Annual report shows trends in employer-funded individual health insurance

By PeopleKeep Team on Mar 9, 2016 11:30:00 AM

With health reform lacing news headlines and bringing with it added pressure on small businesses to provide health benefits to their employees, more and more companies are turning to the individual health insurance market for solutions.

These trends are verified in a new report released by Zane Benefits on Wednesday. The Employer-Funded Individual Health Insurance Annual Report 2016 provides a detailed, nationwide profile of how employers and employees are using employer-funded individual health insurance as an employee benefit today.

The findings in the report are based on a sample of 2,200 employers and 10,500 participants using a Zane Benefits defined contribution health benefit solution during the 2015 calendar year. Some of the key findings of the report are as follows:

- Nationally, the average employer-funded health benefit allowance offered by employers is $426 per month, per employee. This average includes all states and family sizes.

- The average employee utilization amount of the employer-provided health benefit allowance, among all states and family sizes, is $380 per month, per employee (an 89% utilization rate). As such, the actual employer contribution toward health benefits averages $380 per month.

- Compared with offering traditional group insurance coverage, employers using a defined contribution solution save an average of 57% on comparable, comprehensive health benefits. This gives small business employers the ability to afford and, in many cases, improve their employee benefits offering.

“This report validates employer-funded individual health insurance as a viable solution to the benefits needs of small businesses,” says Rick Lindquist, President and CEO of Zane Benefits, “It’s a clear indicator that the old way isn’t working and the market is ready for a better way. As small business employers ask the health benefits question, it is important for them to know about this option. For many, it means the difference between offering benefits and providing nothing at all.”

About Zane Benefits, Inc.

Zane Benefits, now PeopleKeep, helps small businesses establish employee benefits programs that are employer-funded, but employee owned. This creates several time and cost-saving advantages for the small business, while providing employees with better value than cash, and access to the choice, products and perks of the individual insurance market. Zane Benefits solutions have been featured on the front-page of The Wall Street Journal, USA Today, and The New York Times.

You May Also Like

These Related Articles

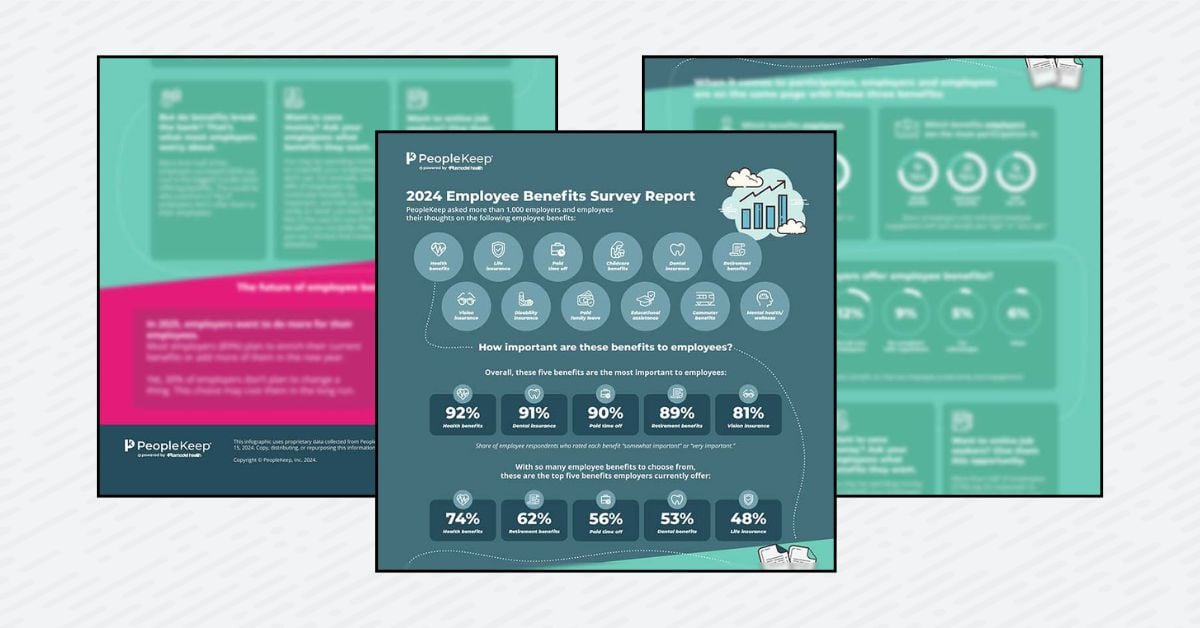

PeopleKeep survey exposes misalignment in employee benefits perceptions and priorities

PeopleKeep's 2024 Employee Benefits Survey highlights a need for employers to invest their money more wisely when it comes to certain employee benefits.

PeopleKeep report: Employers are leveraging ICHRAs to provide a generous employee health benefit that covers higher-tier insurance premiums and more

PeopleKeep Report: Employers are Leveraging ICHRAs to Provide a Generous Employee Health Benefit That Covers Higher-Tier Insurance Premiums and More.

PeopleKeep launches the PeopleKeep Partner Marketplace to help small and medium-size businesses

PeopleKeep launches the Partner Marketplace—a place for brokers, employers, and employees to learn about our partners and how they can enrich their HRA.