Get your copy of PeopleKeep's 2025 QSEHRA Report

Since its launch in 2017, the qualified small employer health reimbursement arrangement (QSEHRA) has made it possible for more small employers to offer a health benefit.

Our eighth annual usage report on the QSEHRA is here! See how PeopleKeep customers designed and used their QSEHRA benefits in 2024.

PeopleKeep's 8th annual QSEHRA Report

According to KFF's 2024 Employer Health Benefits Survey, only 51% of businesses with three to 49 workers offer health benefits. Offer rates for the smallest organizations are even lower.

In contrast, 93% of businesses with 50 or more employees offer health benefits. These stats highlight the gap that small employers struggle to close. By not offering a health benefit, nearly half of small businesses shift the burden of securing coverage onto employees, many of whom go without coverage altogether.

The QSEHRA is a formal, employer-sponsored health benefit for small employers with fewer than 50 full-time equivalent employees (FTEs). It allows these traditionally underserved organizations to reimburse employees tax-free for their health insurance premiums and qualifying out-of-pocket medical expenses. This gives small employers a way to offer meaningful benefits without the burden of rising premiums.

PeopleKeep by Remodel Health, the first vendor to offer QSEHRA administration software, has tracked how thousands of small employers use this benefit. Our eighth annual report offers key insights for any organization looking to take control of its health benefits strategy and better support its employees.

The 2025 edition includes data on:

Average monthly QSEHRA allowances continue to rise

Over the past eight years, one trend has remained consistent: employers are increasing their QSEHRA allowances year after year. In 2024, small businesses offered an average monthly allowance of $442—a 2.55% increase from 2023’s average of $431.

Why the steady rise? One key factor is the IRS’s annual adjustment of QSEHRA contribution limits. From 2023 to 2024, the IRS raised the maximum annual allowance for single employees and employees with families by 5.12% and 5.5%, respectively. In 2024, employers could offer up to $6,150 annually ($512.50 monthly) to single employees and $12,450 annually ($1,037.50

monthly) to employees with families.

One of the biggest advantages of the QSEHRA is that employers can offer an allowance that fits their budget. As such, not all employers offered allowances at the limit. But, 7% of our customers took full advantage of the maximum amount the IRS allows.

We expect this trend to continue in 2025, as the IRS has again increased the annual QSEHRA contribution limits to $6,350 for single employees and $12,800 for employees with families. As small businesses seek more flexible, cost-effective ways to provide health benefits, QSEHRA allowances are likely to keep climbing.

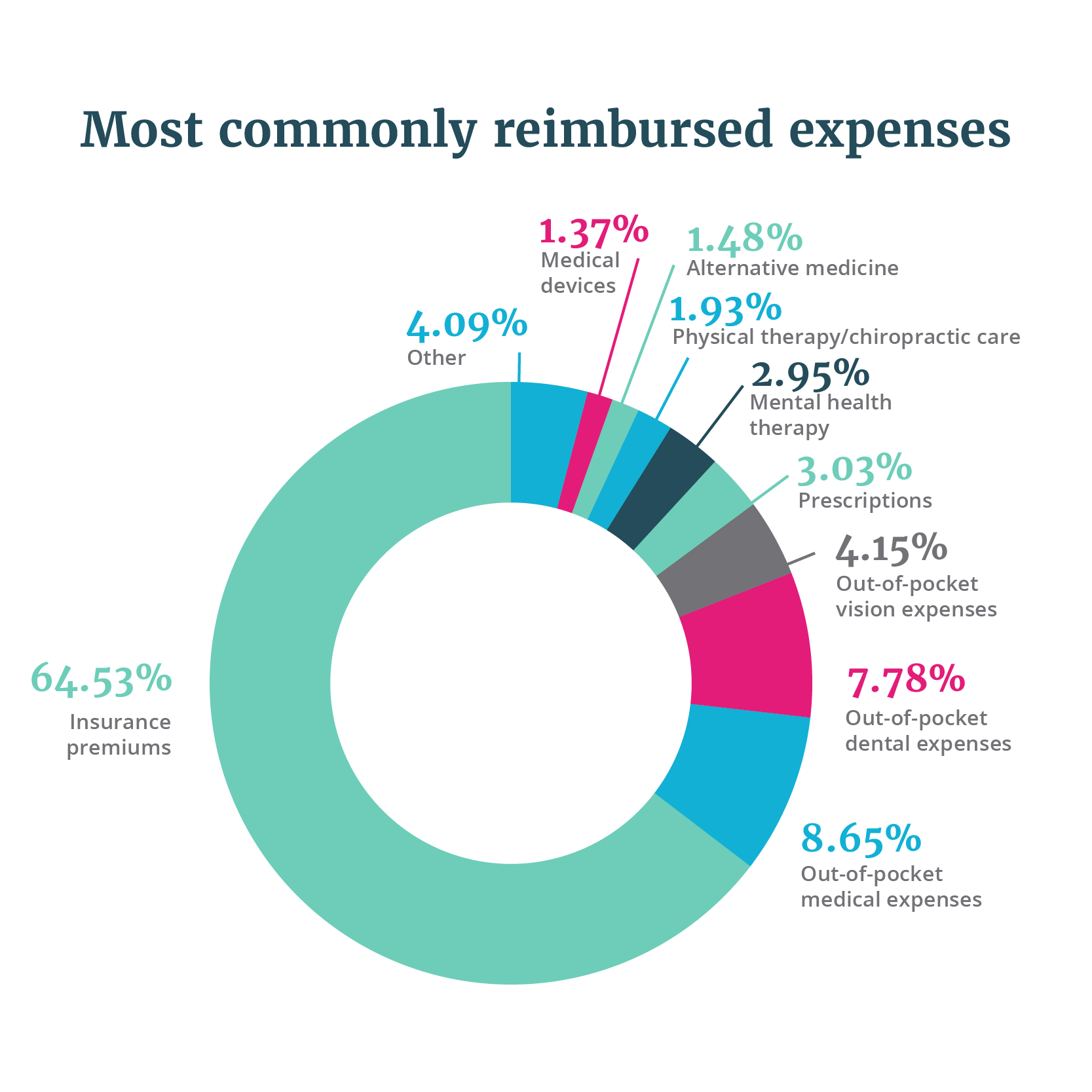

Insurance premiums are the most popular reimbursed expense

We analyzed employee reimbursements to uncover the most commonly reimbursed expenses, both for insurance premiums and non-premium medical costs. The majority of QSEHRA funds go toward insurance premiums, making up 64.53% of total reimbursement dollars in 2024.

In 2024, employers reimbursed more than $44 million through PeopleKeep's QSEHRA platform. nearly $29 million went toward premiums, including health, dental, and vision coverage.

A sneak peek at our key findings

Smaller organizations offer higher QSEHRA allowances, on average

Almost half of the organizations with a QSEHRA use waiting periods

The average age of QSEHRA participants fell four points

More employers offer premium-plus accounts than premium-only

Want more? Download the report

Download the full report to find out:

- How QSEHRA allowances differ by family status, company tenure, and state

- The most popular reimbursed premium expenses

- Which types of health insurance plans employees choose

Frequency asked questions

PeopleKeep’s HRA software helps employers administer their own HRA in just minutes per month. It makes health benefits smooth, efficient, and meaningful to employees. A PeopleKeep HRA gives employers instant access to legal plan documents and award-winning customer support for themselves and their employees.

Watch a demo

- Qualified small employer HRA (QSEHRA): A simple, controlled-cost alternative to group health insurance for employers with 1-49 employees.

- Individual coverage HRA (ICHRA): A flexible health benefit solution for employers of all sizes that can be used alone or alongside group health insurance.

- Group coverage HRA (GCHRA): A group health supplement for employers already offering a group health insurance plan to help employees with out-of-pocket expenses.

ICHRA+

ICHRA+ allows applicable large employers (ALEs) to give their employees a contribution for individual health insurance. Our software and white-glove service approach make it easy for large and enterprise groups to switch from group health insurance to an ICHRA.