Infographic: How much does a hospital stay cost?

By Holly Bengfort on December 26, 2025 at 9:15 AM

For many people, medical emergencies are concerning not only for their health implications but also for the financial burden they can create.

From preventive services and minor injuries to emergency care and major medical issues, health insurance can protect us when we're sick or injured. However, despite more than 90% of Americans having some form of health coverage, medical debt remains a widespread issue1. According to recent national estimates, nearly 20 million people have medical debt2.

In this article, we’ll go over the average cost of a hospital stay by insurance type, including uninsured costs, and outline the expenses of common medical procedures.

In this blog post, you'll learn:

- What a hospital stay consists of.

- How many people stay in hospitals each year.

- How employers can help employees with their healthcare costs.

What does a hospital stay consist of?

Understanding the potential financial impact of a hospital stay is crucial. Here's a look at some of the expenses you might face:

1. Medical procedures and treatments

The cost of medical procedures and treatments can vary based on the complexity and length of the stay. For example, a routine surgery can range from a few thousand dollars to tens of thousands of dollars. Costs can increase further if there are complications or your care requires additional procedures.

2. Room charges

Hospital room charges are a significant part of the overall cost. The type of room you choose, such as a private room or shared room, can impact the amount you pay. Private rooms are more expensive, and rates vary depending on the hospital and location.

3. Medications

Medication costs during a hospital stay can add up quickly. Depending on the drugs prescribed, the cost can skyrocket. Expensive specialty medications can increase the overall bill. It's essential to inquire about generic alternatives or explore other cost-saving options.

4. Doctor fees

You also have to pay for the services provided by nurse practitioners, doctors, surgeons, anesthesiologists, and other specialists involved in your care. These professional fees can vary, especially if you require specialized care or consultations.

5. Additional services

There can be additional charges for various hospital services, including diagnostic imaging, laboratory services, physical therapy, and more. Each of these has its own associated costs, which can quickly add up during an inpatient stay.

How many people stay in hospitals each year?

Now that we've explained which services a hospital can charge you for, let's examine how many patients stay in hospitals each year. According to the American Hospital Association’s 2025 Fast Facts report, there were 6,093 hospitals in 20233. Of these hospitals, about 84% are community hospitals. Community hospitals are generally smaller and serve their local communities. The AHA doesn't consider federally-run institutions or long-term care hospitals as community hospitals.

According to the AHA, there were 34,426,650 hospital admissions in 2023. This includes inpatient admission and other medical services at community hospitals, rural hospitals, and hospital systems.

The Agency for Healthcare Research and Quality (AHRQ), which is part of the U.S. Department of Health and Human Services, analyzed the most common diagnoses (though not necessarily the most expensive conditions) for inpatient hospital admissions in 2022, excluding maternal and neonatal stays4. We've provided this information in the table below.

|

Inpatient admission diagnoses |

Number of hospital stays in 2022 |

|

Septicemia |

2,421,159 |

|

Heart failure |

1,098,199 |

|

COVID-19 |

822,820 |

|

Diabetes mellitus with complications |

687,170 |

|

Cardiac dysrhythmias |

596,160 |

|

Acute myocardial infarction |

581,960 |

|

Pneumonia (except that caused by tuberculosis) |

547,265 |

|

Cerebral infarction |

541,515 |

|

Acute and unspecified renal failure |

497,285 |

|

Urinary tract infections |

462,470 |

How much does an average overnight hospital stay cost?

KFF found in its analysis of AHA data that the average per-day hospital cost was $3,132 in 20235. However, this price tag varies significantly depending on the type of insurance coverage you have and whether you have any insurance coverage at all. The exact cost also varies depending on your location.

Let's review some of the average costs you can expect to pay in different states.

|

State |

Average per-day hospital cost |

|

California |

$4,471 |

|

Florida |

$2,927 |

|

Georgia |

$2,385 |

|

Indiana |

$3,132 |

|

Texas |

$3,183 |

According to HealthCare.gov, the average price of a three-day hospital stay is approximately $30,0006

Average hospital stay cost by payer

Hospital costs aren’t the same for everyone. Depending on whether care is covered by Medicare, Medicaid, private insurance, or paid out of pocket, the average cost of a hospital stay can differ substantially.

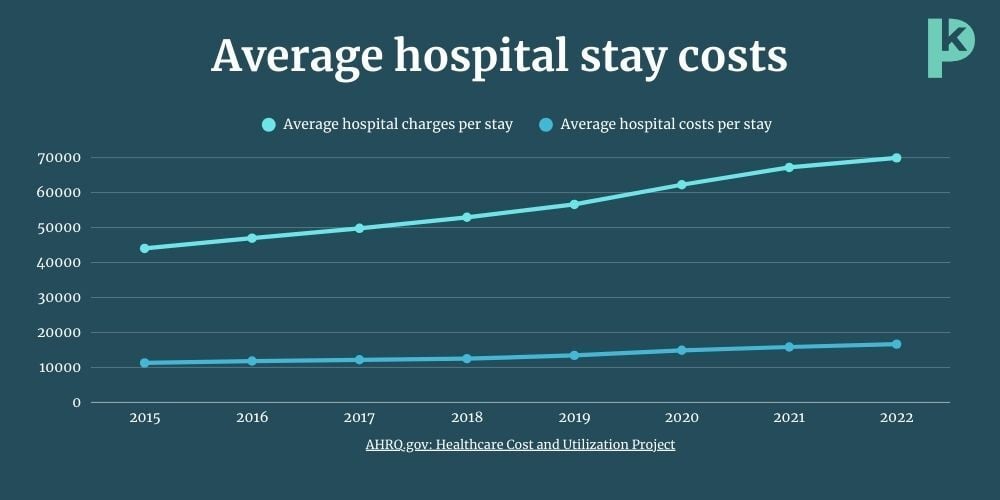

Using national inpatient data from the Agency for Healthcare Research and Quality (AHRQ), the chart below compares average hospital stay costs by expected payer to show how insurance coverage influences what hospitals charge and collect7.

.jpg?width=1000&height=500&name=Healthcare%20Infographic_2%20(1).jpg)

It’s important to note that these figures reflect average hospital costs, not what an individual patient ultimately pays out of pocket.

For example, Medicare-covered stays may appear more expensive in aggregate because they often involve older patients with more complex medical needs, even though Medicare typically limits what beneficiaries owe through standardized cost-sharing rules.

On the other hand, self-pay stays may show lower average costs in the data, but uninsured patients can face higher personal financial responsibility since they don’t benefit from negotiated insurance rates or formal out-of-pocket maximums.

How much are healthcare costs increasing?

Over the past 50 years, annual health expenditures have risen from $353 in 1970 to $14,570 in 20238.

How insurance helps lower hospital costs

While the data show that uninsured patients have a lower average hospital stay cost, it's important to remember that private insurance companies often set an out-of-pocket maximum. While your bill may be high, you'll only have to pay the amount your provider has set as your maximum out-of-pocket cost.

In addition, most insurance companies will often negotiate your hospital costs, helping you get a discounted price compared to what the hospital initially charged you.

Here's a look at what you might pay for each hospital bill without insurance, according to FAIR Health Consumer9:

|

Procedure |

Uninsured price |

|

Arm cast |

$958 |

|

Leg cast |

$1,015 |

|

Childbirth |

$24,498 |

|

Appendix removal |

$32,001 |

|

Hip replacement |

$69,264 |

Estimates based on pricing in Indianapolis, IN. The cost will vary based on your location. You can use FAIR Health Consumer’s tool to see the averages in your ZIP code.

Even with health insurance coverage, hospitalization costs can be staggering. Sometimes, patients who received treatment at an out-of-network hospital for their insurance company would get surprise medical bills. These surprise bills incurred additional medical care costs for patients. In 2022, the No Surprises Act took effect, helping to eliminate or reduce many surprise bills across the country for emergency care.

Estimating your hospital bill costs

Whether or not you have insurance isn't the only factor influencing your hospital bill.

Let's look at a few common factors that can affect how much you pay out-of-pocket:

- Where you live. Your state, ZIP code, cost of living, and availability of doctors and insurers in your area all affect your cost.

- What insurance plan you have. Your insurance company will often negotiate lower prices for you. Uninsured patients have to negotiate on their own.

- Which network you're in. Make sure your doctor and hospital are in your network. In some cases, you won't get the same negotiated discounts or be able to apply the cost toward your deductible if you're out of network.

- Who your provider is. Specialists have a unique skill set, so they generally charge more than a primary care facility.

- Where you go for care. Different facilities charge more or less. Hospitals are more expensive than ambulatory surgical centers, while urgent care and physicians' offices are less costly.

- How you negotiate your bill. If you can't pay the full price of your hospital bill, you may be able to negotiate a lower price that's more affordable.

How employers can help their employees cover their medical bills

With the costs of hospital visits and overnight stays rising, it can be daunting to think about the price you'll pay if you're ever sick, in an accident, or if any medical conditions arise. Most Americans have insurance coverage through their employers.

Small employers and nonprofits face challenges when providing health benefits to their employees. This is especially true with the rising cost of traditional employer plans. That's where alternative employer-provided health benefits can come in handy.

HRAs

With health reimbursement arrangements (HRAs), employers offer employees tax-free monthly allowances to spend on their healthcare needs. You can reimburse your employees for more than 200 types of out-of-pocket costs, including their individual health insurance premiums.

HRA-eligible expenses include:

- Monthly premiums for dental and vision plans

- Doctor visits

- Diagnostic tests

- Ambulance services

- Medical equipment

- Prescription drugs

- Over-the-counter medication

The individual coverage HRA (ICHRA) is an excellent option for organizations of all sizes that want more flexibility with their benefit, including the ability to create employee classes. With no annual allowance caps, you can offer your employees as much as you want to help them cover the cost of hospital stays and other healthcare expenses.

If you run a small business or nonprofit with fewer than 50 full-time equivalent employees (FTEs), a qualified small employer HRA (QSEHRA) might work best for you. While the IRS caps annual allowances, they're an affordable alternative to traditional group health insurance.

Health stipends

Another option for your organization's health benefit is a health stipend. This taxable employee stipend allows you to give your employees money for their medical expenses up to a customizable monthly allowance. Health stipends work like an HRA but with fewer regulations.

While an HRA is often a better choice for organizations looking to offer a health benefit to their employees, health stipends have advantages. If your employees receive advance premium tax credits, they may be able to use their stipend without affecting APTC eligibility. You can also offer stipends to more types of employees, such as international workers or independent contractors. However, a stipend doesn’t satisfy the Affordable Care Act’s employer mandate for organizations with 50 or more FTEs. If you’re an ALE, an ICHRA is a compliant option.

How to get financial assistance

Whether you're an uninsured patient or just facing a hefty medical bill, explore your options for financial aid programs or payment plans.

The federal government requires many hospitals, medical centers, and health systems to provide financial assistance to patients who can't afford medical bills for services deemed "medically necessary." This includes inpatient hospital stays and emergency room visits.

According to the Affordable Care Act (ACA), nonprofit hospitals must have written policies outlining eligibility criteria for financial assistance and specifying whether that assistance covers free or discounted healthcare. It's worth contacting your hospital's medical billing or financial aid department to discuss your options.

Conclusion

Hospital stays in the United States can be expensive. It's important to be aware of the potential costs so you can make informed decisions regarding your healthcare. Understanding the breakdown of expenses and exploring options for financial assistance can help alleviate the burden and ensure you're prepared for the financial impact of a hospital stay.

With personalized health benefits such as HRAs, an employer can help you better afford your medical expenses, including costs associated with hospitalization. If you're an employer looking to provide your employees with a health benefit, PeopleKeep by Remodel Health can help. With our HRA administration software, you can set up and manage your benefit in just minutes each month.

Peoplekeep by Remodel Health doesn't provide financial or medical advice. Consult with the relevant professionals for specific advice related to your situation.

This blog article was originally published on November 21, 2013. It was last updated on December 26, 2025.

References

- KFF Health System Tracker - Percent Uninsured

- KFF Health System Tracker - The burden of medical debt in the United States

- AHA - Fast Facts on U.S. Hospitals, 2025, page 1. Fast Facts on U.S. Hospitals, 2025

- AHRQ - Healthcare Cost and Utilization Project (HCUP) Fast Stats

- KFF - Hospital Expenses per Adjusted Inpatient Day

- healthcare.gov - People under 30

- AHRQ - Hospital Inpatient and Outpatient Use, Cost, and Quality

- KFF Health System Tracker - How has U.S. spending on healthcare changed over time?

Check out more resources

See these related articles

Can I offer a health insurance stipend?

Thinking about offering a health insurance stipend? Learn how it works, when it’s allowed, and why HRAs may be a more compliant alternative for employers.

What is healthcare consumerism?

Discover what healthcare consumerism is and how it empowers individuals to make informed decisions about their healthcare spending and choices.

Five tips to start offering employees health benefits

Learn five essential tips for offering health plans for employees. Discover how to choose the right benefits to attract and retain top talent.