What is the Small Business SHOP Marketplace?

Health Exchange • July 30, 2013 at 2:00 PM • Written by: PeopleKeep Team

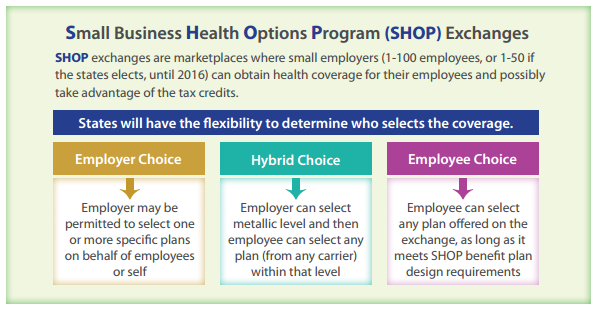

As part of Affordable Care Act (ACA), small businesses will have the option to purchase a small group plan through the new small business SHOP marketplaces. The Small Business Health Options Program (SHOP) is a required program of each state's Health Insurance Marketplace. Small businesses with less than 100 employees or less than 50 employees are eligible, depending on the state. The small business SHOP marketplaces will open on October 1, 2013, with plan coverage starting January 1, 2014.

Small Business Health Care Tax Credits Through the SHOP

A key change is that the small business health care tax credits will only be available through the SHOP marketplace in 2014. Small businesses with 25 or fewer employees who receive less than $50,000 a year in wages may be eligible for tax credits if they purchase the plan through the SHOP marketplace. These credits will cover up to 50% of the employer’s cost (35% for non-profits) for the first two years of coverage. Click here to read more about the small business health care tax credits.

Plan Coverage Options Through the SHOP

Depending on the state, plan coverage selection through SHOP marketplace will fall into one of three categories:

-

"Employer choice": Employer selects one or more plans for employees

-

"Hybrid choice": Employer selects metallic level, and employee selects plan from within that level

-

"Employee choice": Employee can choose any plan that meets SHOP benefit plan requirements.

Starting in 2015, each state will be required to offer the "Employee Choice" option. Until that time it is an optional feature in the state marketplaces. To see if the "Employee Choice" will be offered in your state see 15 States to Offer 'Employee Choice' in Small Business SHOP Marketplace.

Source: Blue Cross Blue Shield of Illinois.

The cost of the plans available through the SHOP marketplaces will vary state to state.

Unlimited Plan Choices through "Pure" Defined Contribution Health Plan

Another option exists for small businesses now, in 2014, and beyond: a "pure" defined contribution health plan. With pure defined contribution, a small business:

- Offers employees tax-free allowances for health insurance premiums and medical expenses (through an IRS-approved Health Reimbursement Arrangement)

- Employees shop for any plan, from any carrier, on the private or public marketplaces.

- The small business then reimburses employees tax-free, up to the amount of their allowance