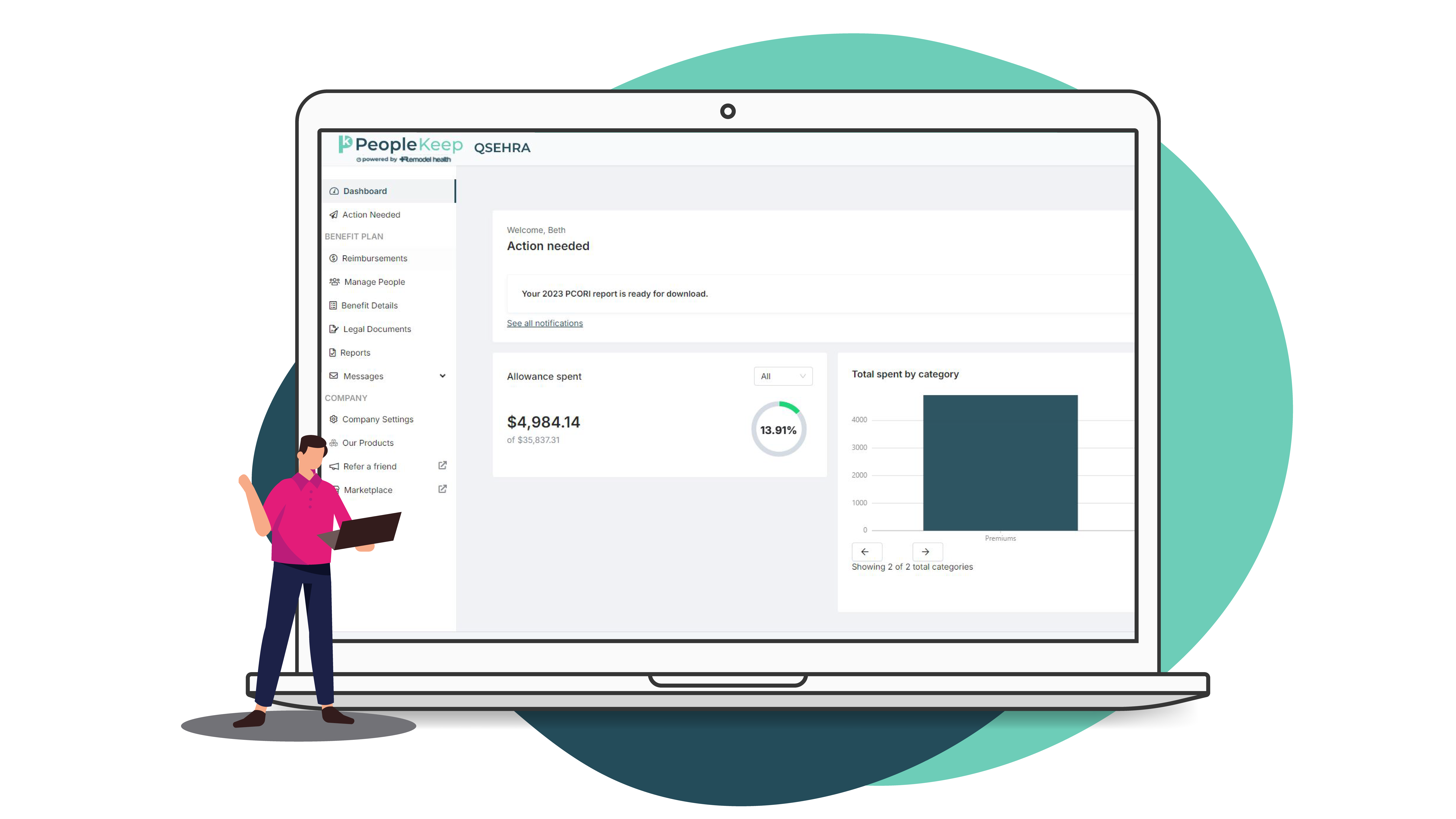

Streamlined health benefits administration for small businesses

As a small employer, you work hard to grow your business. But no business is successful without a team of talented people. By working with PeopleKeep, you can build a solid health benefits package that attracts and retains top talent and still have plenty of time to focus on scaling your business.

Are you struggling to attract and retain talent for your small business?

Now you can offer stand-out personalized benefits that help you keep your ideal employees without breaking the bank. Our health benefits administration platform is designed for small businesses like yours that want to improve their employee experience without the administrative burden of traditional benefits.

With PeopleKeep, you can:

✓ Save time with our easy-to-use benefits administration platform

✓ Control your employee benefits costs

✓ Offer a flexible health benefit that allows you to reimburse insurance premiums and out-of-pocket medical expenses

✓ Improve employee satisfaction and retention through individualized benefits

Why should small businesses offer employee benefits?

At PeopleKeep, we understand that growing your business takes time. There are many challenges along the way, including financial and time constraints and trouble finding good employees.

However, your employees are your most valuable asset. Their dedication and hard work are what drive your business forward. Once you have the right team in place, it’s important to keep them. One of the best ways to retain your team is by investing in a competitive employee benefits package. However, many traditional benefits are too expensive, and managing them can be daunting for small employers, especially if they double as ad hoc HR managers.

That’s where PeopleKeep comes in. We’re the leader in cloud-based personalized health benefits administration solutions, and we’re here to help you build a benefits package that works for your unique needs and budget.

With PeopleKeep, you don’t have to spend a fortune or manage relationships and contracts with numerous vendors. Our platform makes it easy to offer affordable benefits that reflect your company’s values while eliminating the administrative burden.

What is PeopleKeep?

PeopleKeep is your partner in offering personalized benefits administration software. We help organizations of all sizes to offer individualized health benefits that are flexible and scalable. Our mission is to make health insurance accessible for small and midsize businesses so they can better care for their people. We believe every employee deserves access to benefits that support their unique needs, and we’re here to make it easy for you to offer those benefits.

Since starting as Zane Benefits in 2006, we’ve helped thousands of employers administer their benefits.

How does PeopleKeep work for small businesses?

Whether you’re looking to offer your very first benefit or you’re looking for an easier, more affordable option, we can help. With our benefits administration platform, you can offer a variety of perks to your team.

Health benefits options for small businesses

At PeopleKeep, our software allows you to administer health reimbursement arrangements (HRAs), a powerful and affordable alternative to group health insurance plans.

QSEHRA

Qualified small employer HRA. A powerful alternative to group health insurance made specifically for small employers.

ICHRA

Individual coverage HRA. A health benefit that enables employers to cover the individual insurance plans their employees choose.

GCHRA

Group coverage HRA. A health benefit that employers can use to help employees with their out-of-pocket expenses.

Testimonials

"PeopleKeep made the whole process of setting up and administering an ICHRA super easy! They take care of everything from start to finish!"

Joey Raab

| Insurance Depot

“Our experience with PeopleKeep's customer support team has been great! Our customer success manager has also been knowledgeable, helpful, and excellent at providing relevant information to our team.”

Janan Sirhan

| Impactual LLC

"Our client [...] had a previous provider offer a QSEHRA, which was great. But the vendor disappeared and was not available to answer any questions or help them. PeopleKeep was amazing. They were timely and supportive."

Robin Throckmorton

| Strategic HR Business Advisors of Clark Schaefer Hackett

Health reimbursement arrangements (HRAs) for small businesses

An HRA is an IRS-approved health benefit that enables employers to reimburse their employees tax-free for qualifying medical expenses such as health insurance premiums and other out-of-pocket expenses. Employers simply set a monthly allowance for their employees to use and approve their eligible expenses for reimbursement.

There are two types of HRAs that employers can leverage as alternatives to traditional group health insurance. The QSEHRA is specifically designed for small organizations with fewer than 50 full-time equivalent employees (FTEs), while an ICHRA is an excellent option for small employers of all sizes.

Employers that offer a group plan can pair it with a GCHRA to supplement their employees’ health benefits and cover out-of-pocket expenses.

Complete Cost Control

No minimum size requirements

Personalization and flexibility

Tax-free reimbursements

Start offering an HRA to your employees in three easy steps:

Step 1: Design your benefit & invite employees

Customize your benefit so it’s uniquely suited to your needs. You get to decide how much you want to offer to employees each month, which expenses are eligible for reimbursement, and more.Step 2: Employees make eligible medical purchases

Once your benefit is set up and you invite your employees, they can start to use their allowances. Eligible expenses can include anything listed under IRS Publication 502, though you can limit these items. Employees then submit proof of incurred expenses through our software.Step 3: Review and approve expenses

Once employees submit their eligible expenses and documentation, the PeopleKeep documentation review team experts will review your employees’ submissions for you. If it’s a qualified expense, you can reimburse your employee through payroll, check, cash, or bank transfer.Find out which HRA's are the best fit for your team.

Personalize your benefits with PeopleKeep for a happier, healthier team

Speak with a PeopleKeep personalized benefits advisor today to see how HRAs can help your small business reach its full potential.