Guide to the individual coverage HRA (ICHRA)

This is the ultimate guide for employers, brokers, and HR professionals looking to offer a customizable and tax-free personalized health benefit. With an individual coverage health reimbursement arrangement (ICHRA), you can take back control of your benefits budget.

- Intro Introduction

- Chapter 1: What is an ICHRA?

- Chapter 2: When was the ICHRA created?

- Chapter 3: What are the benefits of an ICHRA?

- Chapter 4: How does an ICHRA work?

- Chapter 5: Who can offer an ICHRA?

- Chapter 6: Who can participate in an ICHRA?

- Chapter 7: Can business owners participate in an ICHRA?

- Chapter 8: ICHRA affordability rule

- Chapter 9: How does an ICHRA compare to other types of HRAs?

- Chapter 10: How PeopleKeep by Remodel Health can help

Want to break free from traditional group health insurance?

While health benefits have traditionally been one-size-fits-all and costly to offer, they don’t have to be. Today, personalization and flexibility are what employees expect—and what will win them over in a tight labor market. So, how do you offer health benefits tailored to your employees’ unique needs without breaking the bank?

By offering an individual coverage HRA (ICHRA), you can reimburse your employees for their individual health insurance premiums and qualifying out-of-pocket medical expenses.

Are you already offering a traditional group health plan? You can also offer an ICHRA to your employees who don’t qualify for your group plan to extend your benefits package to different sets of employees.

This guide will cover everything you need to know about offering an ICHRA. Download a copy below or scroll to continue reading.

What is an ICHRA?

An individual coverage HRA is a type of health reimbursement arrangement (HRA). It’s a formal group health plan that allows organizations of any size to reimburse their employees tax-free for their individual health insurance premiums and other qualifying medical expenses listed in IRS Publication 502.

For organizations with 50 or more full-time equivalent employees (FTEs)—known as applicable large employers (ALEs)—an ICHRA is an excellent solution for satisfying the Affordable Care Act’s employer mandate.

Whether you choose to offer your ICHRA as a stand-alone benefit to all your employees or as a separate benefit for your employees who don’t qualify for your group health insurance policy (such as remote employees in other states than where your main office is or part-time employees), it can help you meet the requirements of the mandate.

When was the ICHRA created?

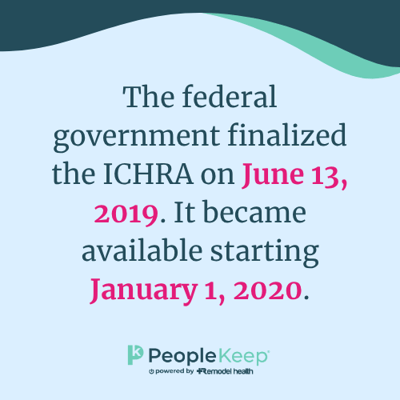

In 2013, IRS Notice 2013-54 limited organizations’ ability to offer HRAs. The notice, which provided further guidance on the ACA, essentially prevented HRAs from integrating with nongroup health insurance except in limited circumstances.

Congress provided some relief in December 2016 by creating the qualified small employer HRA (QSEHRA). With a QSEHRA, small employers with fewer than 50 FTEs could again offer an HRA for individual health insurance (though with many new restrictions).

In October 2017, then-President Donald Trump issued an executive order asking the Departments of the Treasury, Labor, and Health and Human Services to look into ways to expand the availability and usability of HRAs.

The Departments responded with proposed regulations on October 23, 2018. These were finalized on June 13, 2019, creating two new HRAs—the individual coverage HRA and the excepted benefit HRA (EBHRA). The ICHRA was first available to employers on January 1, 2020.

What are the benefits of an ICHRA?

Offering an ICHRA to your employees has many benefits, including its customizable nature, no contribution or participation requirements, and tax advantages. It empowers employees to take control of their healthcare.

Empower employees to get the coverage and medical services that work best for them

With an ICHRA, instead of the employer choosing one health policy for everyone, each employee can shop for their preferred individual health insurance policy through an insurance broker or on the public and private health insurance exchanges. Now, employees can choose a plan with the network, doctors, and monthly health insurance premiums that work best for them.

If an employee already has a qualifying individual health insurance plan, they can keep their existing policy. And when they leave the organization, they keep their individual policy since it’s portable and not tied to their employment.

Completely customizable plan design

You can tailor an ICHRA in several ways to make it fit the diverse needs of your organization and your employees. By dividing your employees into classes, you can legally offer different benefits and allowances to different groups of employees based on bona fide job-based criteria. For example, you can offer different allowances to full-time and part-time employees or choose only to offer an ICHRA to your salaried employees.

You can also differ allowances based on your employees’ age and family status, like single or married.

No contribution or participation requirements

Unlike other HRAs, the ICHRA has no minimum or maximum employer contribution limits, so you can offer your employees as little or as much as you choose. This allows you to customize it to fit your budget while eliminating annual rate hikes.

There are also no participation requirements to offer an ICHRA, so you don’t need to have a certain number of employees enrolled in the benefit to offer it. This differs from traditional group health plans, which often require 60-70% of your employees to enroll in the benefit.

Tax advantages

With an ICHRA, reimbursements are free of payroll taxes for the employer and free of income taxes for the employee. That means you don’t need to report ICHRA funds as income on employees’ W-2s at the end of the year.

Learn how an ICHRA compares to a qualified small employer HRA (QSEHRA).

How does an ICHRA work?

With an ICHRA, employers offer a tax-free monthly allowance to their employees for eligible medical expenses. Employees then buy the healthcare services and items they want, including individual health insurance coverage, and the organization reimburses them up their available allowance amount.

If you’re new to offering an ICHRA, we can help. At PeopleKeep, we’re experts on HRA administration and help thousands of employers reimburse their employees daily through our hassle-free ICHRA administration software.

Regardless of how you choose to administer your ICHRA, the following steps and information apply.

Step 1: Design your benefit to fit your needs

First, the employer designs their ICHRA benefit so it’s suited to the needs of their employees. When setting up your ICHRA, you’ll decide how much tax-free money you want to offer employees each month in a set allowance, which expenses you’d like to be eligible for reimbursements, and if you’d like to customize allowances and eligibility by employee class.

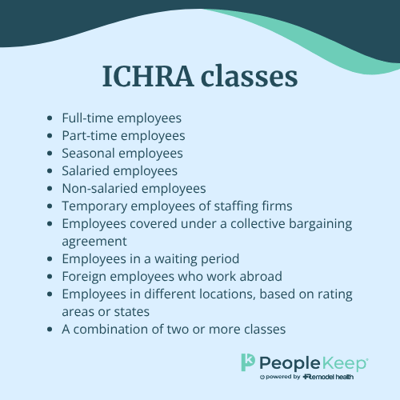

You can customize your ICHRA with the following classes of employees:

- Full-time employees

- Part-time employees

- Seasonal employees

- Salaried employees

- Hourly employees

- Temporary employees working for a staffing firm

- Employees covered under a collective bargaining agreement

- Employees in a waiting period

- Foreign employees who work abroad

- Employees in different locations, based on rating areas, states, or multi-state regions

- A combination of two or more of the above classes

If you offer an ICHRA through PeopleKeep by Remodel Health, only full-time, part-time, seasonal, salaried, non-salaried, state-based classes, and a combination of those are available. If you need an ICHRA with the other class options, Remodel Health’s ICHRA+ solution is the way to go.

In general, HRA allowances should be the same within each class of employees. However, employers can make distinctions based on the employee’s age or family status.

If employers also provide group coverage and choose to structure eligibility based on full-time or part-time status, hourly or salaried pay structure, or geographic location smaller than the state-level, the employee classes must meet a certain size requirement.

The ICHRA minimum class sizes are:

- Ten employees for employers with fewer than 100 employees

- Ten percent of the total number of employees for employers with between 100 and 200 employees

- Twenty employees for employers with more than 200 employees

Step 2: Employees make healthcare purchases

Once you set up your benefit, employees can opt into it and start making healthcare purchases. First, employees must purchase individual health insurance coverage to be eligible for the ICHRA. Then, once they opt in, employees can submit their premiums and potentially other qualified medical expenses for reimbursement.

Eligible out-of-pocket expenses can include anything listed in IRS Publication 502, although employers can limit some of these items according to their preference.

For example, if you want only to reimburse employees for their premiums, you can offer a premium-only ICHRA.

Step 3: Employees submit proof of incurred expenses

Next, after employees make purchases, they’ll submit documentation showing proof of the incurred expenses when requesting reimbursement.

The IRS requires ICHRA reimbursement documentation to include the following:

- The name of the item or service purchased

- The cost of the item or service

- The name of the vendor or service provider

- The date of purchase

Invoices, receipts, or an explanation of benefits from an insurer or healthcare provider typically satisfy this requirement. Depending on the item an employee requests reimbursement for, a doctor’s note or prescription may also be required under the regulations. Remember that this information is subject to HIPAA privacy rules, so you need to handle it carefully if you’re self-administering an ICHRA.

Step 4: Review and reimburse expenses

Finally, the employer reviews expenses, and either approves or rejects the requests. If you use PeopleKeep to administer your ICHRA, our expert team will review your employees’ reimbursement requests for you to ensure compliance with HIPAA and federal laws and regulations. If the expense qualifies under the IRS guidelines, we’ll verify the request. Then, you can reimburse your employees up to their available allowance.

Typically, employers choose to reimburse employees through payroll by adding a non-taxable line item to employees’ paychecks. But you can also pay out ICHRA reimbursements with a separate check, cash, or a bank transfer.

Who can offer an ICHRA?

All employers with at least one W-2 employee can offer an ICHRA. This includes businesses, nonprofits, government entities, and religious organizations.

You can offer an ICHRA as a stand-alone benefit or alongside a group health insurance policy. But remember, you can’t offer the same group of employees a choice between group health insurance and an ICHRA.

For example, you could offer group health insurance to full-time employees and an ICHRA to part-time employees, but you can’t offer full-time employees a choice between a group health plan and an ICHRA.

An organization also can’t offer a QSEHRA or an excepted benefit HRA (EBHRA) alongside an ICHRA.

Who can participate in an ICHRA?

To participate in the ICHRA, employees must have coverage through an individual health insurance policy. Eligible policies include qualifying on-exchange or off-exchange coverage and Medicare coverage. Employees with Medicare need Medicare Parts A and B together, or Medicare Part C.

Employees’ family members are also eligible to participate in the ICHRA provided they meet the same qualifications and the employer chooses to extend eligibility to spouses and dependents. If the employee or a participating family member ever loses individual plan coverage, they can no longer receive reimbursements.

Employees covered by any group plan, including a spouse’s or parent’s plan, can’t participate in an ICHRA. Other unacceptable forms of coverage include COBRA, healthcare sharing ministries, association health plans, Tricare, or being uninsured—to name a few.

See the full list of eligible forms of coverage here

The ICHRA also comes with premium tax credit restrictions. Specifically, employees who participate in the ICHRA are no longer eligible for premium tax credits. For this reason, employees are free to opt out of the ICHRA and keep their tax credits as long as their allowance amount is considered “unaffordable” and wouldn't provide minimum value under the ACA.

Beyond that, eligibility requirements are up to the employer.

Can business owners participate in an ICHRA?

Some types of business owners can’t participate in their organization’s ICHRA. Let’s review each type of business owner below.

Can S-corporation owners participate in an ICHRA?

IRS regulations dictate that S-corporation owners, their spouses, and their dependents who own more than 2% of the business can’t participate in an ICHRA. This is because owners can write off their medical expenses through other means. The IRS also doesn’t consider S-corp shareholders as employees. Fortunately, this rule only applies to owners, and employees can still participate.

Can C corporation owners participate in an ICHRA?

C corporations are legal entities separate from the owner. This means the IRS considers owners common-law employees of the corporation. C corp owners can participate in an ICHRA. As with all employees, this eligibility extends to the C corp owner’s family as well. All reimbursements paid to the C corp owner and the owner’s family are tax-free to the company and the owner.

Can sole proprietors participate in an ICHRA?

A sole proprietorship is an unincorporated business owned and run by one person. There’s no distinction between the business and the owner, so the owner isn’t an employee. This means sole proprietors can’t participate.

If the owner is married to a W-2 employee of the business, the owner could gain access through their spouse’s allowance as a dependent. All reimbursements would be tax-free to the sole proprietorship and the owner’s spouse.

Can partners participate in an ICHRA?

A partnership is a pass-through entity, meaning the company isn’t subject to income tax. Instead, the partners are directly taxed individually. Partners in a partnership are self-employed rather than company employees, so they’re not eligible to participate in an ICHRA.

Similar to sole proprietors, partners can access the benefit if they’re married to a W-2 employee of the business, as long as the partner’s spouse isn’t also a business partner.

ICHRA affordability rule

ALEs subject to the employer mandate can use an ICHRA to satisfy the employer shared responsibility provisions of the ACA. The employer mandate requires organizations with 50 or more FTEs to offer affordable health coverage that meets minimum essential coverage (MEC) and minimum value to 95% of their full-time employees.

While affordability is important to employers for compliance reasons, it also impacts employees. If you offer an unaffordable allowance, your employees can opt out of the ICHRA and choose to receive premium tax credits instead.

An ICHRA is affordable in 2026 if an employee isn’t expected to pay more than 9.96% of their household income for a self-only silver plan after using their allowance. This means your ICHRA allowance must be greater than the lowest-cost silver plan monthly premium minus 9.96% of your employee’s household income.

To learn more about determining ICHRA affordability in 2026, see our blog post

How does an ICHRA compare to group health insurance?

Group health insurance is the traditional way employers offer health coverage to their employees. If you’re considering an ICHRA, you likely want to know how it compares to different types of group coverage.

A fully-insured group plan is health coverage that organizations provide to a group of employees. Employers typically cover a large portion of the monthly premiums. According to KFF, employers covered, on average, 84% of group premiums for single coverage and 75% for family coverage in 2024. This type of coverage usually requires at least 70% of employees to participate.

Fully-insured group insurance plans are expensive for many small businesses. With a small health risk pool, employees with large medical claims can drive up premiums for the entire organization. It’s not uncommon for group plans to experience double-digit rate increases each renewal period. If you’re facing a significant rate increase or spending too much on premiums, switching to an ICHRA can help you control healthcare costs.

There are also self-insured group plans. With this type of plan, employers pay employees’ medical claims directly. This can save businesses money on premiums if their group has low utilization. However, if your employees make many medical claims or have a few really expensive claims, it can put small businesses into financial ruin. There are ways to mitigate the risk of self-funded plans, like implementing a stop-loss policy. However, an ICHRA is an excellent alternative. Employers can control their costs by setting an allowance for their employees, all without the risk of paying high medical claims. Employees instead purchase individual health plans that handle the risk.

Here’s how the ICHRA compares to common types of group plans.

|

ICHRA |

Fully-insured group plans |

Self-insured group plans |

|

|

Plan cost |

The cost of an ICHRA depends on how much the employer wants to offer in allowances. Our 2024 ICHRA Report found that ALEs offered an average of $448 per month per employee while non-ALEs offered an average of $600 per month per employee. |

Group plan premiums vary depending on the number of employees the plan covers, plan usage, location, employee ages, and more. According to KFF, the average annual group premium in 2024 is $8,951 for single coverage and $25,572 for family coverage. |

Costs vary based on benefit utilization and claims volume. Low utilization could result in savings over other group models. But high claims volume or expensive claims could create financial hardship. |

|

Plan funding |

Employers set a defined contribution for employees. This is the maximum amount the employer will pay per employee for the year. |

Employers pay a portion of the premium. In 2024, employers covered 84% of self-only and 75% of family coverage premiums on average. |

Employers directly pay for employees’ medical claims. |

|

Who bears the financial risk of covering employee claims? |

The individual health insurance carriers take on the risk of insuring your employees. |

The group health insurance carrier takes on the risk of insuring your employees. Employers are responsible for contributing to a portion of the premiums. |

The employer takes on the full responsibility of covering employee medical claims. |

|

What employers are eligible to offer the benefit? |

Employers with at least one W-2 employee can offer an ICHRA. |

Employers of all sizes, though many plans require a minimum percentage of employees to participate. |

Any employer can offer a self-insured plan. |

|

What employees are eligible to participate? |

In general, W-2 employees can participate in an ICHRA. They’ll need to enroll in qualifying individual health insurance coverage. Employers can use employee classes to customize eligibility. |

Any employee can participate in a fully-insured group plan. Employers can use non-discriminatory factors to customize eligibility. They’ll just need to follow any regulations and carrier rules. |

Any employee can participate in a self-insured group plan. Employers can use non-discriminatory factors to customize eligibility. |

|

Employee choice of coverage |

Employees choose the individual plans that best fit their needs and location. |

Employees usually have only one coverage option. |

Employees have only one coverage option. They don’t choose how the employer designs the plan. |

|

When do employees enroll in coverage? |

If offering an ICHRA for a January 1 start date, employees can use the individual market Annual Open Enrollment Period to enroll in coverage. Otherwise, the offer of an ICHRA creates a 60-day special enrollment period (SEP) for employees to enroll in coverage. |

Employers define the annual open enrollment period for the plan. Employees can change coverage if they experience a qualifying life event that triggers a SEP. |

Employers define the annual open enrollment period for the plan. Employees can change coverage if they experience a qualifying life event that triggers a SEP. |

|

Are there minimum participation requirements? |

No. |

Yes. |

No. |

|

Is the benefit portable? (Can employees take it with them if they leave the company?) |

No. However, employees’ individual health plans are portable. They can pay their premiums and continue their coverage. |

No. |

No. |

|

Does the benefit satisfy the ACA’s employer mandate? |

Offering an affordable ICHRA allowance can satisfy the mandate. Employees’ individual plans must meet minimum value and MEC to participate in the ICHRA. |

Yes, if the benefit is affordable and provides minimum value and MEC. |

Yes, if the benefit is affordable and provides minimum value and MEC. |

Want to see how the ICHRA compares to other types of HRAs?

How PeopleKeep by Remodel Health can help

When it comes to health coverage for your team, it may be a good idea to look beyond traditional group health plans. An ICHRA is a company-funded health benefit with more design flexibility than group policies offer. It gives employers a cost-effective way to offer personalized health benefits to their employees. It also empowers employees by giving them the freedom of choice when it comes to their healthcare services and coverage options.

With an ICHRA, organizations of all sizes can offer tax-free reimbursements to employees for out-of-pocket medical costs, such as monthly individual health insurance premiums and other eligible expenses.

If you want to offer an ICHRA to your employees, PeopleKeep and Remodel Health can help!

At PeopleKeep, we offer HRA administration software for:

Our HRA administration software makes it easy to set up and manage your benefit in minutes each month. We can help you ensure compliance with your ICHRA by reviewing your employees’ reimbursement requests, generating required plan documents, and storing your documents.

Ready to offer an ICHRA?

Learn how Remodel Health can help you depending on your role and organization size. Select your business type below to learn more.

How an ICHRA with PeopleKeep works for small employers

ICHRA administration for organizations with fewer than 50 employees.

PeopleKeep's individual coverage health reimbursement arrangement administration software makes offering an ICHRA hassle-free for small businesses and nonprofits. Learn more about our ICHRA software or book a call with an HRA specialist.

Want to launch an ICHRA with white glove service?

ICHRA administration for organizations with 50 or more employees.

As PeopleKeep's parent company, Remodel Health offers enhanced personalized support and expert guidance. Their deep expertise in individualized health plans helps ensure that your ICHRA needs are fully met.

Empower your clients and earn commissions

As a local broker or agent, you need every advantage to maintain your client relationships. By working with Remodel Health to offer an ICHRA to your clients, you'll get access to expert resources and earn commissions. With PeopleKeep, you’ll also remain the agent of record for your clients so you can sell individual policies and ancillaries to their employees.

Frequently asked questions about ICHRA

Reimbursements made through an ICHRA aren’t considered income, and you don't need to report them as such on an employee's W-2.

Not all coverage types are created equal. Employees and their dependents who plan to opt in to an ICHRA need a qualifying individual health plan. Generally speaking, as long as your plan has no annual or lifetime limits and covers preventive health services with no cost-sharing, it can work with an ICHRA. Healthcare sharing and direct primary care plans aren’t eligible.

An ICHRA is an excellent health benefit for employees because it allows them to choose their own health insurance. Rather than their employer making decisions for them on which health insurance policy they can participate in, employers can give the decision-making power back to employees. This empowers them to shop on the individual market and choose the right plan that fits their budget, network, and health needs.

With an ICHRA, employees who qualify for premium tax credits must choose whether they want to participate in the ICHRA or collect their tax credit based on whether or not the ICHRA is considered affordable.

If an ICHRA allowance is affordable, then an employee’s best option is to participate in the ICHRA. Offering an affordable allowance makes employees ineligible for premium tax credits, even if they don’t participate in the ICHRA. So, if they decide to opt out of your ICHRA, they still wouldn’t be eligible for tax credits.

If an ICHRA allowance is unaffordable, employees can opt in or out of the ICHRA based on whether the ICHRA or tax credits will give them more money. If their premium tax credit is larger than your ICHRA allowance, they’ll want to opt out of the ICHRA and collect the tax credit.

Learn more about how the premium tax credit coordination works with an ICHRA.

Your employees can shop for an individual health insurance plan directly from an insurance company, through a broker, or on the public exchanges. While individuals can normally only get Marketplace coverage from the exchanges during open enrollment, offering an ICHRA creates a special enrollment period (SEP) where your employees can purchase individual health coverage.

Most states use the Federal Health Insurance Marketplace, HealthCare.gov, but many states operate their own exchanges.

You can see a list of exchanges by state here.

With PeopleKeep by Remodel Health, your employees can shop for health and ancillary insurance policies right from their PeopleKeep account.

PeopleKeep’s ICHRA administration solution is the perfect low-touch option for small businesses wanting to offer a health benefit. Many of our customers are offering benefits for the first time, and appreciate our innovative technology platform and ease of use. However, businesses with 50 or more employees or those switching from a group health insurance plan might need more support and features. Remodel Health’s ICHRA+ platform offers a full-service concierge model with additional benefit design features. ICHRA+ also boasts AutoPay for employee premiums, payroll integrations for larger groups, and in-house white-glove service from signup through renewal.

ICHRA resources from our blog

Offering SHOP coverage vs. ICHRA

What is an ICHRA?

Why your small business can't afford to ignore ICHRA in 2026

What is the CHOICE Arrangement? ICHRA could become CHOICE

Does an HRA work with Medicare?