What does pay or play mean in health insurance?

Learn what pay or play means in health insurance. Understand how employers must offer coverage or face penalties under the ACA's employer mandate.

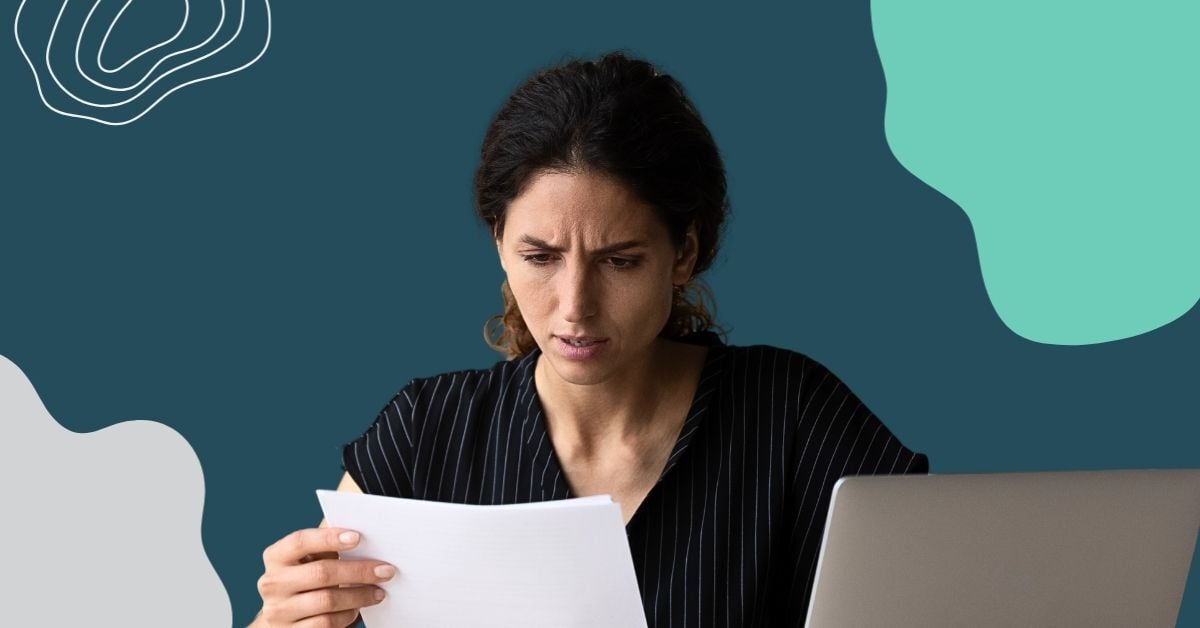

How to appeal claim denials and policy cancellations by an insurance company

Learn how to successfully appeal an insurance denial or policy cancellation. Follow key steps to challenge claim decisions and protect your coverage.

What to do when your group health insurance premiums go up

Dealing with a health insurance premium increase? This guide has you covered with tips and strategies to navigate changes and keep your coverage affordable.

How age impacts your health insurance costs

Learn how your age affects the price you pay for your health insurance plan, why your state matters, and how to get help paying for your premiums.

What are reimbursable out-of-pocket costs?

Learn which of your employees’ out-of-pocket costs are reimbursable and how to start adding this kind of coverage to your employee benefits package.

Does ICHRA work with group health insurance?

Learn how ICHRA and group health insurance can work together. Understand coordination rules and when offering both options may be beneficial.

What is employee benefits administration?

Employee benefits administration involves managing and coordinating the various benefits offered to employees by an organization. Learn all about it here!

HR tech vs. work tech

Curious about HR tech and work tech? Learn about the distinctions between the two and how they can benefit your organization in this helpful guide.

How to set your first HR department up for success

Learn what an HR department is and how to set up your first one for success. Discover key roles, tools, and strategies to support your growing team.