What can an HRA reimburse?

By Elizabeth Walker on January 5, 2026 at 3:30 PM

Offering health benefits can be expensive and complex, especially for small businesses. That’s why health reimbursement arrangements (HRAs) are becoming a popular alternative to traditional group health insurance. With an HRA, employers can provide tax-free reimbursements for employees’ out-of-pocket medical expenses. However, there are many eligible expenses, so it can be tricky to know what’s covered.

Depending on which type of HRA you offer and how you design your benefit, you can reimburse employees for more than 200 types of items outlined in IRS Publication 5021. The CARES Act2 further expanded these eligible expenses. To make it easier, we’ve compiled a summary to help you and your employees understand what an HRA can cover.

In this blog post, you’ll learn:

- How HRAs work, including how tax advantages apply for both employers and employees.

- Which medical expenses HRAs can reimburse, and what documentation the Internal Revenue Service (IRS) requires for different types of costs.

- How employers can use a health stipend to supplement an HRA if their employees need greater coverage and flexibility.

How does an HRA work?

With an HRA, you give eligible employees a defined monthly contribution, called an allowance, that they can spend on qualified healthcare costs. Depending on your HRA type, the IRS may set maximum annual limits that cap how much of an allowance you can offer. Once an employee buys an eligible medical expense and submits claim documentation, you reimburse them tax-free up to their set allowance amount. Once they reach their limit, they can’t exceed it.

HRA allowances can roll over monthly. But unlike a health savings account (HSA), unused HRA funds with PeopleKeep remain with the employer at the end of the year, and if an employee leaves your company. This gives employers more control over their benefits budget and provides employees with greater flexibility in managing their healthcare spending.

Lastly, according to the final rules outlined by the IRS in 2019, all compliant HRAs are tax-advantaged benefits for employers and employees3, provided employees meet applicable coverage requirements. Reimbursements are tax-deductible and payroll tax-free for employers. They’re also income-tax-free for your participating employees.

Now that you understand how HRAs work, let’s review the two main categories that are eligible expenses for reimbursement.

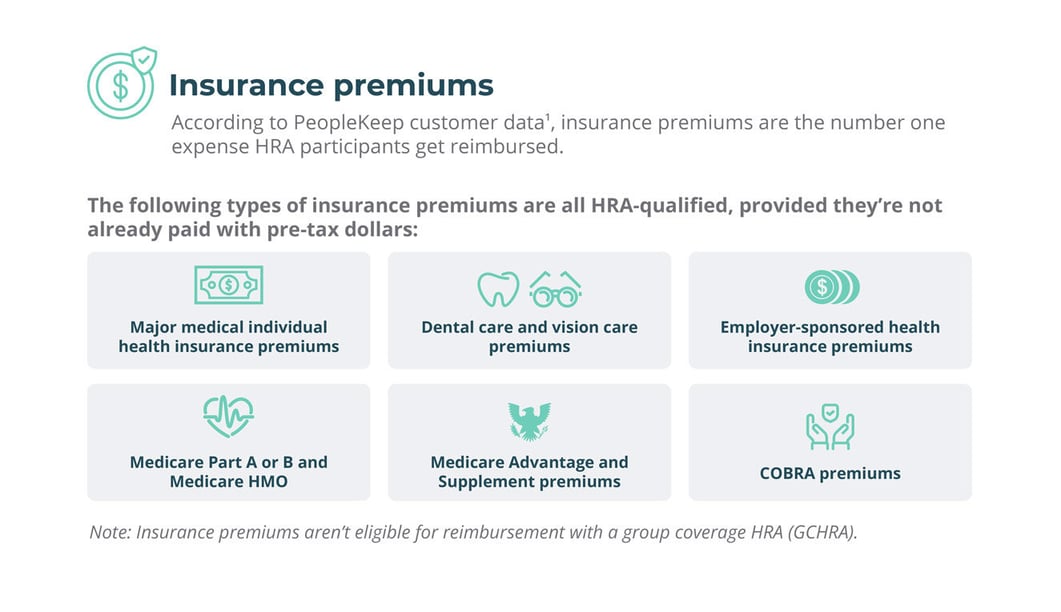

1. Insurance premiums

The first category is insurance premiums. You can reimburse employees for individual health insurance premiums if you offer a qualified small employer HRA (QSEHRA) or an individual coverage HRA (ICHRA). But, according to IRS guidelines, you can’t reimburse employees for insurance premiums if you have an HRA that’s integrated with a group plan, like a group coverage HRA (GCHRA).

However, if an employee is paying for an insurance policy with pre-tax dollars, they can’t receive HRA reimbursement for the payment. Remember, an HRA is a tax-free benefit. So, this rule prevents employees from paying an expense with pre-tax money and then receiving a tax-free reimbursement for the same cost. The federal government would consider this action to be “double dipping”4.

The following insurance premiums are HRA-qualified medical expenses:

- Major medical individual health plan premiums

- This includes plans on public health exchanges, such as the federal Health Insurance Marketplace and state-based marketplaces. Private exchange plans that provide minimum essential coverage (MEC) are also eligible.

- Ancillary coverage premiums

- This includes dental and vision plans.

- TRICARE insurance premiums

- Medicare premiums

- However, there are coordination rules your employees must follow if using an HRA with Medicare.

- CHIP insurance premiums

- Long-term care premiums

- COBRA premiums

- Short-term health insurance plan premiums

It’s essential to note that while employers can reimburse employees for these types of premiums, not all of these insurance types qualify as coverage for a QSEHRA or ICHRA. For example, those with short-term health insurance only can’t participate in a QSEHRA or ICHRA unless they enroll in a qualifying health plan.

Health insurance premium payments typically recur on a monthly basis. To account for this, employees can submit proof of their monthly premium amount once at the beginning of the plan year. If the amount, provider, and timing of their previously approved medical expense don’t change, employees can receive automatic monthly reimbursements for the premium. They’ll just need to attest that they still have insurance coverage.

Depending on your HRA type and plan design, you can reimburse health plan premiums only or out-of-pocket medical expenses in addition to premiums. According to PeopleKeep’s 2025 QSEHRA Report, individual health insurance premiums are the most common expense employees submit, making up roughly 65% of QSEHRA reimbursement dollars in 2024.

2. Out-of-pocket healthcare costs

Next, there are out-of-pocket medical expenses. This includes any qualifying medical costs that an employee’s health insurance plan doesn’t cover, as well as any expenses their insurer expects them to pay for on their own, such as copayments or coinsurance.

If an employee has unused HRA funds, out-of-pocket expenses are a good way to spend them. Our 2025 QSEHRA report found that out-of-pocket costs are the second most requested for HRA reimbursement, after premiums, accounting for 8.65% of claims. If you have the budget, setting an allowance that allows your employees to receive reimbursement for premiums and out-of-pocket expenses can help them maximize the value of their HRA.

Qualifying out-of-pocket medical expenses include:

- Doctor visits

- Vision care

- Dental treatment

- Occupational therapy

- Prescription drugs

- Over-the-counter medication

- Mental health counseling

Depending on the type of out-of-pocket service or item your employees incur, they must submit different claim documents for reimbursement.

You should include claim information in your HRA’s plan documents along with the medical expenses the benefit covers. However, we’ll go over the three different expense category types in the sections below to give you an idea of how it works.

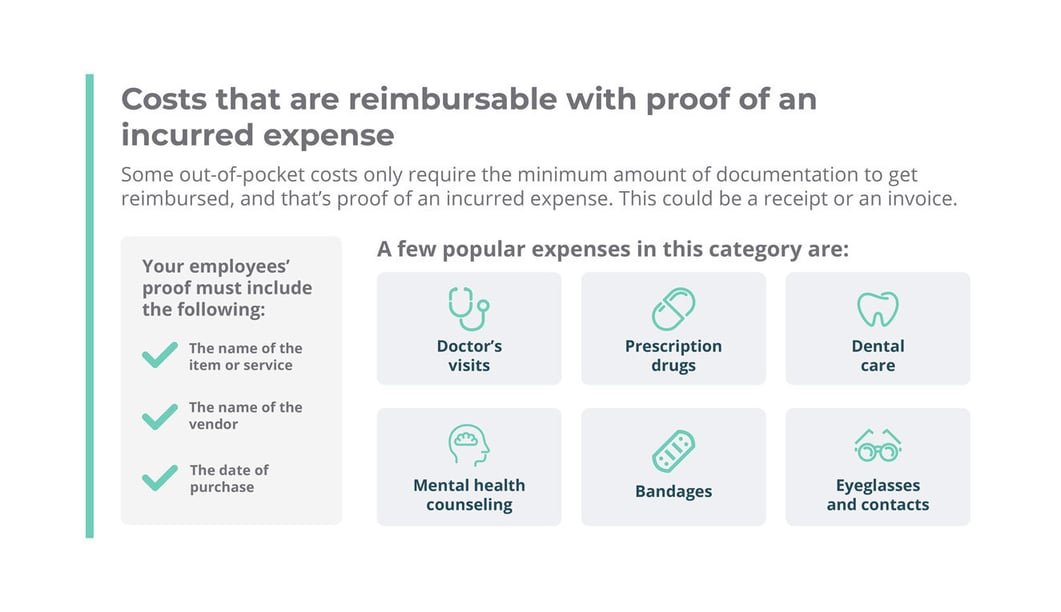

Costs that are reimbursable with proof of an incurred expense

Some out-of-pocket medical expenses require your employees to submit only a minimum amount of documentation. This proof of an incurred cost is typically in the form of a receipt or an invoice.

Your employees’ proof must include the following:

- The name of the item or medical service

- The name of the vendor

- The date of purchase

This category includes any qualifying medical expenses employees must pay out-of-pocket before they meet their plan’s annual deductible or out-of-pocket maximum. Some examples are psychiatric care, diagnostic services, physical exams, and chiropractic care.

This group also includes smaller healthcare expenses, such as several over-the-counter medications and items. These can include:

- Cough syrup

- Eye drops

- Sunscreens with SPF 15 or higher

- Prescription eyeglasses and contact lenses

- Acne treatment

- Menstrual care products

- Hearing aids

Most HRAs don’t roll over year to year. So, your staff may want to stock up on a few of these items before the new plan year to fully take advantage of their employee benefit plan.

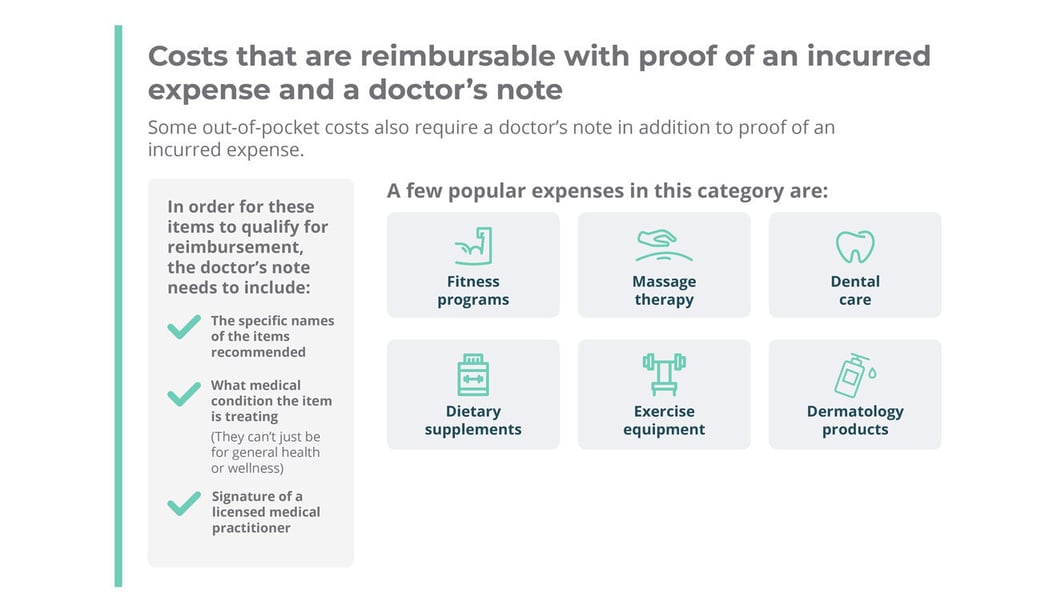

Costs that are reimbursable with proof of an incurred expense and a doctor’s note

Next, discuss qualified medical expenses requiring proof and a doctor’s note. For example, many over-the-counter items are eligible for reimbursement. However, some require your employees to provide a doctor’s note explaining why they have a medical need for that specific service or item.

For these items to qualify for reimbursement, the doctor’s note needs to include:

- The specific names of the recommended medical service or item

- What medical condition the service or item is treating

- A doctor’s note must show medical necessity. Items related to general health or wellness are ineligible.

- The signature of a licensed medical practitioner

The following are HRA-eligible items or services that are reimbursable with a doctor’s note:

- Fitness programs

- Dental veneers

- Massage therapy

- Dietary supplements

- Exercise equipment

- Special equipment and foods

- Dermatology products

- Orthopedic shoes and inserts

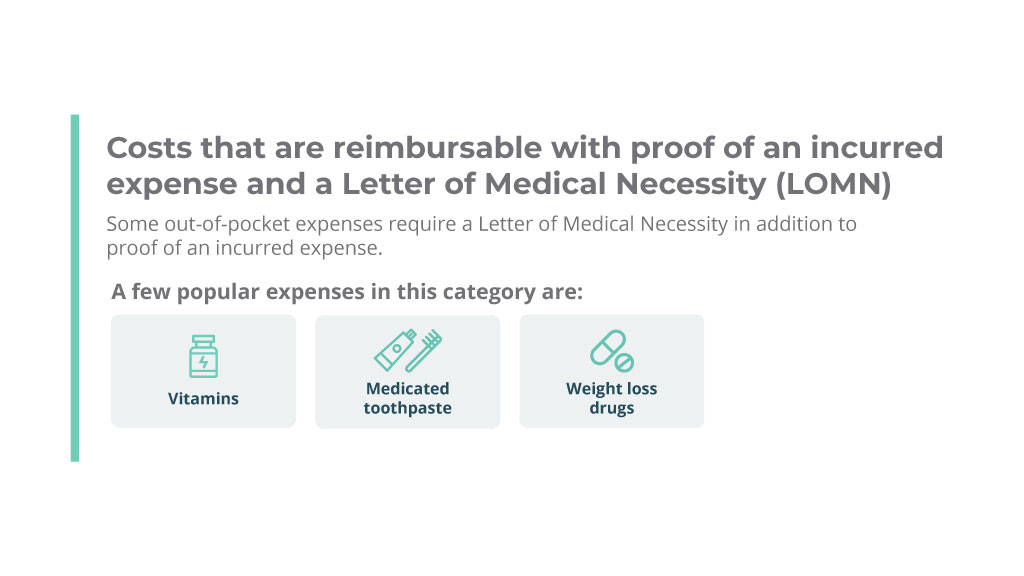

Costs that are reimbursable with proof of an incurred expense and a prescription

The last category is qualified medical expenses that are reimbursable with proof and a prescription. Eligible items that employees can receive reimbursements for with a prescription include vitamins and medicated toothpaste.

Employees don’t need to submit their prescriptions to receive reimbursements. This is because certain drugs already require a doctor's prescription before the employee can pick them up from a pharmacy. Therefore, you don’t need to ask employees to submit proof of their prescriptions.

Your employees will simply submit a receipt showing any out-of-pocket costs, like a copay or coinsurance, that they paid for the prescription.

What are examples of ineligible HRA expenses?

Any medical expenses not included in IRS Publication 502 or the CARES Act are ineligible for reimbursement with an HRA.

Examples of items ineligible for reimbursement are:

- Adoption fees

- Cancer insurance plan premiums (and other fixed-indemnity plans that provide set cash benefits)

- Cosmetic medical procedures or surgery

- CPR classes

- Business expenses

- General dental products, such as standard toothpaste

- Hair removal treatment, or hair transplants

- Child care

- Household upkeep or help

- Meals and lodging when away from home for medical treatment

- Maternity clothes

- General vitamins and dietary supplements without a doctor’s note

While the above list isn’t complete, it provides an idea of what expenses you can’t have reimbursed with an HRA.

Want to supplement your HRA? Consider a health stipend.

Suppose an HRA doesn’t cover all the healthcare items your employees need, or you simply want to enhance your HRA benefit. In that case, you can supplement it with a health stipend.

A health stipend works similarly to an HRA. It allows you to give your employees a contribution for medical care costs, including out-of-pocket expenses and health insurance premiums. However, a health stipend is less federally regulated. So, you can use a stipend to reimburse more medical services and items than the IRS allows.

For example, a weight loss program isn’t an HRA-eligible expense unless it’s doctor-supervised and the employee provides a letter of medical necessity. But with a health stipend, you can give an employee money for a general weight loss program without a doctor’s note.

Below are some other key features of a health stipend:

- You can offer a health stipend annually, as a one-time spot bonus, or on a regular basis, such as a monthly or quarterly allowance. There are also no annual contribution or reimbursement limits, so you can offer as much or as little as your budget allows.

- According to IRS Notice 2013-54, you can’t require your employees to buy a medical insurance plan with their stipend funds, nor can you ask for proof that they did5. Doing so would change your stipend into a more formal reimbursement benefit and subject it to additional requirements.

- However, you can require claim documentation for healthcare sharing membership or direct primary care fees.

- Health stipends are taxable for employers and employees. An HRA is a better option if you and your employees want tax savings.

- A stipend isn’t a formal health benefit. So, it doesn’t satisfy the Affordable Care Act’s employer mandate for organizations with 50 or more full-time equivalent employees (FTEs).

- If your business grows to the size of an applicable large employer (ALE), you can transition to the ICHRA and design the benefit to comply with ACA requirements.

- Health stipends are excellent for 1099 contractors and international workers who can’t participate in an HRA. It also benefits employees who receive advance premium tax credits (APTCs) and remote workers who live in multiple states.

You can offer a stipend alongside any type of HRA or medical insurance plan to cover additional healthcare costs, making it a flexible addition to your employee benefits package without having to comply with any extra federal regulations.

Conclusion

An HRA is ideal for businesses looking to offer their employees a comprehensive health benefit. However, the key to ensuring your employees get the most out of their HRA lies in communicating with them throughout the year, providing tips and reminders about which medical services and items are eligible for reimbursement. By doing so, you’ll be able to keep your employees satisfied and recruit talented workers more effectively.

If you’re ready to offer your employees an HRA, PeopleKeep by Remodel Health can help! Our HRA administration software makes setting up personalized health benefits for your organization quick and easy. Schedule a call with us today to learn how we can get you started.

This article was originally published on February 10, 2020. It was last updated on January 5, 2026.

References

- IRS Publication 502

- CARES Act

- IRS - 2019 Final HRA Regulations

- IRS Memo - Employer Payment of Employee Health Insurance Coverage Provided Under a Spouse's Group Health Plan

- IRS Notice 2013-54

Check out more resources

See these related articles

Can I have an HRA and an FSA at the same time?

Learn if you can have an HRA and an FSA at the same time. Understand the rules, benefits, and how these accounts can work together for healthcare costs.

Health insurance reimbursements: What are the options?

Explore your options for health insurance reimbursement. Understand what insurance reimbursement means and how HRAs can support employees.

Can HRAs reimburse long-term care premiums?

Find out if long-term care insurance premiums are reimbursable from an HRA. Learn the rules and eligibility for HRA-covered premium expenses.