefits survey template

The best way to make sure your employees are enjoying their...

Topics: Human Resources Recruitment/Retention Employee Benefits -

Downloadable GuideTool Kit | December 8, 2023

HRA compliance toolkit

Our HRA compliance tool kit serves as a reference point for...

Topics: Compliance HRA -

| December 8, 2023

Infographic: What can be reimbursed with an HRA?

Find out what you can get reimbursed with an HRA, including doctor...

Topics: Compliance HRA -

| December 8, 2023

HRA vs. HSA flowchart

If you're trying to decide between an HRA and an HSA, this...

Topics: Health Benefits -

Downloadable Guide | December 7, 2023

The veterinary clinic's guide to personalized health benefits

Learn how vet clinics can provide employee benefits, why benefits...

Topics: Employee Benefits -

Downloadable Guide | December 7, 2023

How to set up personalized employee benefits in an hour

This guide will explore how to choose and set up the right...

Topics: Recruitment/Retention Stipends Employee Benefits -

Downloadable Guide | December 7, 2023

Broker scenario guide: Which HRA is right for your client?

This guide goes over everything brokers need to know about HRAs,...

Topics: Comparison HRA Health Benefits Brokers -

Downloadable Guide | December 7, 2023

Guide to remote employee reimbursement rules by state

This guide will break down expense reimbursement laws by state and...

Topics: Compliance Human Resources Stipends -

Downloadable Guide | December 7, 2023

The HR handbook on running a virtual open enrollment

This guide covers everything you need to know to have a successful...

Topics: HRA Health Benefits Open Enrollment Human Resources -

Downloadable Guide | December 7, 2023

The tech startup's guide to personalized employee benefits

Learn how tech startups can provide employee benefits, why...

Topics: Health Benefits Employee Benefits Small Business -

Webpage | December 4, 2023

Guide to the QSEHRA

Here's everything you need to know about the QSEHRA, the new small...

Topics: HRA QSEHRA Health Benefits -

Downloadable Guide | December 1, 2023

The comprehensive guide to employee stipends

Learn how to offer reimbursable employee stipends to broaden your...

Topics: Stipends Employee Benefits -

Downloadable Guide | November 30, 2023

The complete guide to offering the ICHRA

Our ebook describes how to offer the individual coverage health...

Topics: HRA ICHRA -

Downloadable Guide | November 30, 2023

HRA compliance 101 guide

Get our guide to learn everything you need to know about HRA...

Topics: Compliance HRA -

Downloadable Guide | November 30, 2023

Complete guide to employee well-being

Learn how to encourage and support employee wellness, both in the...

Topics: Health Benefits Stipends Employee Benefits -

Downloadable Guide | November 30, 2023

How the HRA works for employees - guide

When an employer considers offering an HRA, they want to be sure...

Topics: HRA -

Checklist | November 29, 2023

Company size compliance checklist

As your company grows, so too does your list of regulations. Use...

Topics: Compliance Human Resources -

Downloadable Guide | November 28, 2023

The employer’s guide to tackling group health insurance renewals

When renewing your group health insurance plan comes with a huge...

Topics: Health Benefits -

Downloadable Guide | November 22, 2023

11 strategies for employee retention on a small business budget

This guide will provide 11 practical strategies for building an...

Topics: Human Resources Recruitment/Retention Small Business -

Downloadable Guide | November 22, 2023

The complete guide to the group coverage HRA (GCHRA)

This is the perfect e-book for employers who are interested in...

Topics: GCHRA HRA -

Downloadable Guide | November 22, 2023

What to do if you if your group health plan doesn't qualify for an HSA

Learn the reasons why your group plan may not qualify for an HSA...

Topics: GCHRA Health Benefits -

Downloadable Guide | November 21, 2023

How to self administer an ICHRA

This is the perfect e-book for employers who are interested in...

Topics: HRA ICHRA -

Downloadable Guide | November 21, 2023

HRA and HSA compatibility guide

Can health savings accounts (HSAs) and health reimbursement...

Topics: HRA Health Benefits -

Downloadable Guide | November 21, 2023

Are we reimbursing employees' health insurance correctly?

How do you make sure you're reimbursing employees’ individual...

Topics: Compliance HRA -

Downloadable Guide | November 17, 2023

Small business guide to health benefits

Read about strategies, statistics, and costs of offering benefits...

Topics: Health Benefits Small Business -

Comparison Chart | November 17, 2023

Employee stipends vs. salary increases comparison chart

This comparison chart will show the difference between providing a...

Topics: Stipends Employee Benefits -

Downloadable Guide | November 17, 2023

ICHRA employee classes 101 guide

Download our complete guide to ICHRA employee classes, including...

Topics: ICHRA HRA -

Webpage | November 16, 2023

Guide to Indiana employee benefits and HR rules

Are you following Indiana's employment and benefit laws? This...

Topics: Human Resources State-Specific -

Downloadable Guide | November 9, 2023

How to self administer a QSEHRA

In this eBook, we go over how to best administer your Qualified...

Topics: HRA QSEHRA -

Comparison Chart | November 9, 2023

HRA comparison chart

PeopleKeep offers 3 compliant HRAs available to small employers to...

Topics: Comparison GCHRA HRA ICHRA QSEHRA -

Downloadable Guide | November 9, 2023

The comprehensive guide to the QSEHRA

Download this eBook to learn how implementing the Small Business...

Topics: HRA QSEHRA Health Benefits -

Comparison Chart | November 9, 2023

QSEHRA vs. ICHRA comparison chart

With the QSEHRA vs. ICHRA comparison chart as your guide, you'll...

Topics: Comparison ICHRA QSEHRA -

Comparison Chart | November 9, 2023

Health stipends vs. HRAs comparison chart

In this comparison chart, we’ll explain the difference between...

Topics: Comparison HRA Health Benefits Stipends -

Webpage | November 8, 2023

Guide to South Carolina employee benefits and HR rules

Understanding employee benefits and HR rules in South Carolina is...

Topics: Human Resources State-Specific -

Webpage | November 3, 2023

Guide to the ICHRA

In this comprehensive overview, we cover what an ICHRA is, what...

Topics: HRA ICHRA Health Benefits -

Comparison Chart | October 18, 2023

Group health insurance vs. HRAs

In this chart we look at some of the most crucial features that...

Topics: Comparison HRA Health Benefits -

Comparison Chart | October 18, 2023

GCHRA vs. HSA comparison chart

GCHRA vs. HSA - What is the difference? Download this free chart...

Topics: Comparison GCHRA Health Benefits -

Webpage | October 18, 2023

Guide to Pennsylvania employee benefits and HR rules

Discover the ins and outs of Pennsylvania employment laws and...

Topics: Human Resources State-Specific -

Comparison Chart | October 16, 2023

HRA vs. HSA vs. FSA comparison chart

HRA vs. HSA vs. FSA - What is the difference? Download this free...

Topics: Comparison HRA Health Benefits -

Comparison Chart | October 16, 2023

Cost of health insurance by state

Get our state-by-state guide to see what the average cost of...

Topics: Comparison Health Benefits Open Enrollment -

Webpage | October 11, 2023

Guide to New Hampshire employee benefits and HR rules

Navigating employee benefits and HR rules in New Hampshire can be...

Topics: Human Resources State-Specific -

Downloadable Guide | October 3, 2023

The nonprofit's guide to health benefits

In this guide, we cover the different types of health benefits...

Topics: Health Benefits Nonprofit -

Webpage | September 21, 2023

Guide to Florida employee benefits and HR rules

If you employ people in Florida, you need to know which employee...

Topics: Human Resources State-Specific -

Webpage | September 20, 2023

Guide to New Mexico employee benefits and HR rules

Looking for a clear guide to New Mexico employment laws? This...

Topics: Human Resources State-Specific -

Webpage | September 13, 2023

Guide to Minnesota employee benefits and HR rules

Looking for a clear guide to Minnesota employment laws? This...

Topics: Human Resources State-Specific -

Webpage | August 14, 2023

Guide to New Jersey employee benefits and HR rules

If you employ people in New Jersey, you need to know which...

Topics: Human Resources State-Specific -

Webpage | August 10, 2023

Guide to Virginia employee benefits and HR rules

Looking for a clear guide to Virginia employment laws? This...

Topics: Human Resources State-Specific -

Webpage | August 9, 2023

Guide to Kentucky employee benefits and HR rules

Navigating Kentucky employment laws and employee benefits can be...

Topics: Human Resources State-Specific -

Webpage | July 20, 2023

Guide to Georgia employee benefits and HR rules

If you employ people in Georgia, you need to know which employee...

Topics: Human Resources State-Specific -

Webpage | July 20, 2023

Guide to Colorado employee benefits and HR rules

If you employ people in Colorado, you must know which employee...

Topics: Human Resources State-Specific -

Webpage | June 20, 2023

Guide to Washington employee benefits and HR rules

If you employ people in Washington, you need to know which...

Topics: Human Resources State-Specific -

Webpage | June 20, 2023

Guide to Ohio employee benefits and HR rules

If you employ people in Ohio, you need to know which employee...

Topics: Human Resources State-Specific -

Special Report | June 5, 2023

2023 Nonprofit QSEHRA Report

Download our report to see proprietary data from PeopleKeep...

Topics: QSEHRA Nonprofit -

Webpage | May 18, 2023

Guide to California employee benefits and HR rules

If you employ people in California, you need to know which...

Topics: Human Resources State-Specific -

Webpage | May 11, 2023

A guide to human resources metrics

Basic tracking and analysis of your HR data can produce actionable...

Topics: Human Resources -

| March 23, 2023

Employee benefits quiz

Take our employee benefits quiz to find out which health...

Topics: Comparison HRA -

Webpage | October 4, 2022

Guide to Utah employee benefits and HR rules

If you employ people in Utah, you need to know which employee...

Topics: Human Resources State-Specific -

Webpage | September 28, 2022

A guide to section 105 plans

Learn the ins and outs of Section 105 Plans with this...

Topics: Health Benefits -

Webpage | September 22, 2022

Guide to Texas employee benefits and HR rules

If you employ people in Texas, you need to know which employee...

Topics: Human Resources State-Specific -

Comparison Chart | September 19, 2022

Generational employee benefits comparison chart

This comparison chart highlights the different benefits each...

Topics: Comparison Recruitment/Retention Employee Benefits -

Webpage | September 15, 2022

Guide to New York employee benefits and HR rules

If you employ people in New York, you need to know which employee...

Topics: Human Resources State-Specific -

Checklist | September 12, 2022

The open enrollment checklist for brokers

This checklist contains tips and tricks to help you prepare your...

Topics: Open Enrollment Brokers -

Special Report | August 16, 2022

Benefits survey report: Part 3

See survey data from PeopleKeep customers highlighting SMBs'...

Topics: Recruitment/Retention Employee Benefits -

Webpage | July 28, 2022

Defined contribution health plans made easy

Learn the ins and outs of Defined Contribution Health Plans like...

Topics: Health Benefits -

Special Report | July 19, 2022

Benefits survey report: Part 2

See how factors like gender, age, and work environment influence...

Topics: Recruitment/Retention Employee Benefits -

Webpage | July 12, 2022

Health savings accounts made easy

Learn the ins and outs of a Health Savings Account (HSA) with this...

Topics: Health Benefits -

Downloadable Guide | April 22, 2022

Benefits administration software guide

Shopping for a software solution to help administer your employee...

Topics: Employee Benefits -

One-pager | January 21, 2022

FTE calculation worksheet

Learn how to calculate the number of FTEs at your organization for...

Topics: Compliance -

Downloadable Guide | November 1, 2021

Do I have to offer health insurance?

Not sure if you have to offer health insurance? See if the...

Topics: Compliance Health Benefits -

Demo | October 25, 2021

GCHRA administration software demo

Watch our GCHRA product demo to see how you can offer better...

Topics: GCHRA -

| August 9, 2021

Infographic: How much does a hospital stay cost?

Get an infographic summary of how much healthcare costs in...

Topics: Health Benefits -

Downloadable Guide | May 12, 2021

Seven ways to budget with a QSEHRA

In this eBook, learn how a QSEHRA is a powerful tool for keeping...

Topics: HRA QSEHRA -

Downloadable Guide | November 18, 2020

The construction company's guide to HRAs

In this ebook, you'll learn how to use a health reimbursement...

Topics: HRA -

| November 2, 2020

ICHRA affordability calculator

Use our affordability calculator to ensure your health benefit is...

Topics: ICHRA -

Webpage | August 26, 2020

GCHRA made easy

In this comprehensive overview, we cover what a GCHRA is, what...

Topics: GCHRA HRA Health Benefits -

One-pager | June 25, 2020

ICHRA at a glance

Get our Individual Coverage HRA guide to learn how it works, who...

Topics: HRA ICHRA -

One-pager | June 17, 2020

QSEHRA at a glance

Get our Qualified Small Employer HRA guide to learn how it works,...

Topics: HRA QSEHRA -

Tool Kit | June 1, 2020

How to cancel group health insurance toolkit

In this toolkit, we've included four separate assets you can use...

Topics: Health Benefits -

One-pager | May 7, 2020

GCHRA at a glance

Get our Group Coverage HRA guide to learn how it works, who it's...

Topics: GCHRA HRA -

| March 21, 2020

QSEHRA benefit calculator

Instantly calculate your monthly benefits budget with our free...

Topics: QSEHRA -

| November 20, 2019

ICHRA benefit calculator

Instantly calculate your monthly benefits budget with our free...

Topics: ICHRA

Popular

Downloadable Guide | November 17, 2023

Small business guide to health benefits

Read about strategies, statistics, and costs of offering benefits as...

Tool Kit | June 1, 2020

How to cancel group health insurance...

In this toolkit, we've included four separate assets you can use as...

Downloadable Guide | November 30, 2023

The complete guide to offering the ICHRA

Our ebook describes how to offer the individual coverage health...

Popular resources

Small business guide to health benefits

The complete guide to offering the ICHRA

2024 ICHRA Report

Looking for state-specific resources?

See our health insurance, employee benefits, and human resources guides for your state.

_fb.jpg)