HRA administration software for the modern workforce

Elevate your health benefits effortlessly with PeopleKeep by Remodel Health. Our health reimbursement arrangement (HRA) software makes offering quality health benefits more manageable and accessible for all employers.

Manage health employee benefits for any organization

Companies at every stage of their health benefits journey turn to PeopleKeep to modernize and simplify their employee benefits administration. Whether your team is in-office, remote, or hybrid, we can help your organization set up and manage quality health benefits in just minutes each month.

Inclusive

Health benefits don't always work for a diverse or remote team. HRAs can support employees regardless of their age, state, or family status.

Individualized

No two employees have the same healthcare needs—so why offer a one-size-fits-all plan? HRAs give employees the freedom to choose their own health coverage.

Flexible

Every team is different, and their health benefits should reflect that. HRAs offer the flexibility to support employees no matter their age, location, family status, or individual needs. Employees can choose their own health plan that best fits their needs.

Straightforward

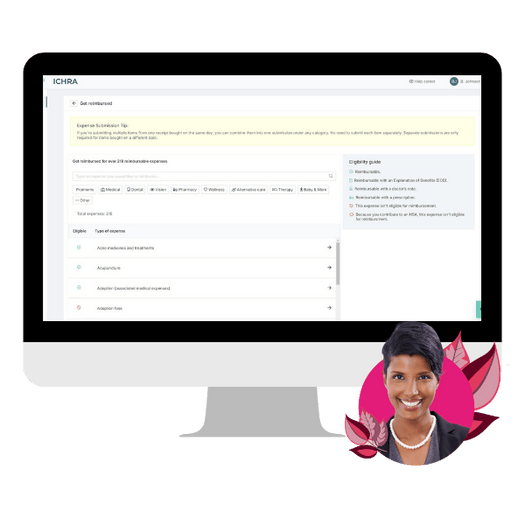

HRAs let employees choose the health coverage that works best for them. Employees simply choose a plan and submit eligible premiums and out-of-pocket expenses through the PeopleKeep software for reimbursement.

If you want to attract and retain talented employees, you need to offer a standout employee benefits package. With health reimbursement arrangements (HRAs) you can reimburse your employees for the health insurance plans and medical expenses they choose while staying within your budget. Our benefits management software simplifies the most time-consuming tasks.

What are the advantages of administering your HRA with PeopleKeep?

Flexibility

Ease

Recordkeeping

Customer support

Best of all, there’s no need to pre-fund an account. You only reimburse employees once they’ve incurred expenses. Many benefits administration software providers require employers to pre-fund accounts before making any reimbursements. When you offer your benefits through PeopleKeep, the money stays with you until your employees have an approved expense.

What our customers say

“We were sold on PeopleKeep because of your affordable pricing, great customer service... It fits within our budget and the product is clean, robust, and easy to use.”

NOBL BEVERAGES

“PeopleKeep is modern, accurate, compliant, and user-focused. The platform helps keep our records up-to-date. We just log on and it’s all there.”

COASTAL COMMUNITY CHURCH OF VIRGINIA BEACH

“We were excited to go with PeopleKeep because we could take care of our employees without the extreme cost of group health insurance.”

2 PEES IN A POT

HRA software: Offer a compliant and personalized health plan in minutes

An HRA is a formal employer-funded health benefit that allows organizations to reimburse their employees, tax-free, for the individual health insurance premiums and out-of-pocket medical expenses of their choosing. Unlike traditional group health insurance plans, HRAs enable your employees to choose their own health coverage that best fits their needs.

PeopleKeep makes launching and managing an HRA more accessible and intuitive for employers. We automate all the time-consuming tasks like preparing and updating legal documentation and reviewing employee reimbursement requests so you can focus on running your business, not your benefits.

Learn more about the HRAs you can offer with PeopleKeep

Qualified small employer HRA (QSEHRA)

A powerful first-time benefit or alternative to group health insurance made specifically for small employers.

Individual coverage HRA (ICHRA)

A health benefit that enables employers to cover the individual insurance plans their employees choose.

Group coverage HRA (GCHRA)

A health benefit that employers can use to help employees with their out-of-pocket expenses. It pairs with a group plan.

HRA administration software features

Compliance assurance

Adaptive customization

Integrated shopping

Frequently asked questions

PeopleKeep’s HRA software solutions help small and midsize businesses administer their own individualized health benefits in minutes each month. With it, employers can offer inclusive and meaningful benefits that help them attract and retain top talent.

We accept credit card and ACH payments.

We don't believe in hidden fees at PeopleKeep. The only charges that will show up on your invoices are the one-time setup fee when you first purchase a plan, the monthly base fee, and the monthly per-employee fee.

Ready to break free from cookie-cutter employee benefits?

Schedule a live demo with a PeopleKeep benefits specialist who can answer your questions and show you how our platform works.