What percent of health insurance is paid by employers?

By Elizabeth Walker on December 5, 2025 at 9:45 AM

If you’re in charge of choosing your company’s employee benefits and are considering a new health insurance option, your organization's contribution strategy is a key factor in that decision. When working the new benefit’s cost into your budget, you must know how much employees will pitch in for health coverage and the percentage you’ll pay.

With traditional group health coverage, employers typically contribute a certain percentage toward the plan’s premium and have employees pay the remaining share, usually through a pre-tax payroll deduction. So, what percentage of health insurance premiums do employers typically pay in the United States?

This article will discuss the average costs of employer-sponsored health insurance and the typical percentages that business owners and employees share. We’ll also explain how you can use a health reimbursement arrangement (HRA) to control your budget.

In this blog post, you’ll learn:

- How much employers typically contribute toward employees’ health insurance premiums, and how those costs differ for self-only and family coverage.

- What factors influence group health insurance costs for both employers and employees.

- How HRAs can help employers manage cost pressures, set predictable budgets, and give employees more control over their healthcare.

How much does group health insurance cost?

When a business provides health coverage to employees, it typically purchases a plan (or plans) from a commercial insurance carrier to cover all eligible employees and their qualified dependents. Most people know these plans as traditional group health plans or “fully-insured plans.”

According to KFF’s employer health benefits survey, the average cost of group coverage in 2025 was $9,325 annually (or $777/month) for self-only plans and $26,993 annually (or $2,249/month) for family policies1. Although these numbers can vary by insurer, policy type, and ZIP code, employers will know their annual rate when they buy a new plan or renew their current policy.

What percent of health insurance is paid by employers?

According to KFF, in 2025, employers covered 84% of their employees’ single coverage plans and 74% of employees’ family insurance plans on average2.

The following chart provides a closer look at these percentages:

|

Employer percentage |

Employer dollar amount |

Employee percentage |

Employee dollar amount |

|

|

Self-only premium of $9,325 annually |

84% |

$7,833 annually |

16% |

$1,492 annually |

|

Family premium of $26,993 annually |

74% |

$19,975 annually |

26% |

$7,018 annually |

Large employer contributions vs. small employer contributions

While large employers typically contribute a significant amount to employees’ healthcare, in some cases, small employers cover even more.

According to KFF, employers pay for the entire self-only premium for 29% of enrolled employees at small to mid-sized organizations with 10-199 employees, compared to only 7% of workers in large companies with 200 or more employees. In contrast, 29% of covered workers in small businesses must pay more than half of the healthcare premium for family plans, compared to 5% of covered workers in large organizations3.

A possible reason for this is that small businesses have fewer eligible workers. That can make it easier for them to pay the entire premium amount for their employees — whether it be self-only or family coverage — than large businesses with significantly more employees.

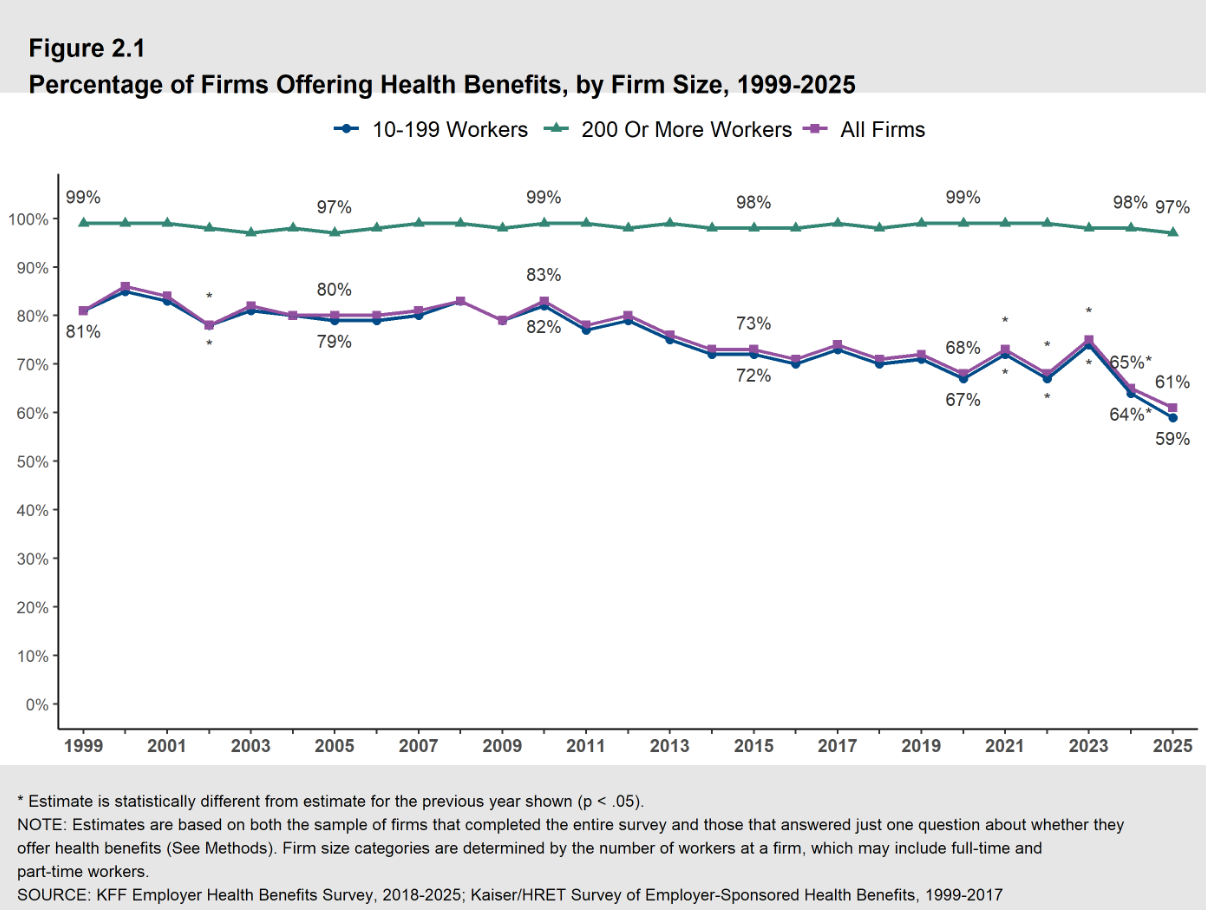

What percentage of businesses offer health benefits?

While virtually all organizations with 1,000 or more workers offer their employees health coverage, that’s different for small employers. Only 51% of businesses with ten to 24 workers offered coverage to their employees in 20254. This is a decrease from 56% in 2024, showing that more small employers are forgoing health insurance coverage.

Small employers generally have tighter budgets, but the rising cost of health insurance can make it even harder to offer a benefit. The annual premium cost for family coverage has increased 26% over the last five years and 47% during the previous 10 years, significantly more than either workers’ wages or inflation.

This increase in healthcare services and costs can make it challenging for employers to continue offering a health benefits program that provides enough value.

How much does group health insurance cost for employees?

From the type of plan you choose to your employees’ health conditions, many factors affect how much your employees will pay for health insurance.

Looking again at KFF’s 2025 report, employee contributions toward a family plan were $7,018 annually (roughly 26% of the average premium) and $1,492 (approximately 16%) for single coverage.

The premium cost associated with a group health insurance plan typically increases every year. You can adjust contribution strategies, health plan types, or covered benefits annually to minimize or reduce fluctuation in premium amounts and control health insurance costs.

How can employers better control group health insurance costs?

Although your health insurance program is likely one of the most expensive benefits you’ll offer at your organization, it’s an essential investment in your company’s future. By better understanding what factors affect your employee health benefits costs, you’ll gain greater cost control over your budget and set your workers up for success.

The annual cost of providing group insurance to employees depends on the following key factors:

- The health insurance company

- The plan type. Common policies are preferred provider organizations (PPOs), exclusive provider organizations (EPOs), point of service plans (POSs), and health maintenance organizations (HMOs).

- The provider network

- The plan’s features and cost-sharing amounts. This includes annual deductibles, copayments, coinsurance rates, and out-of-pocket maximums.

- Your ZIP code

- Your employer contribution amount.

- To keep health insurance costs low for your company, you can shift more of the cost burden to your employees. But keep in mind that moving too much of the cost to your staff can negatively impact employee wellbeing.

- Your employees' demographics or plan rates for the “risk pool” at your company.

- For example, older workforces tend to have higher medical care costs, which might increase your group’s overall rates.

Alternative health benefit options for employers

If you’re struggling to meet minimum contribution requirements, alternative health benefit options can be helpful. For example, instead of paying for employer-sponsored plans from an insurer, you can go with an HRA. This type of health benefit allows employers to provide their employees with a certain amount of tax-free money, which they can then use to pay for individual health plan premiums and other qualified out-of-pocket costs.

Because employers can set their own contribution limit, many find HRAs more predictable and affordable than traditional health benefit options. Individual health insurance premiums are cheaper than small group premiums in many states and counties, meaning you can experience greater cost savings by reimbursing your employees’ premiums through an HRA.

The following four simple steps outline how an HRA works:

- You choose a monthly allowance that your employees can use on premiums, medical services, and healthcare items. You can also limit contributions to premiums only if you choose.

- Employees buy their own health insurance plan on a private exchange, the federal Health Insurance Marketplace, or a state-based exchange. They can choose whatever qualifying medical policy works best for their budget and needs, including their preferred insurer and provider network.

- Employees pay their monthly premiums and other out-of-pocket medical costs upfront.

- Once they provide proof of purchase for an eligible expense, you reimburse them for the amount up to their set allowance limit. HRA reimbursements are income-tax-free for employees. They’re also tax-deductible and free of payroll taxes for employers.

Below, we’ll go over two stand-alone HRAs for employers who choose not to offer a group health coverage plan.

Qualified small employer HRA (QSEHRA)

A qualified small employer HRA (QSEHRA) is for businesses with fewer than 50 full-time equivalent employees (FTEs) that don’t offer a traditional group or ancillary plan. With the QSEHRA, you can reimburse your employees for their individual insurance premiums and qualified out-of-pocket medical expenses. To use the benefit, employees enroll in a health plan that provides minimum essential coverage (MEC).

The IRS sets annual caps on how much employers can contribute through a QSEHRA, but you can offer any amount up to that limit. You also decide whether the benefit will reimburse premiums only or both premiums and qualified medical expenses.

You must offer the QSEHRA to all your full-time W-2 employees. However, you may include part-time staff if they have insurance with MEC, as long as they receive the same monthly allowance as your full-time workers.

Check out our latest QSEHRA annual report to see how a QSEHRA helped our customers.

Individual coverage HRA (ICHRA)

An individual coverage HRA (ICHRA) also reimburses employees with qualifying coverage for individual insurance premiums and eligible medical expenses. However, it offers more flexibility than a QSEHRA. Employers of any size can adopt an ICHRA, and there are no IRS-imposed limits on contribution amounts. You can customize eligibility and allowance levels across 11 employee classes and may also vary amounts by age or family size.

Applicable large employers (ALEs) may also use an ICHRA instead of group coverage to meet the Affordable Care Act’s employer mandate, as long as they offer it to at least 95% of full-time employees and their dependents, and the allowance meets federal affordability standards.

Conclusion

When considering how much employer-sponsored health plans will cost your company, you must consider what percentage of health insurance premiums they’ll cover. Many larger companies that offer traditional employer-sponsored health insurance pay for most of their employees’ monthly premiums. However, small businesses may not have the benefits budget to cover a significant portion of group plan premiums.

Many employers prefer stand-alone HRAs because they’re more flexible and allow employees to choose their own individual plans. If an HRA sounds like a good choice for your company, PeopleKeep by Remodel Health can help! Schedule a call with us today to learn more about which HRA is right for you.

This article was originally published on August 12, 2020. It was last updated on December 5, 2025.

References

1. 2025 Employer Health Benefits Survey

2. Average Percentage of Premium Paid by Covered Workers for Single and Family Coverage, 1999-2025

3. Distributions of worker contributions to the premium

4. Health Benefits Offer Rates

Check out more resources

See these related articles

How group health plans & group health insurance compare

This blog goes over group health plans and group health insurance, how they differ, and how you can use an HRA to help your employees save on healthcare.

What does pay or play mean in health insurance?

Learn what pay or play means in health insurance. Understand how employers must offer coverage or face penalties under the ACA's employer mandate.

How much do employers pay for health insurance?

In this blog, we’ll break down the average cost of health insurance per employee as well as the average cost of employer-provided group health insurance.