PeopleKeep’s 2024 Employee Benefits Survey

PeopleKeep surveyed employers and employees to understand what each group values, prioritizes, and struggles with when it comes to employee benefits.

Read our report below or download our infographic summary to understand which benefits are worth the investment.

Download the infographic summary

Introduction

In today’s tough labor market, it’s crucial for employers to do everything they can to keep their current employees happy. One of the best ways employers can do this is by ensuring their benefits package aligns with what their employees really value.

One of the biggest challenges many employers face when offering employee benefits is cost. This is why it's crucial to know which specific benefits are worth the investment.

To help you better understand what today’s employers and employees prioritize, PeopleKeep's 2024 Employee Benefits Survey investigates employees’ benefits expectations and identifies which benefits enhance the employee experience.

PeopleKeep surveyed more than 1,000 employers and employees who provided feedback on the following employee benefits:

Health benefits

Life insurance

Paid time off (PTO)

Childcare benefits

Dental insurance

Vision insurance

Disability insurance

Paid family leave

Retirement benefits

Educational assistance

Commuter benefits

Mental health/wellness

Highlights from the survey:

- More than half of the employers (56%) said cost is the biggest hurdle when offering employee benefits.

- Most employees (81%) said an employer’s benefits package is an important factor in whether or not they accept a job.

- Employers saw the most employee participation in health benefits (76%), retirement benefits (76%), and paid time off (75%).

- Most employers (89%) plan to enrich their current benefits or add more of them in 2025.

Which benefits are most important to employees?

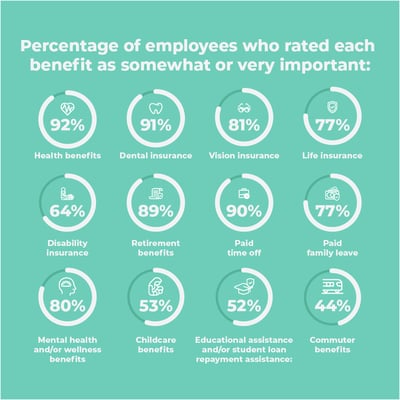

Employees shared their thoughts on the importance of 12 common benefits. These numbers represent the share of employee respondents who rated each benefit as “somewhat important” or “very important.”

The five benefits most important to employees include the following:

- health benefits (92%)

- dental insurance (91%)

- paid time off (90%)

- retirement benefits (89%)

- vision insurance (81%)

In the middle of the pack in terms of importance to employees are mental health and/or wellness benefits (80%), life insurance (77%), and paid family leave (77%).

In contrast, the four least important benefits to employees were disability insurance (64%), childcare benefits (53%), educational assistance and/or student loan repayment assistance (52%), and commuter benefits (44%).

The most important benefits to employers

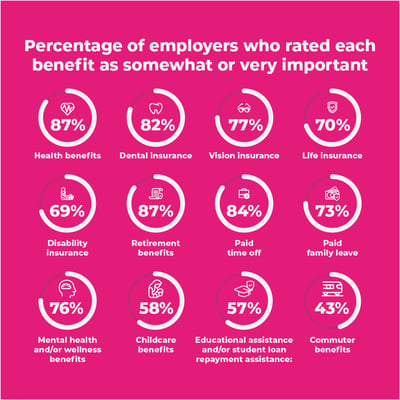

We also asked employers to rate the importance of each benefit and compared the share of employers who rated each as "somewhat important" or "very important" to employee totals.

Employers and employees agree that health benefits—including health insurance and alternatives like HRAs—dental and vision insurance, retirement benefits, and paid time off, are the most important benefits.

"I feel like it's important to show value to your workers. Helping to make sure they stay healthy shows you value them."

"I value PTO the most because spending time with family is what really matters in life."

"My most valued benefit would be retirement or 401k."

Which benefits do employees use the most?

Next, we asked employers to share how often they used their benefits. Employee participation is an excellent indicator of which benefits are worth the cost to employers.

| Employee benefit | "Never" and "rarely" | "Often" and "always" |

| 12.36% | 58.88% | |

| 18.89% | 39.55% | |

| 29.17% | 38.69% | |

| 53.42% | 34.25% | |

| 69.39% | 14.29% | |

| 23.80% | 61.27% | |

| 9.88% | 64% | |

| 54.93% | 25.35% | |

| 34.08% | 36.31% | |

| 45.26% | 41.05% | |

|

58.78% | 22.14% |

| 51.90% | 35.44% |

Do employees feel their needs are met by employers? Sort of.

While most employees polled rated most benefits as important, only 47% felt the benefits their employers offered fit their specific needs, and nearly two-thirds agreed that there were gaps in their benefits packages.

Which benefits do employers see the most participation in?

We also asked employers which benefits their employees use.

| Employee benefit | "Low" and "very low" usage | "High" and "very high" usage |

|

Health benefits

|

7.40% | 76.16% |

|

Dental insurance

|

12.76% | 64.39% |

|

Vision insurance

|

14.76% | 59.04% |

|

Life insurance

|

19.21% | 47.60% |

|

Disability insurance

|

21.12% | 45.34% |

|

Retirement benefits

|

9.71% | 75.71% |

|

Paid time off (PTO)

|

6.96% | 74.65% |

|

Paid family leave

|

17.96% | 53.25% |

|

Mental health and/or wellness benefits

|

17.95% | 53.53% |

|

Childcare benefits

|

26.09% | 48.91% |

|

Educational assistance and/or student loan repayment

|

29.17% | 46.88% |

|

Commuter benefits

|

37.41% | 35.19% |

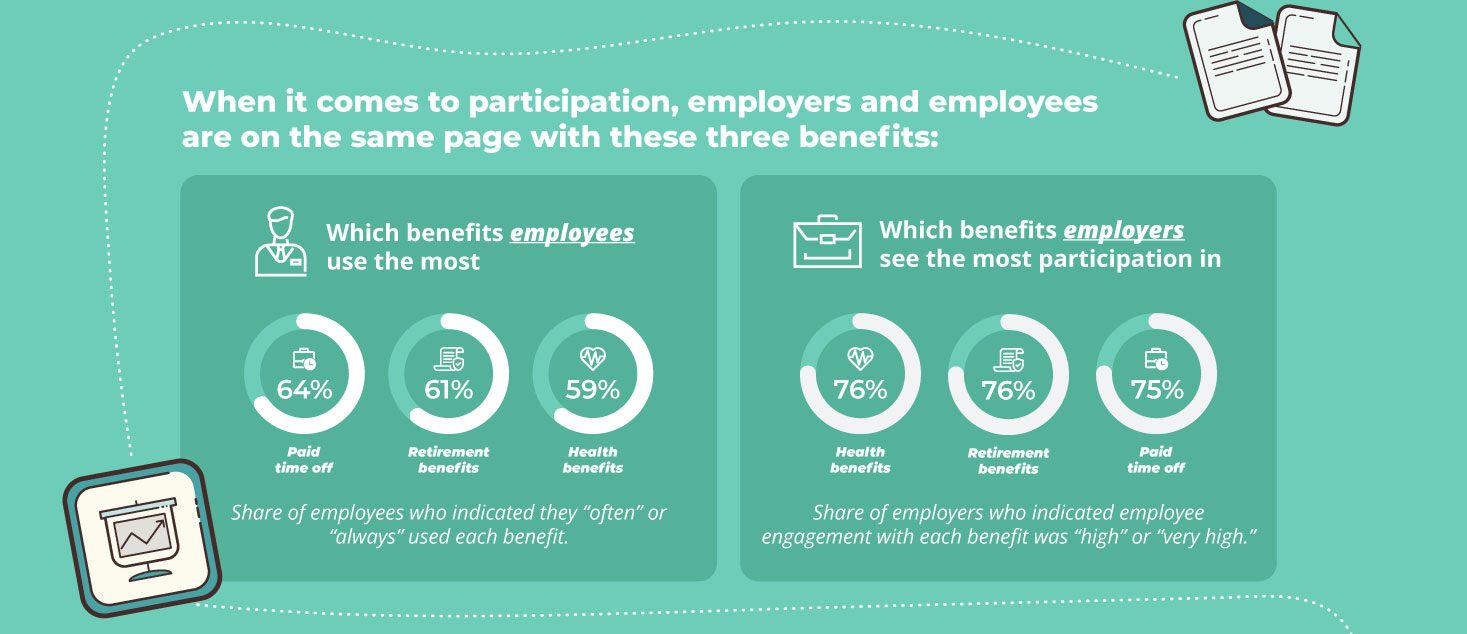

When it comes to participation, employers and employees are on the same page with three benefits: paid time off (64%), retirement benefits (61%), and health benefits (59%).

Which benefits do employers offer?

We also asked employers which benefits they offer to their employees.

![]()

Health benefits

74.23%

![]()

Retirement benefits

61.70%

![]()

Paid time off

56.03%

![]()

Dental benefits

52.72%

![]()

Life insurance

48.46%

![]()

Vision benefits

48.23%

![]()

Paid family leave

36.64%

![]()

Disability insurance

32.86%

![]()

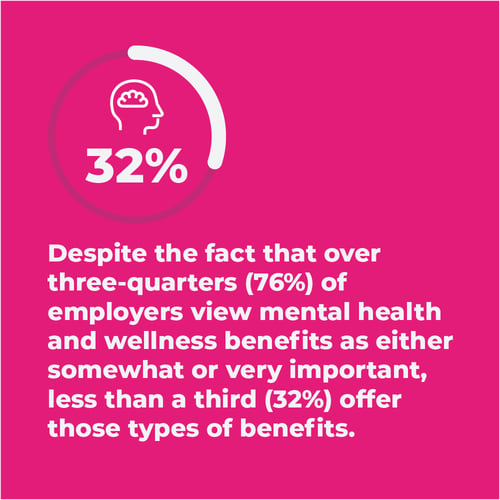

Mental health/ wellness benefits

31.91%

![]()

Educational assistance

26.95%

![]()

Childcare benefits

16.55%

![]()

Commuter benefits

10.87%

Additionally, 10.64% of employers surveyed said they didn't offer any of the benefits listed above. This is where we start to see some discrepancies between what employees value and what employers actually offer. For example, 79.58% of employees value mental health or wellness benefits, However, only 31.91% of employers offer them.

Is competitive compensation enough? Not always.

Most employees (81%) said an employer’s benefits package is an important factor in whether or not they accept a job. The majority of employers agree. Survey results show that 72% of employers said their benefits package is an important factor in whether or not an employee accepts a job.

Why do employers offer employee benefits?

There are several advantages to offering employee benefits, but one reason stood out among the rest to employers. Nearly half of employers (49%) offer employee benefits to improve employee productivity and engagement.

One of the best ways to improve productivity and engagement at an organization is to offer employee benefits. For example, when employees are cared for through health benefits, they’re less likely to take sick days. Education benefits show employees that their futures are worthy investments for the company. An ample amount of paid time off promotes work-life balance, which is important for keeping employees engaged and avoiding burnout.

“The workforce is the beating heart and backbone of any organization. If you take care of the workers, your organization thrives."

“These days, in order to keep quality workers, you must keep your benefits package competitive with your competitors, or your employees who have a lot of experience will leave the organization."

"I want people to know that we appreciate them and that they're taken care of when they work with the company."

What is the biggest hurdle for employers when it comes to offering employee benefits?

More than half of employers (56%) said cost is the biggest hurdle when offering benefits. This could be why a portion (11%) of them don’t offer any benefits to their employees. To address this issue, employers can reallocate their resources more strategically.

Want to save money? Ask your employees what benefits they want.

You may be spending money on a benefit your employees don’t use. For example, only 44% of employees said commuter benefits are important, and 52% said they rarely or never use them. If this is the case for any of the benefits you currently offer, you can reinvest that money elsewhere.

How important is having access to remote work or a hybrid work environment?

If employers really want to entice job seekers, they should consider offering more flexibility in their work arrangements. More than half of employees (57%) said it’s important to have access to remote work or a hybrid work environment.

How can employers afford to offer the most desired employee benefit?

Year after year, health benefits rank as the top benefit for employees. Unfortunately, this benefit is usually the most expensive one for employers. This is because they often rely on traditional group health insurance to get the job done.

According to KFF, the average annual cost of employee health insurance premiums for family coverage was $23,968 in 2023. The average premium for a self-only plan was $8,435. On average, employers covered 83% of their employees’ self-only insurance plans and 73% of employees’ family insurance plans.

|

Employer percentage |

Employer dollar amount |

Employee percentage |

Employee dollar amount |

|

|

Self-only premium of $8,435 annually |

83% |

$7,034 annually |

17% |

$1,401 annually |

|

Family premium of $23,968 annually |

73% |

$17,393 annually |

27% |

$6,575 annually |

Traditional health benefits also some with unpredictable annual rate hikes and strict participation requirements that small and midsize employers may not meet.

If you want a cost-effective way to offer a health benefit, you can utilize health reimbursement arrangements (HRAs). Stand-alone HRAs like qualified small employer HRAs (QSEHRAs) and individual coverage HRAs (ICHRAs) are popular alternatives to traditional group health plans. They’re IRS-approved, employer-funded health benefits that allow employers to reimburse employees tax-free for individual health insurance premiums and qualifying out-of-pocket medical expenses rather than buying the coverage for them.

What will employee benefits look like in 2025?

The new year brings promise. In 2025, employers want to do more for their employees. Most employers (89%) plan to enrich their current benefits or add more of them in the new year. Yet, 30% of employers don’t plan to change a thing. This choice may cost them in the long run.

Methodology and demographics

PeopleKeep gathered the data from this report through online surveys from April 11 to 15, 2024. This includes responses from 423 employers and 617 employees. Among employers, 54.17% identified as male and 45.39% as female. Among employees, 44.89% identified as male and 54.78% as female. The remaining respondents choose not to disclose their gender.

We had a nearly even split between employee respondents who employed fewer than 50 workers and those who employed more than 50 employees.

Closing thoughts

While offering employee benefits can be a significant financial challenge for many small and midsize organizations, it doesn't have to be. It comes down to employers investing their money in the benefits their employees will actually use. When employers know what their employees want to see in their benefits package, they can tailor it to their needs. This way, they can invest in their workforce without wasting money.

PeopleKeep helps small to midsize organizations thrive by taking care of their employees with hassle-free benefits. As the leader in personalized benefits, PeopleKeep has learned what the thousands of employers who use our software want: a seamless employee experience, easy-to-use software, and automated compliance.

Get the infographic summary

Learn more about PeopleKeep

What is PeopleKeep?

PeopleKeep, part of Remodel Health, is a personalized benefits administration software company. We serve small and midsize employers across many industries ranging from nonprofits, to high tech, to engineering. Because our software is intuitive and can be managed in minutes per month, we make providing benefits more accessible to organizations that do not want to manage complex and tedious administrative tasks.

Since starting as Zane Benefits in 2006, we've been the leader in cloud-based personalized benefits administration.

What other reports has PeopleKeep published?

As the industry leader in HRAs, PeopleKeep prides itself on publishing proprietary data on all things HRAs and employee benefits.

We also release annual reports on the QSEHRA and the individual coverage HRA (ICHRA).

What products does PeopleKeep offer?

We provide software that allows organizations to offer health reimbursement arrangements (HRAs) and employee stipends. Learn more about each of our products below:

- Qualified small employer HRA (QSEHRA): A simple, controlled-cost alternative to group health insurance for employers with 1-49 employees.

- Individual coverage HRA (ICHRA): A flexible health benefit solution for employers of all sizes that can be used alone or alongside group health insurance.

- Group coverage HRA (GCHRA): A group health supplement for employers already offering a group health insurance plan to help employees with out-of-pocket expenses.

- WorkPerks: Reimbursable employee stipends that broaden employee benefits. Offer your employees benefits for health, wellness, remote work, education, transportation, and more.

How much does a plan with PeopleKeep cost?

At PeopleKeep, we help you implement budget-friendly, compliant benefits without the hassle. Pricing will vary depending on which product you're interested in and how many employees you'll have enrolled in the benefit.