HRA claim documentation requirements

By Elizabeth Walker on June 30, 2023 at 11:17 AM

A health reimbursement arrangement (HRA) is a great way for employers to provide a meaningful health benefit by reimbursing their employees, tax-free, for qualified medical expenses. Although HRAs are typically easier to manage than traditional group plans, they still come with compliance considerations. One is the IRS requirement for employees to submit proper claim documentation to receive reimbursements.

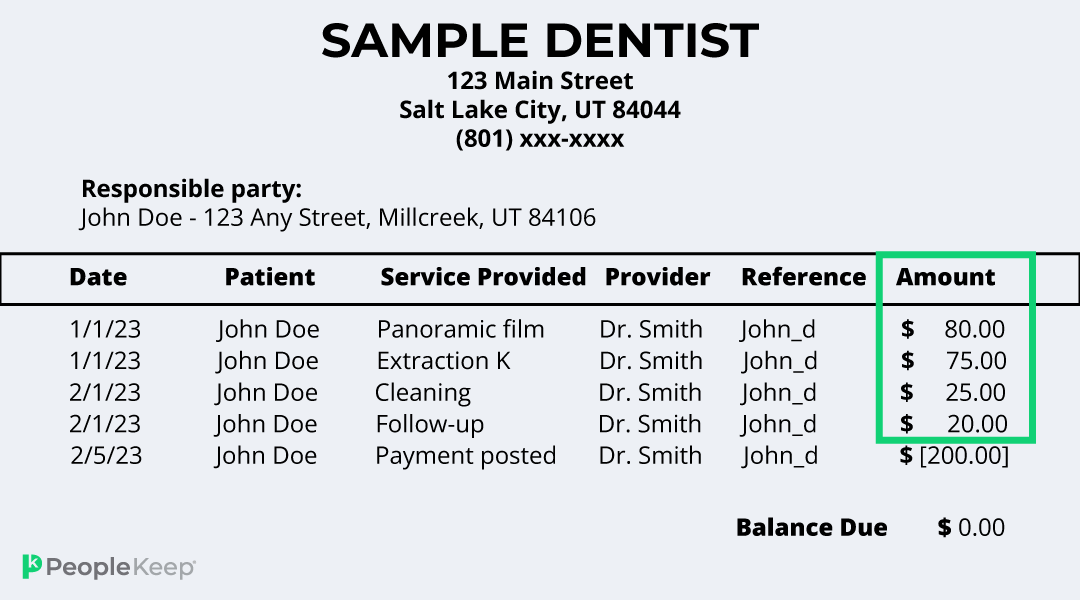

Acceptable documentation can be an itemized receipt, invoice, or Explanation of Benefits (EOB). Before you approve an employee’s claim, you must verify that the document contains five key elements. If the document doesn’t meet the requirements, the employee must submit additional documentation before you can process their claim. That’s why knowing what you’re looking for when reviewing a document is essential.

In this article, we’ll go over the five HRA claim documentation requirements and how PeopleKeep makes the review process quick and easy for employers.

Get everything you need to know about health reimbursement arrangements in our guide

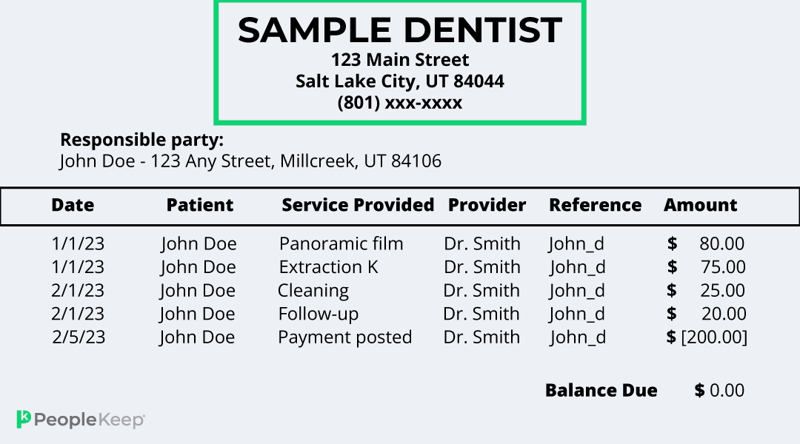

1. Provider name

The first documentation requirement you must check for is the provider’s name. If the employee received a medical service, the provider's name is where they received treatment, like the name of the clinic, urgent care center, hospital, or doctor’s office.

Another scenario is if they purchased a qualified over-the-counter item or picked up a prescription. In this case, the provider is the name of the store or pharmacy where they purchased the item. For health insurance premiums, the insurance company would be the provider.

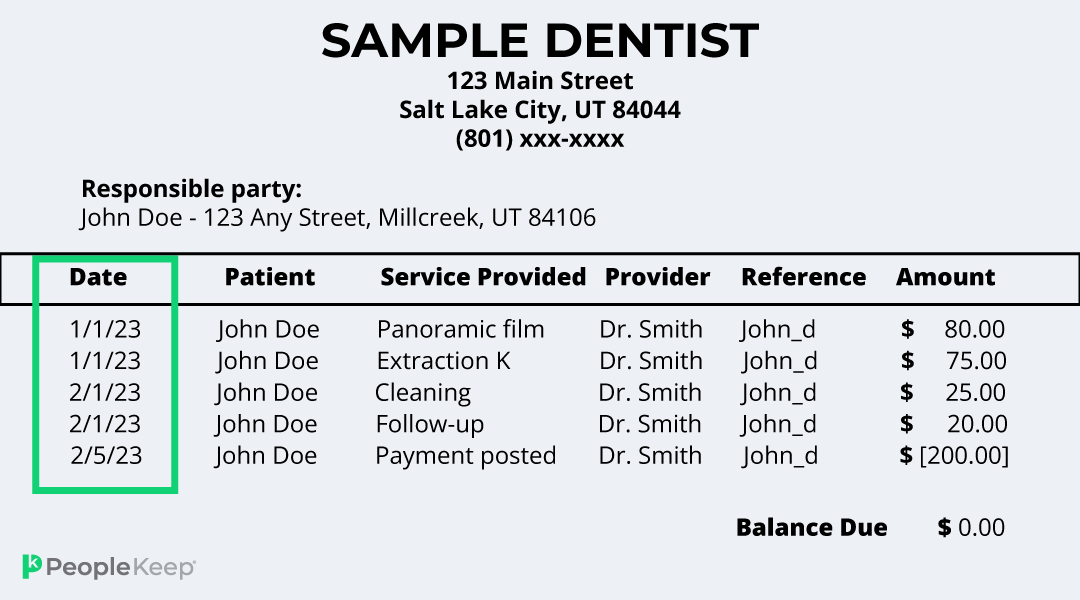

2. Date of service

Next is the date the employee received the medical service or item. It can also be the coverage period for their insurance policy if they’ve submitted documentation for their health plan premium costs.

Remember that the date of service is often different than the billing date or the date the employee submitted their document for verification. The date must show that the employee received the treatment, service, or items, and that it isn’t a duplicate claim. The date listed must also show that the employee incurred the qualified expense during your HRA’s plan year.

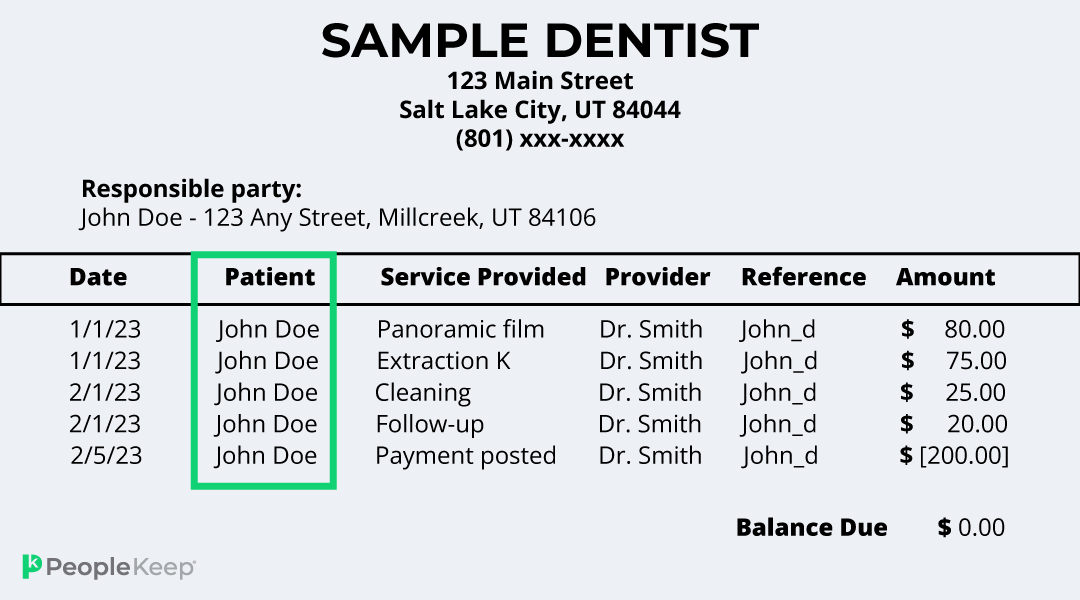

3. Recipient of service

Depending on the plan design, an HRA can reimburse an employee’s eligible dependents, such as a spouse or child, for their medical expenses. With a qualified small employer HRA (QSEHRA), an employer can even allow an employee to receive reimbursements for their spouse’s group health insurance premiums. If the spouse’s premium is paid for with pre-tax dollars, the reimbursement is taxable income. However, if the spouse pays their premium post-tax, it would be eligible for tax-free reimbursement.

That’s why documentation must show which person using the benefit received the service or item. For health insurance policies, the insured person would be the “recipient of service.”

Suppose an employee submits a document listing more than one person receiving a medical service, like an invoice from an employee and their child’s recent doctor visit. In that case, they should submit separate claims for each person who received the service.

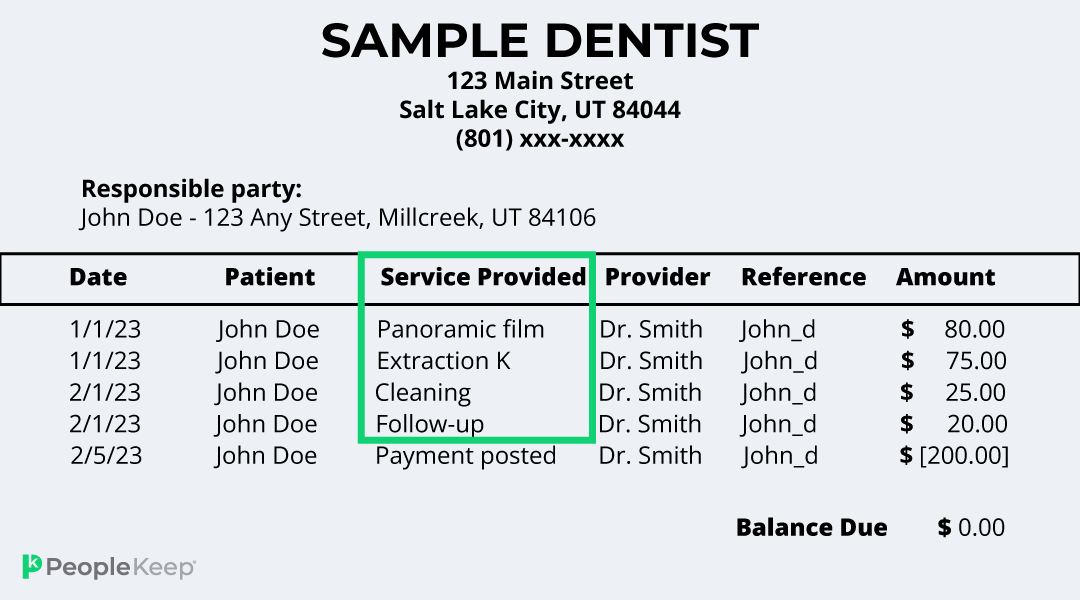

4. Service or item provided

Next is a description of the item. This could be a service, like an annual check-up, surgery, or emergency treatment, or a healthcare item, like a prescription, health insurance premium, or over-the-counter medication.

IRS Publication 502 outlines what medical expenses are eligible for reimbursement according to the federal government. But you can narrow that list in your plan documents when designing your HRA. So employees must understand what items and services are eligible for reimbursement according to their employer’s specific benefit.

If the expense isn’t a “traditional” medical necessity, like a dermatology product, dietary supplement, or massage therapy, the employee must submit a doctor’s note proving the item or service was for a specific medical reason.

5. The amount paid for the service or item

Lastly, claim submissions should always include how much the employee paid for the cost of service or item. For health insurance plans, the document should show the monthly premium for the entire coverage year.

The total cost of over-the-counter medical items is straightforward. But for medical services or prescriptions, the employee can only receive reimbursements for what they paid for out-of-pocket after insurance, like a copayment. They can’t receive a claim for reimbursement for any medical costs their insurance company already paid for.

The employee can submit separate claims for each medical expense if the documentation shows multiple qualified purchases.

How PeopleKeep can help verify documentation for HRA claims

If you’re unsure about managing the compliance requirements and HIPAA privacy rules that come with reviewing documents, consider using a benefits administration software, like PeopleKeep.

At PeopleKeep, we make reviewing claim documentation easy. When your employees incur an expense, they upload their documents to our secure platform. Once we receive the receipt or invoice, our team reviews it to ensure it meets all the requirements.

If the submitted document needs any extra information, we follow up with the employee to request further details to verify the expense according to IRS standards.

When we verify the health expense, we’ll send it to you for approval so you can reimburse the employee up to their set allowance amount. To keep it simple, we’ll notify you of any pending reimbursements in a weekly email so you never miss a payment.

The IRS also requires you to keep a record of all employee HRA documentation for at least seven years. That’s why PeopleKeep digitally stores all submitted documents in one convenient location so you don’t have to worry about losing any files.

Conclusion

If you’re self-administering your HRA, it’s your responsibility to review your employees’ claim documentation and ensure it meets federal regulations. Once you understand what proper documents look like, you can easily process your employees’ claims so they receive their reimbursements quickly.

Using HRA administration software is an excellent option for business owners who don’t want to self-administer their benefits. With PeopleKeep, we handle time-consuming tasks, like drafting plan documents and reviewing claim documents, so you can focus on running your organization.

Contact our personalized benefits advisors, and we’ll set you up with everything you need.

This article was originally published on August 22, 2012. It was last updated on June 30, 2023.

Check out more resources

See these related articles

What can an HRA reimburse?

Wondering if your HRA can cover specific medical costs? Discover the comprehensive list of eligible expenses that your HRA can reimburse in this article.

What are health insurance rewards programs, and how do they impact HRAs?

In this article, we'll explain how health insurance rewards programs work and how they impact benefits like health reimbursement arrangements (HRAs).

Does an HRA work with Medicaid?

Find out if an HRA can be used with Medicaid. Learn how HRA reimbursements work for employees enrolled in Medicaid and what limitations may apply.