2022 QSEHRA Annual Report

By Gabrielle Smith on February 3, 2022 at 5:45 AM

Since it first became available in 2017, the qualified small employer HRA (QSEHRA) has been offering small employers the unique opportunity to reimburse their employees, tax-free, for their individual insurance premiums and qualifying healthcare expenses.

This year’s report proves that five years is just the beginning for the QSEHRA, and that it will continue to be an important health benefits solution for small employers for many years to come.

Because it doesn’t come with the expensive premiums, annual rate hikes, and restrictive participation and contribution requirements of traditional group health insurance plans, the QSEHRA has only grown in popularity among employers with fewer than 50 full-time equivalent employees—the size requirement for employers who wish to offer the benefit.

As the first to deliver cloud-based QSEHRA administration, PeopleKeep has reported on how small employers use the benefit each year. This year’s report details how over 2,300 small employers made the most of their QSEHRA benefit in 2021, including average allowance amounts offered, common expenses reimbursed, plan design choices, and more.

Download the full report and infographic summary here

Looking for a specific stat? Jump to a section below:

-

Average percentage of an employee’s allowance that gets used

-

Top reimbursed insurance carriers and their average premium reimbursement amount

-

Average monthly reimbursements among employees who submitted expenses

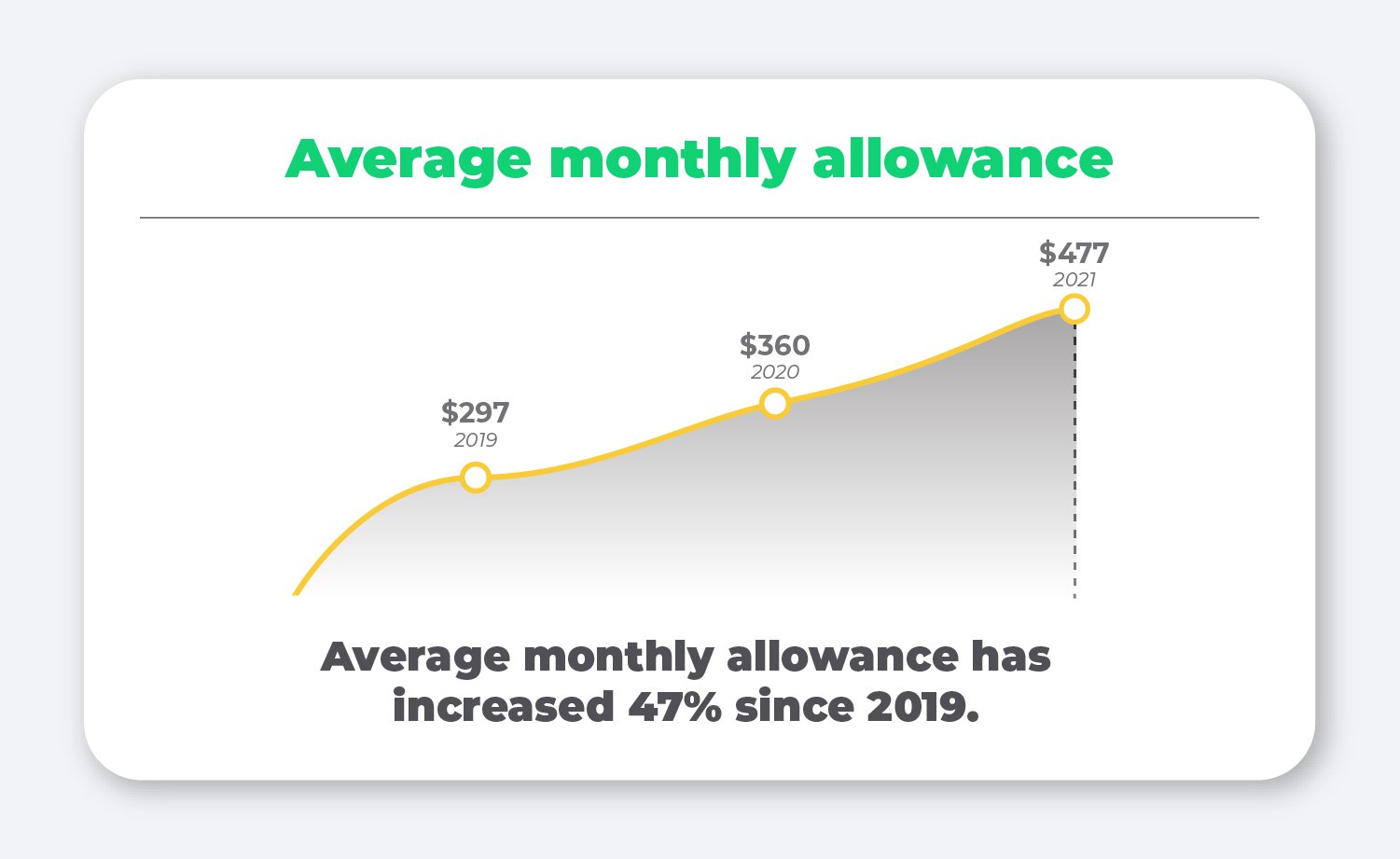

Average monthly allowance

One thing that consistently holds true year to year is that the average allowance amount offered by employers increases.

Data from the Kaiser Family Foundation finds that only 58% of small employers offer health benefits to their employees, compared to 99% of large employers.

Our data shows that the QSEHRA not only empowers small employers to offer health benefits, but also allows them to increase their contributions over time without breaking the bank.

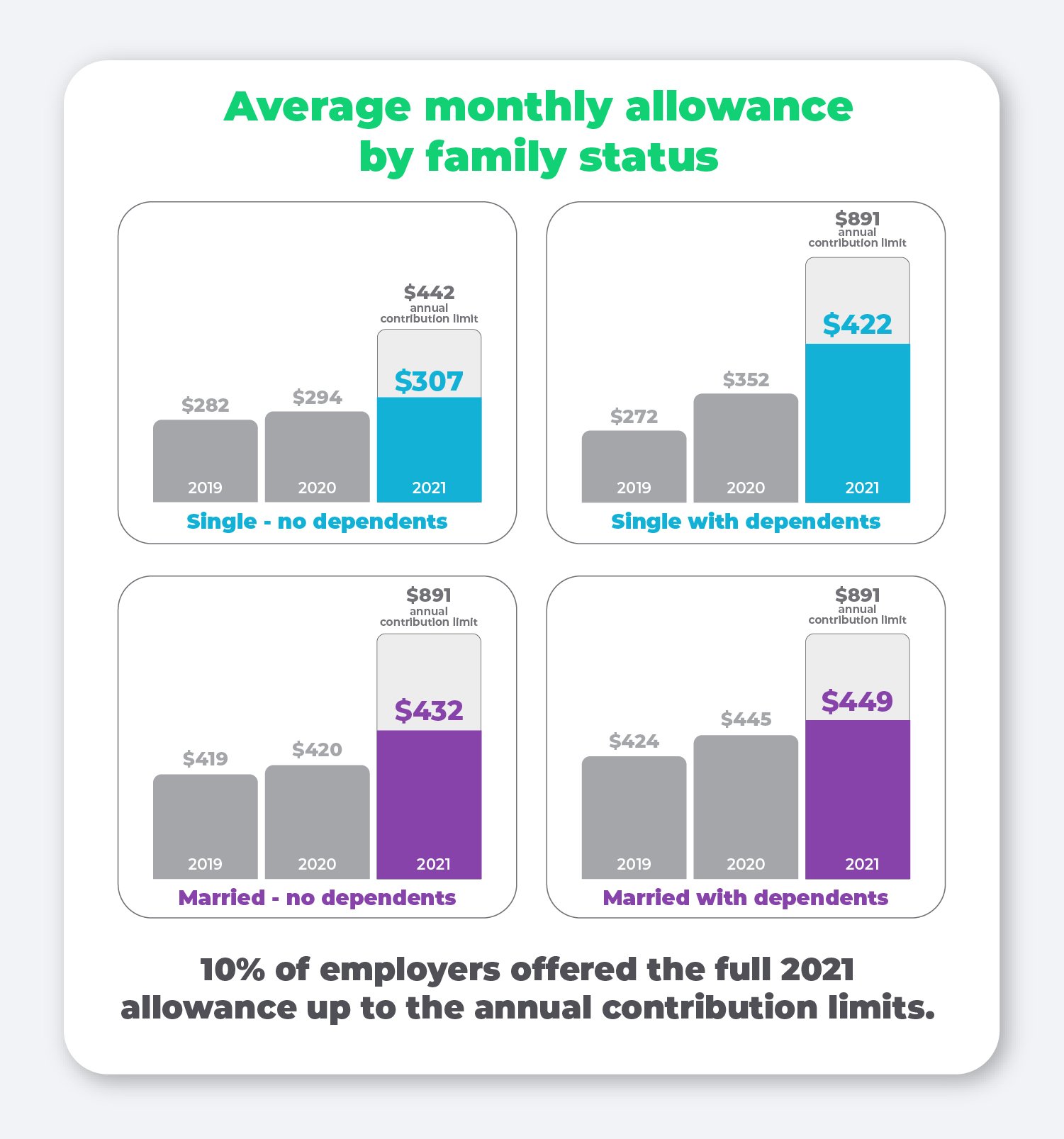

Average monthly allowance by family status

While the QSEHRA has no minimum contribution limits, there is an annual contribution limit employers are permitted to offer employees. These IRS-imposed limits are updated annually and adjusted for single and family statuses.

In 2021, 10% of employers chose to max out their contributions to the full allowance cap. The largest increase over the past year was for single employees with dependents, which saw an increase of 43% from 2020 to 2021.

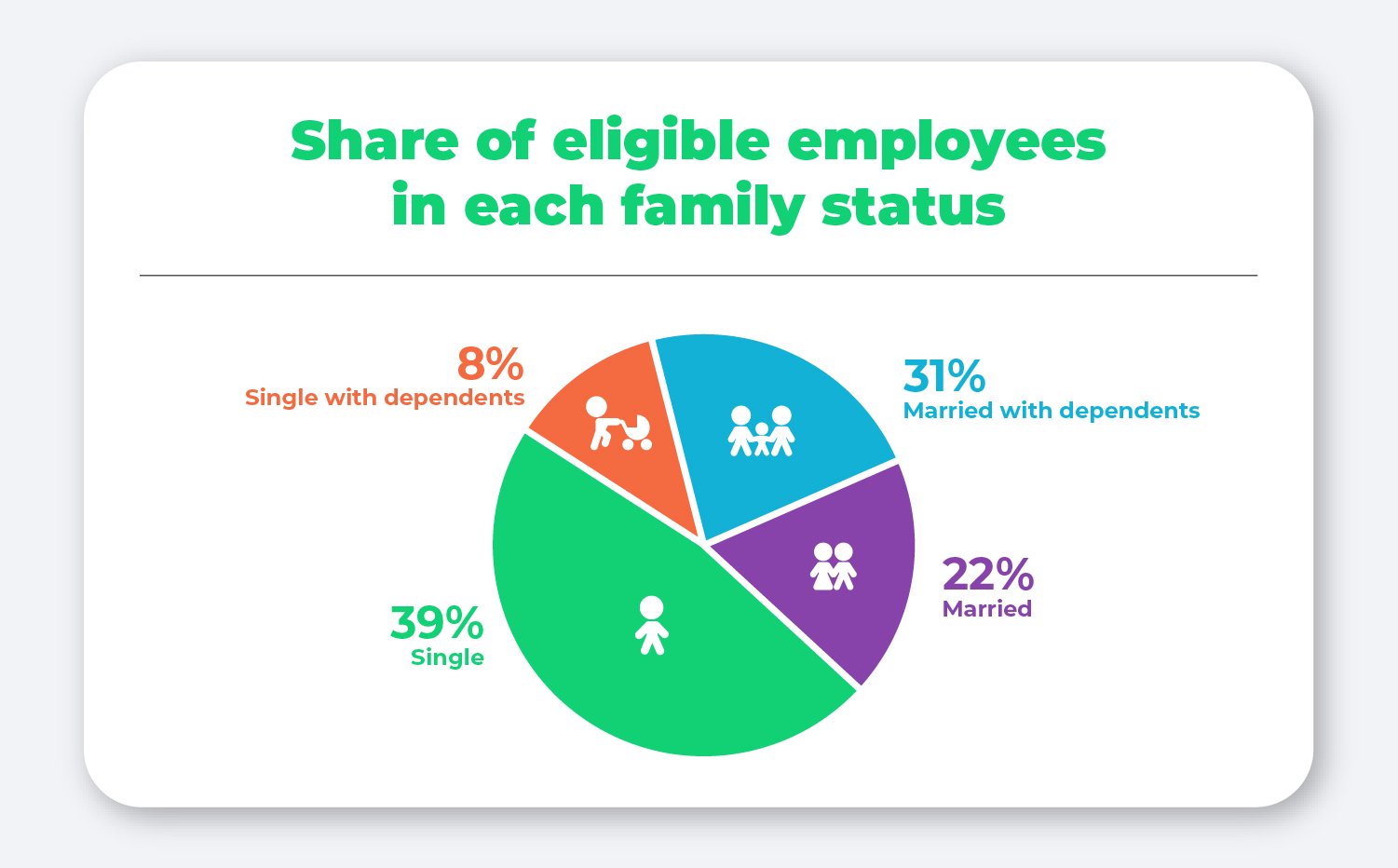

Most employees (39%) who participated in the QSEHRA are single without dependents, with the next greatest share belonging to employees who are married with dependents (31%).

Average monthly allowance by company size

In order to be considered a “qualified” small employer, an organization must employ fewer than 50 full-time equivalent employees. Interestingly enough, we’ve consistently found each year that on average, the smallest organizations offer the highest allowances compared to their larger counterparts.

This year, organizations employing between 1 and 4 employees offered nearly 13% more than organizations employing between 20 and 49 employees.

While this may seem counterintuitive, it’s important to remember that organizations with only a handful of employees may have specific individuals in mind when setting up the benefit.

What’s more, many of our smaller customers run non-profits that often have religious and moral beliefs at the heart of their organization, making a generous health contribution to their small group of employees in line with their organization’s values.

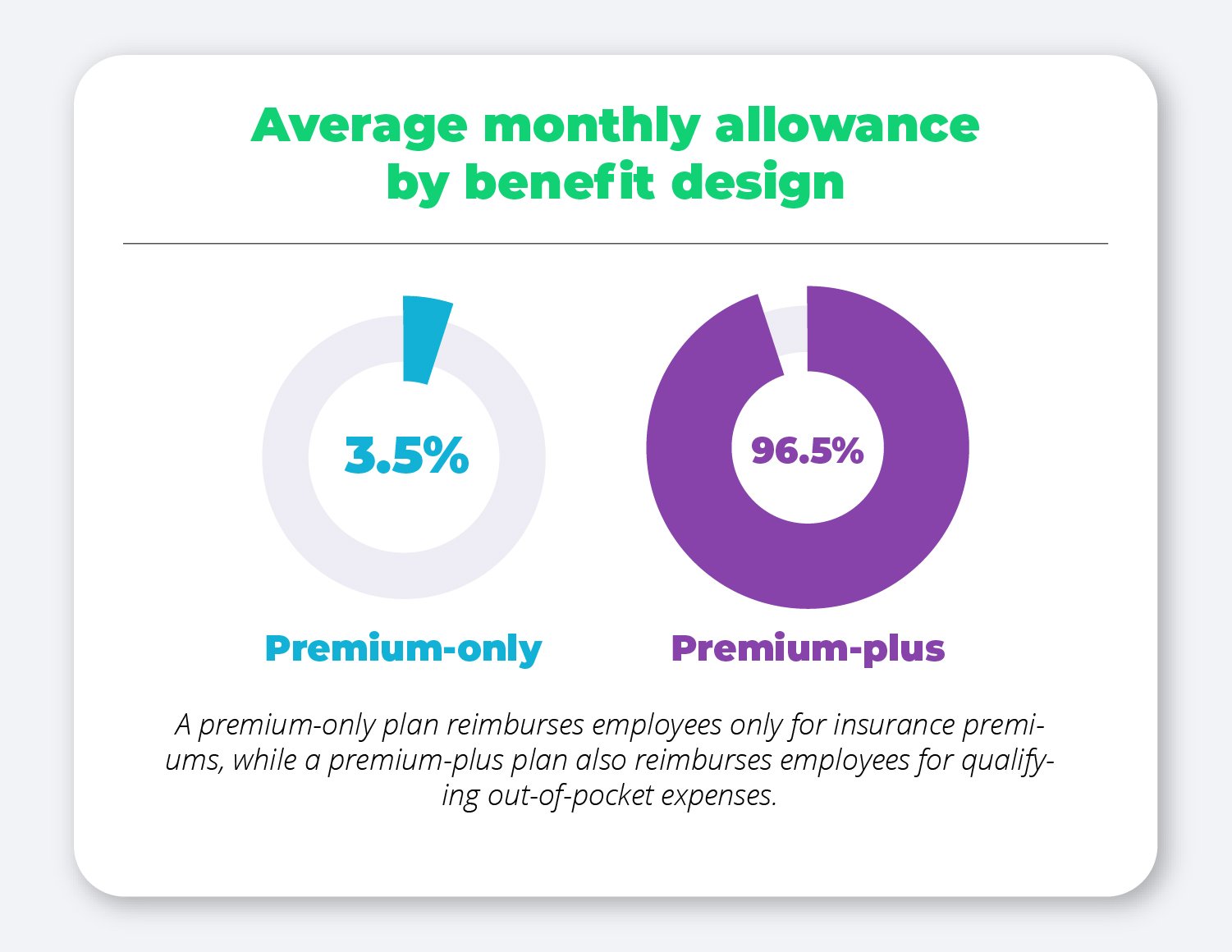

Average monthly allowance by benefit design

When designing a QSEHRA with PeopleKeep, employers have two plan types to choose from: a premium-only plan that reimburses employees only for their insurance premiums, or a premium-plus plan that also reimburses employees for other qualifying out-of-pocket expenses as outlined in IRS Publication 502.

Given the flexibility and freedom a premium-plus plan offers employees, the vast majority of PeopleKeep customers (96.5%) choose to reimburse their employees for additional out-of-pocket expenses.

It’s interesting to note that this year employers offering a premium-only plan offered higher allowances, on average, than those with a premium-plus plan.

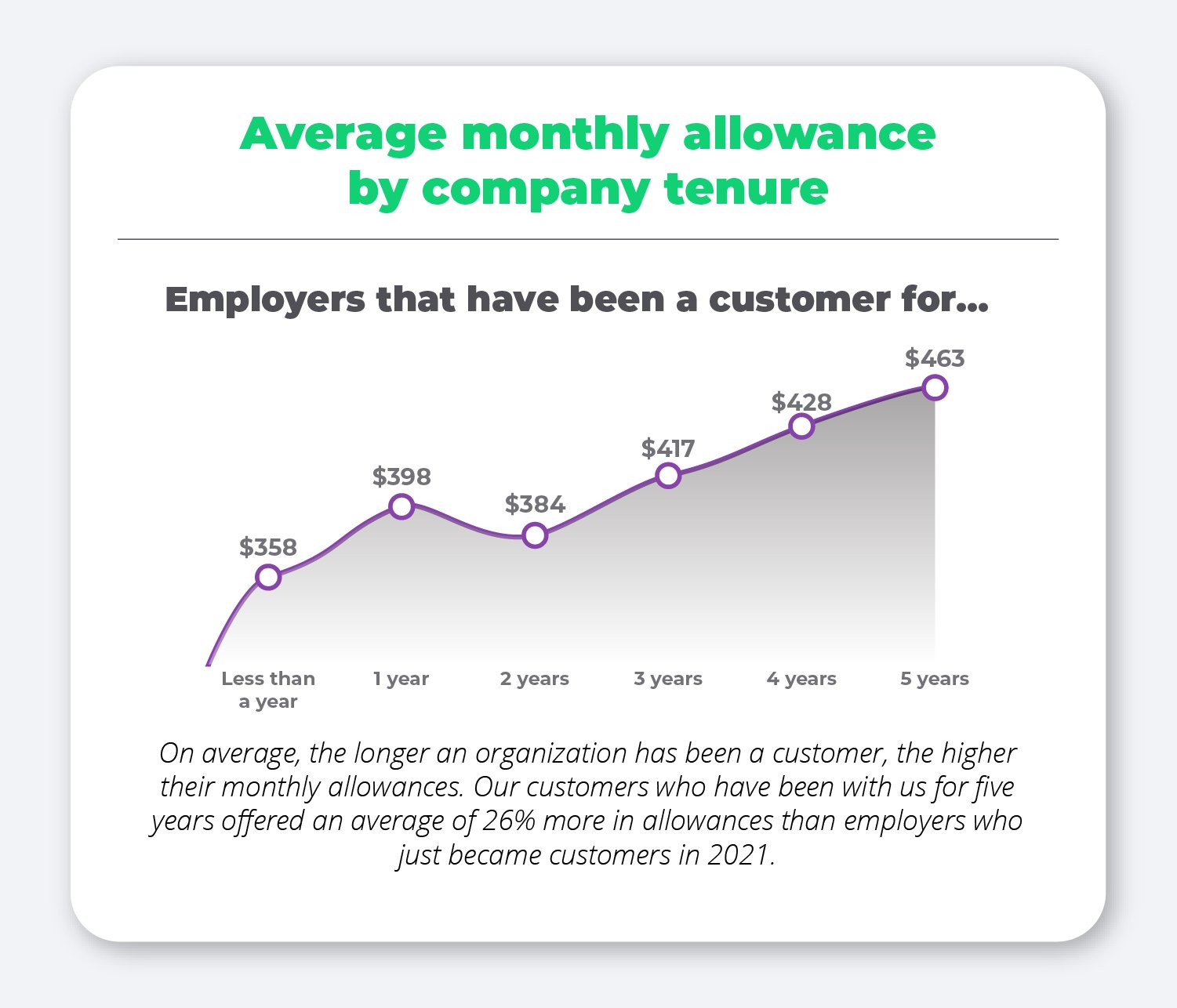

Average monthly allowance by company tenure

Another consistent finding we’ve seen year to year is that there is a direct correlation between company tenure and allowance amount.

On average, the longer an organization has offered a QSEHRA through PeopleKeep, the more likely they are to offer higher allowances. In other words, the more experience an employer has with their QSEHRA benefit, the more they understand its value to employees, how much they can afford to offer, and how to make the most of the benefit.

Voluntary features

In addition to offering a unique allowance amount of their choosing and deciding if they want to limit reimbursement to only cover insurance premiums or not, employers also have the option to customize their QSEHRA even further by adding other voluntary features.

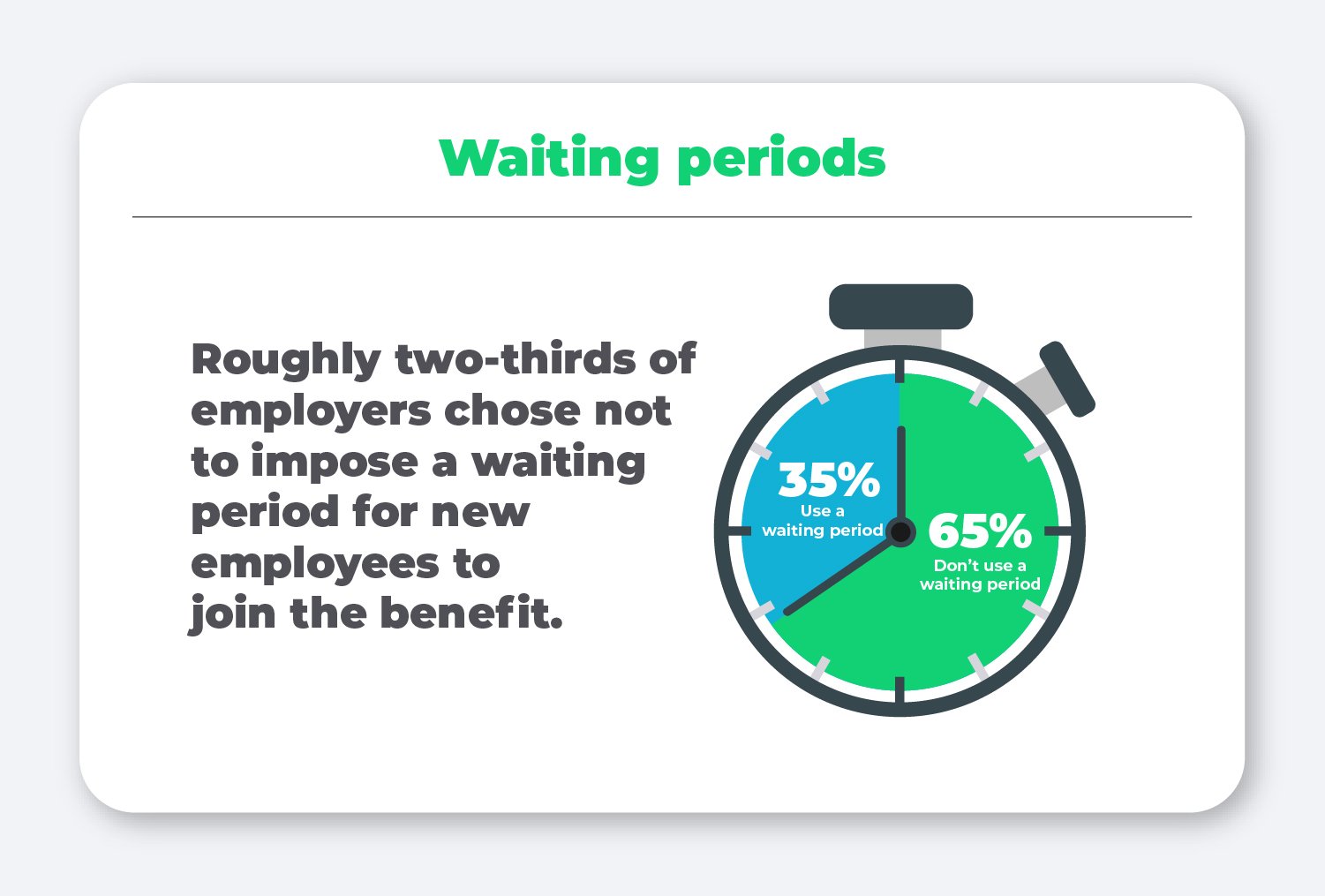

Waiting periods

Waiting periods, sometimes referred to as probationary periods, are a period of time new employees must wait before they're able to use their benefit.

This may be helpful for employers who want to align their QSEHRA benefit with other probationary benefits already in place for new employees.

Roughly two-thirds (65%) of employers chose not to impose a waiting period for new employees to join the benefit.

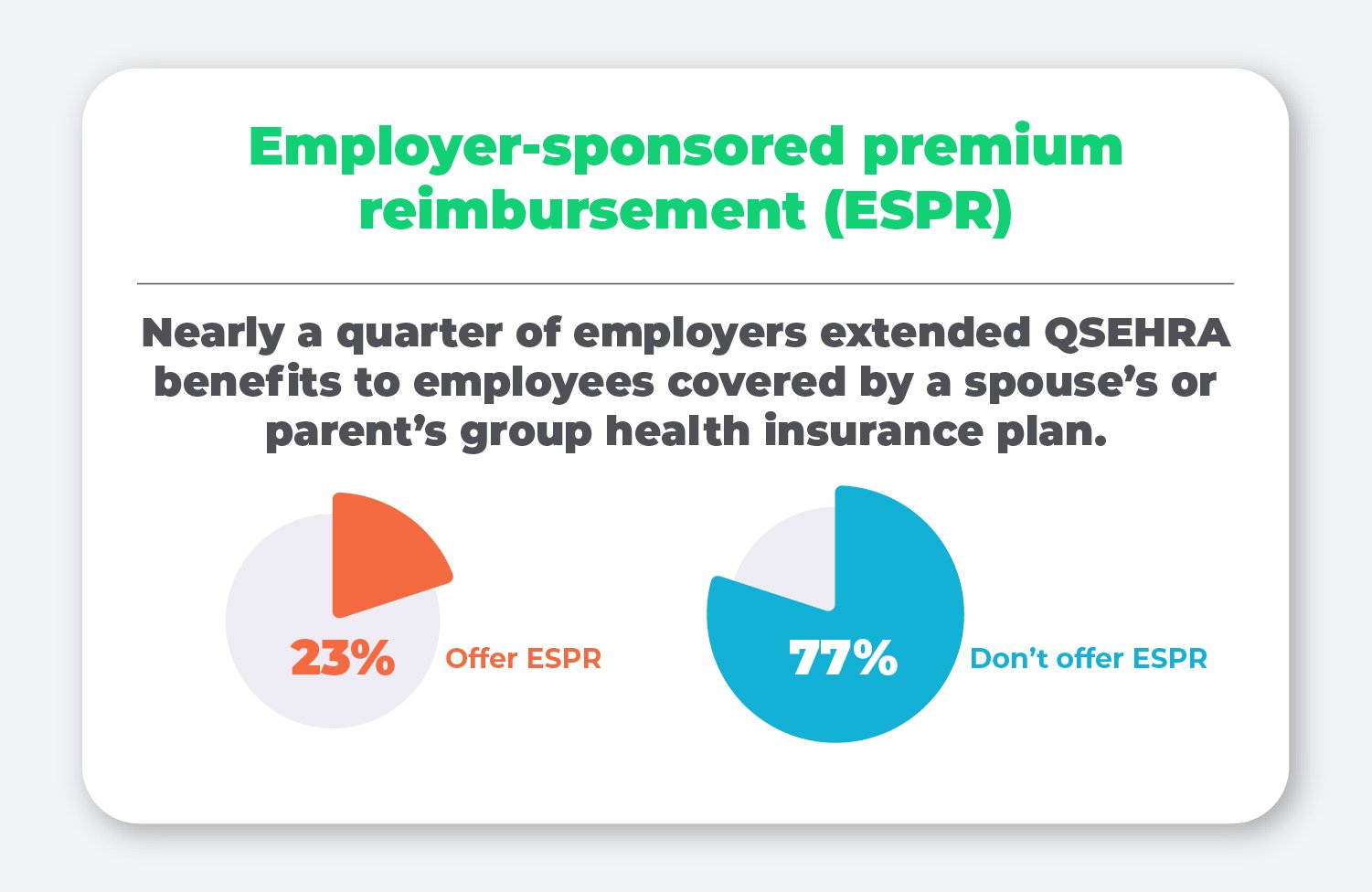

Employer-sponsored premium reimbursement (ESPR)

Employers can also choose whether or not they want to reimburse employees for a spouse’s employer-sponsored health insurance plan. Given that over half of our customers’ employees are married (53%), this can be an added benefit to those already participating in their spouse’s plan.

In 2021, nearly a quarter of our customers (23%) enabled this feature.

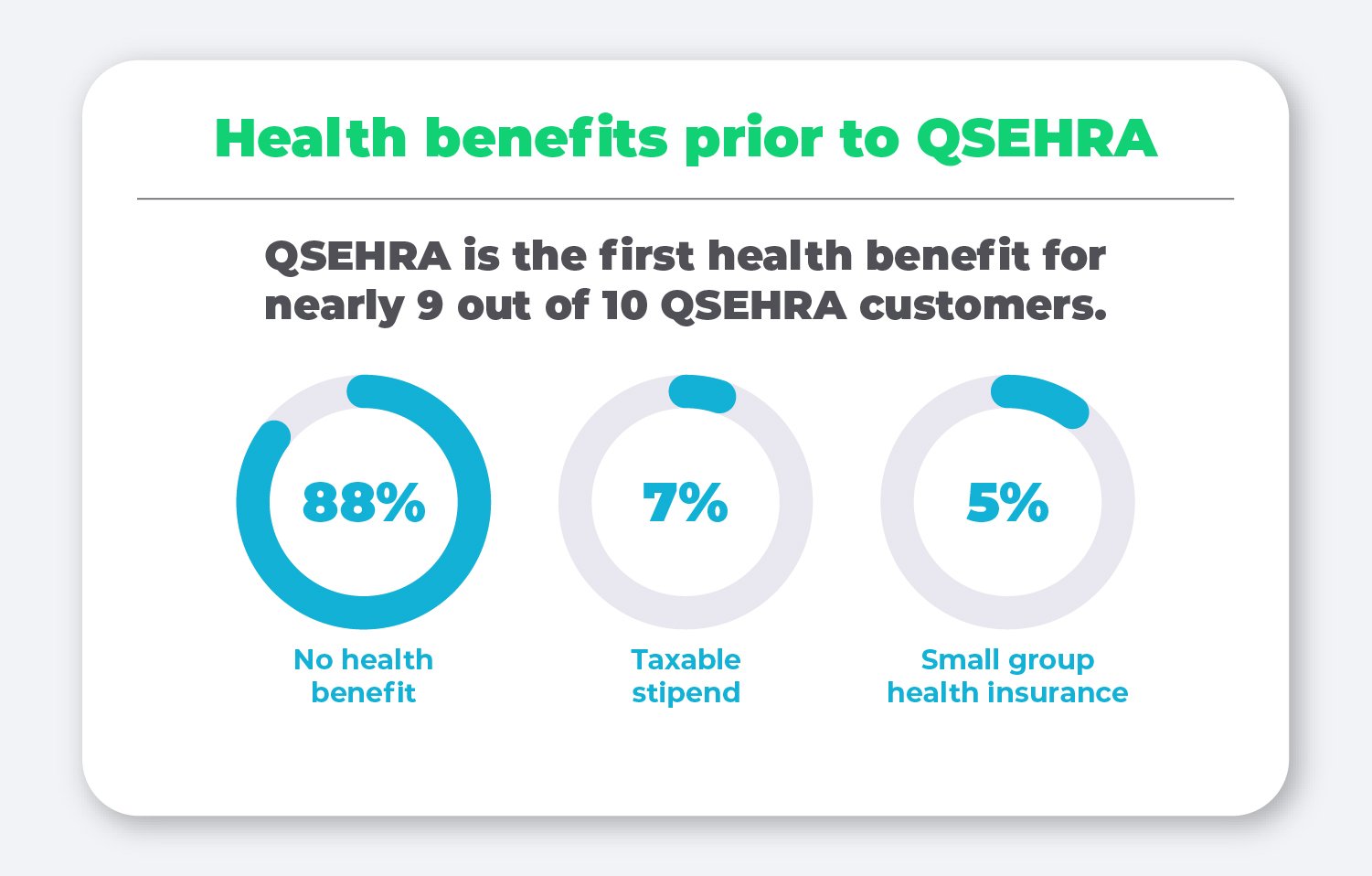

Health benefits prior to QSEHRA

Next, we looked into what kind of health benefits employers offered before signing up for a QSEHRA with us, and the answer is unsurprising—nearly 90% had never offered any kind of health benefit before their QSEHRA.

This data highlight just how empowering a QSEHRA can be for small employers who thought offering health benefits wasn’t possible for them, and are now offering a formal plan that recruits and retains employees.

QSEHRA + HSA coordination

Many employees may have a health savings account (HSA) that they or their spouse contribute to regularly. The QSEHRA can be coordinated with an HSA easily, providing even more tax-savings on healthcare expenses.

This coordination requires the QSEHRA to become a “limited-purpose HRA” that only reimburses employees for health insurance premiums, long-term care premiums, dental, and vision expenses. 6% of employees choose to coordinate their HSA with their QSEHRA.

Average percentage of an employee’s allowance that gets used

One of the nice things about offering a QSEHRA is that employers are given complete control over their costs. By determining a set allowance amount, employers always know the most they’ll spend on employee healthcare reimbursements each month. In addition, if employees don’t use their full allowance amount, employers keep that money.

Our data finds that, on average, employees who received reimbursements in 2021 only claimed 71% of their allowance amounts, leaving the remaining 29% with the employer.

To put that in dollars and cents, if an employer offers the full $441.67 allowance amount to a single employee, they would only be reimbursing $313.59 each month on average. The remaining $128.08 cost is not incurred by the employer.

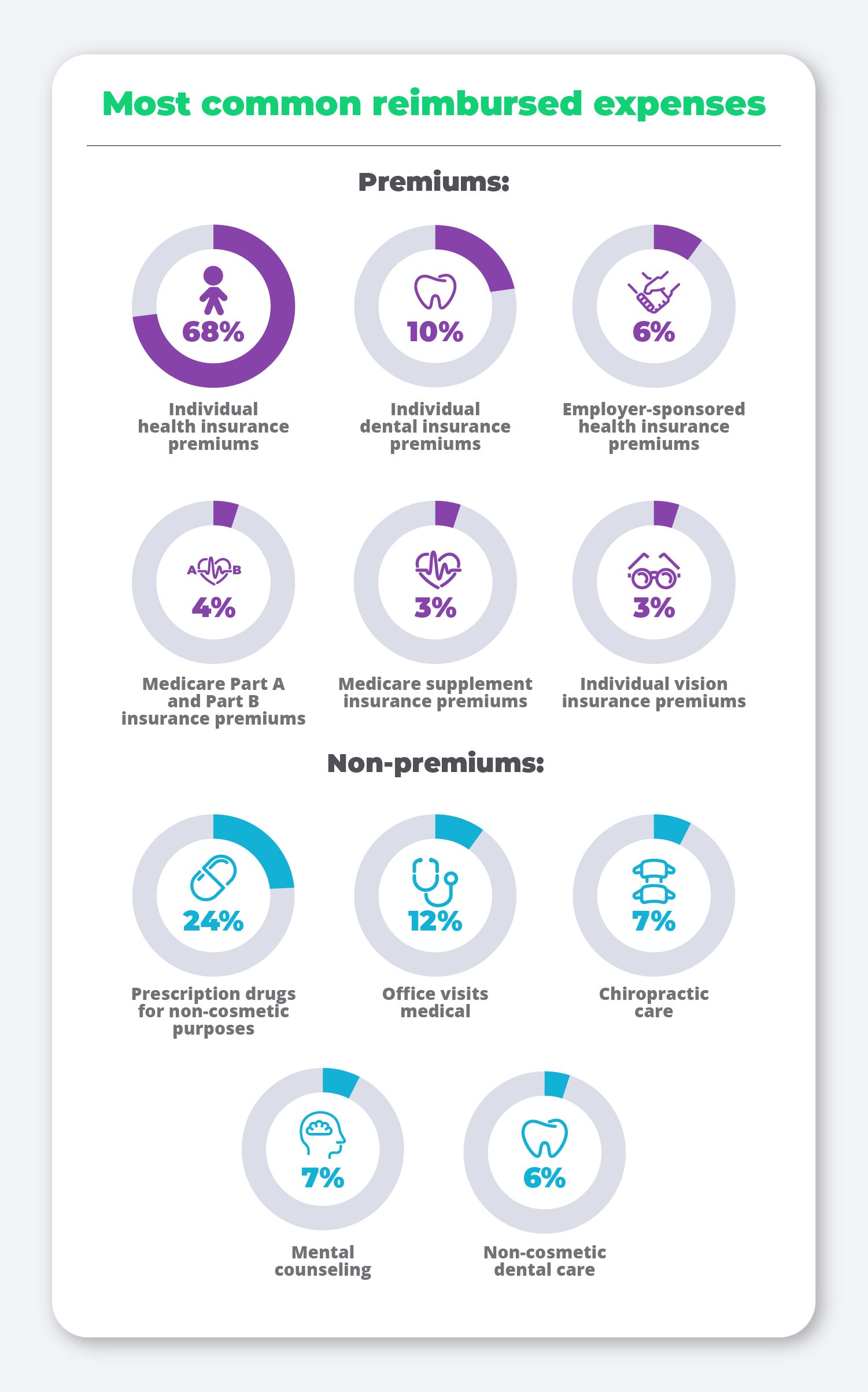

Most commonly reimbursed expenses

We broke out the most commonly reimbursed expenses into two categories: premiums and non-premium expenses.

In the premiums category, the vast majority of employees are simply looking to get their individual health insurance premiums reimbursed. However, other premiums, such as dental and vision, are in the mix as well to help cover other expenses such as braces or a new pair of glasses.

As for the non-premium expenses category, prescription drugs remain at the top of the list, while doctor’s visits, chiropractic care, mental health counseling, and dental care also continue to be important employee medical needs met by their QSEHRA allowance.

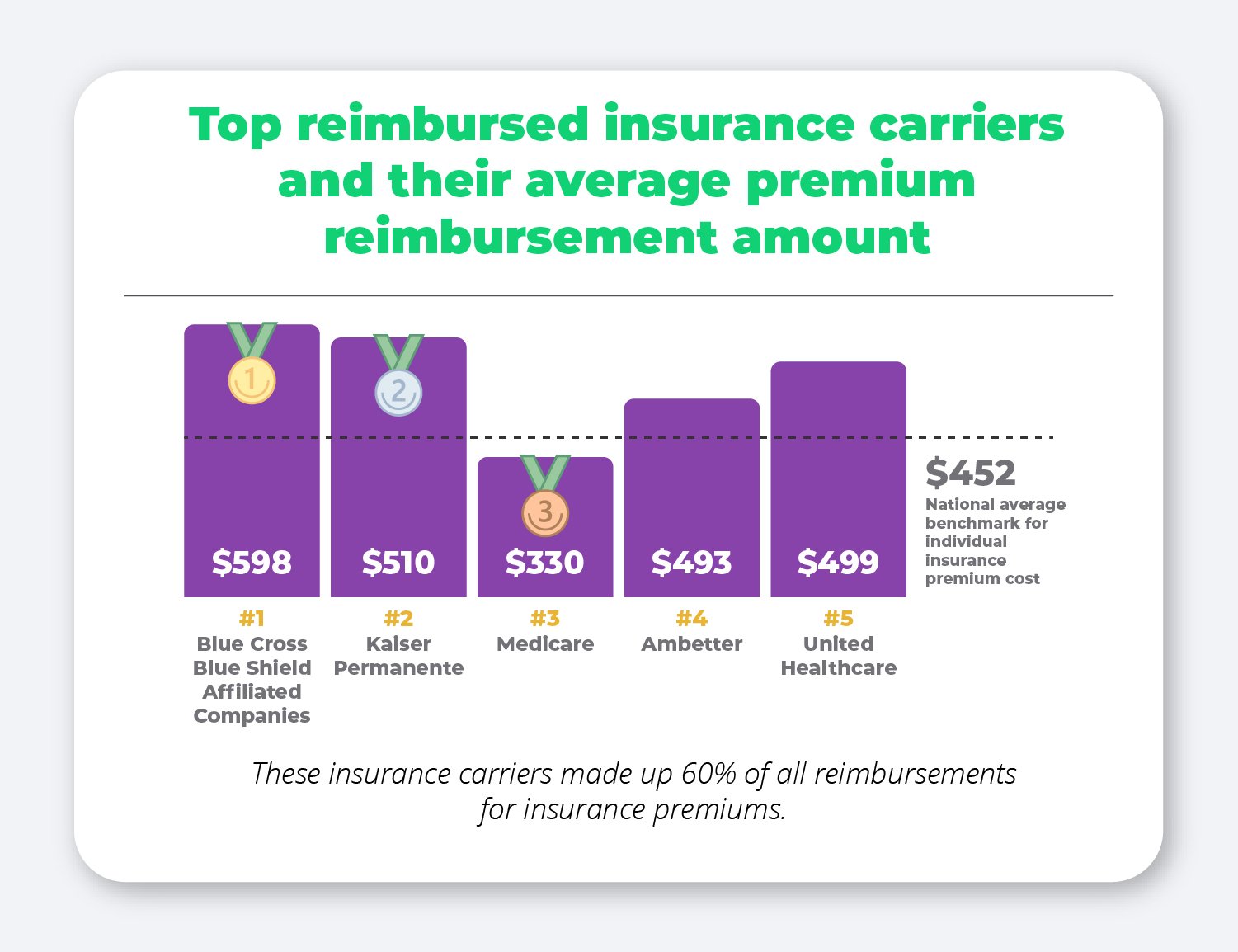

Top reimbursed insurance carriers and their average premium reimbursement amount

Given that health insurance premiums are the most common expense employees get reimbursed through their QSEHRA, we decided to take a closer look at which insurance carriers are the most commonly used among employees offered a QSEHRA through PeopleKeep. In addition, we also took a look at how much employees are getting reimbursed for their monthly premium for each insurance carrier.

Blue Cross Blue Shield and their affiliated companies came out on top as the most popular insurance carrier among our customers, with Kaiser Permanente and Medicare coming in the second and third place spots.

When comparing these average reimbursement amounts to the average cost of group health insurance premiums, we found that the amount being reimbursed for each of these premiums is lower than the cost would have been for a group plan. The Kaiser Family Foundation finds that the average cost of employer-sponsored coverage for an individual plan in 2021 was $7,739 for single coverage ($645/month) and $22,221 for family coverage ($1,852/month).

Average reimbursement amount by expense type

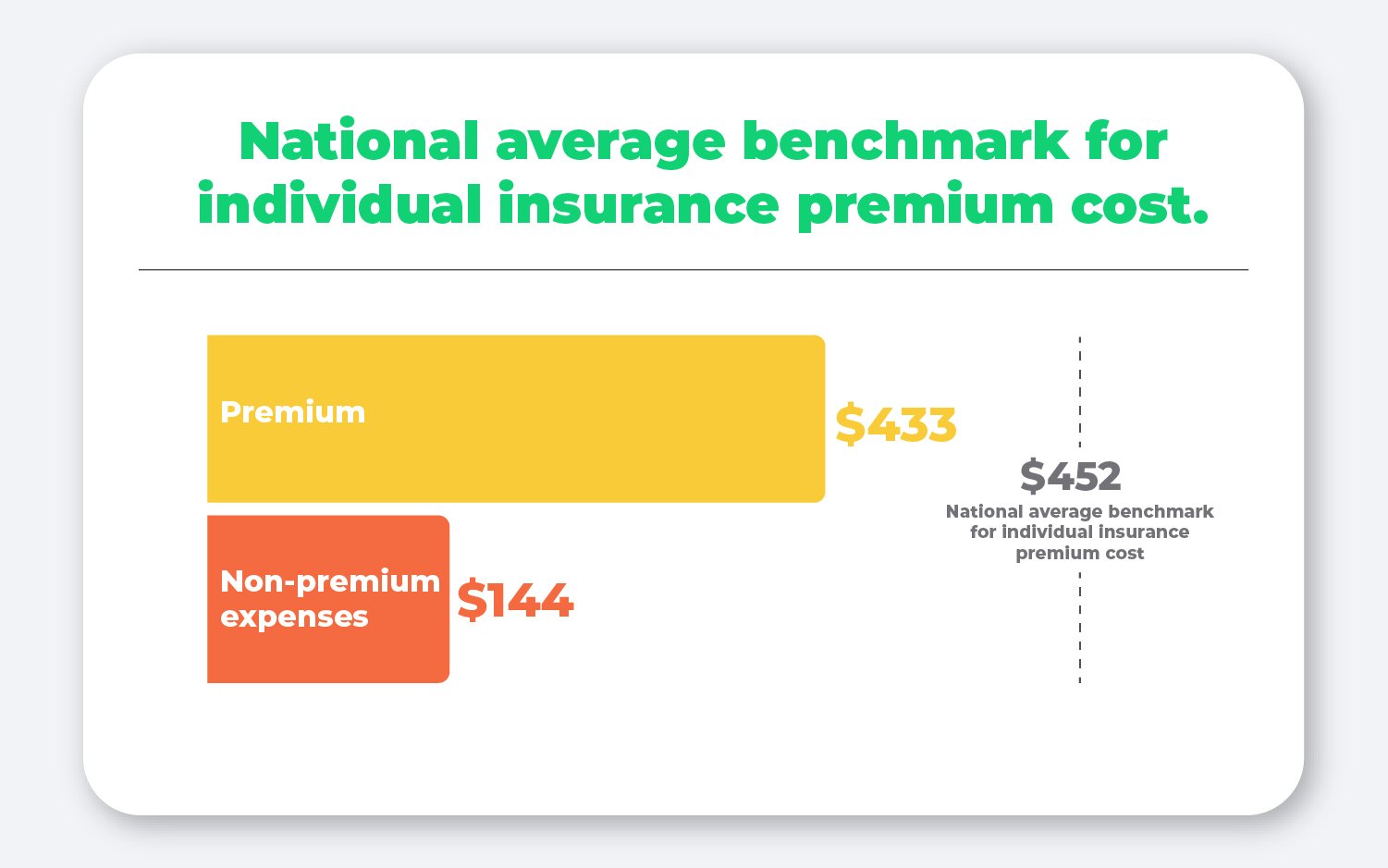

Given that most employers offer a premium-plus plan, we found it important to examine the average reimbursement amounts for each type of expense—premiums and non-premium expenses—to see what employers can expect when their employees submit expenses.

The average cost of a premium expense was $433, putting it just under 2021’s national average benchmark individual health insurance premium. This means that the average premium expense takes up most of the average allowance amount employees are offered.

However, some employees also use their allowance to cover other out-of-pocket expenses. The average non-premium expense in 2021 was $144.

Average monthly reimbursements among employees who submitted expenses

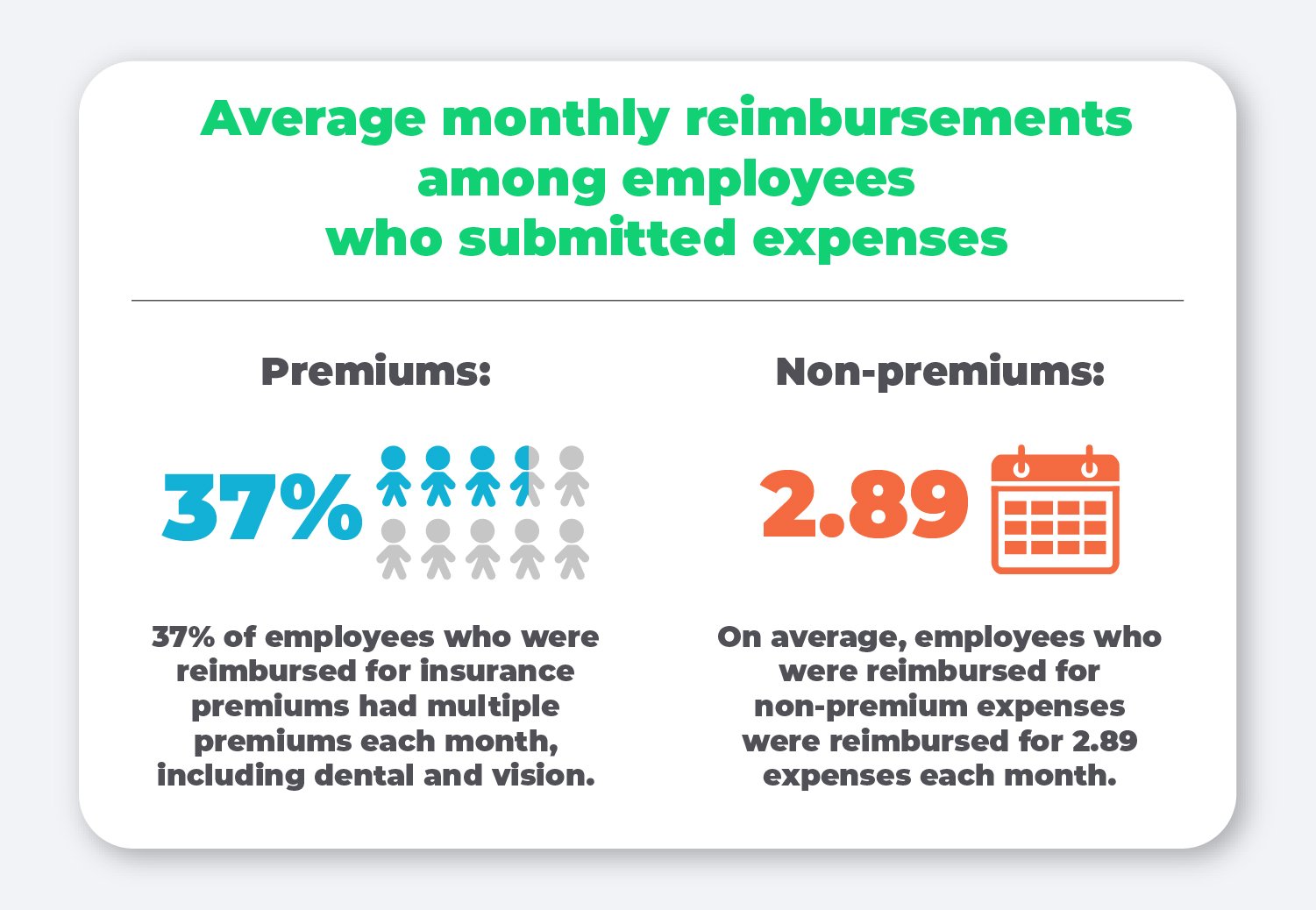

Finally, we reviewed the average number of expenses employees submitted each month to help employers estimate how many expenses, on average, they can expect to see employees submit for reimbursement.

On average, 37% of employees who were reimbursed for insurance premiums had multiple premiums each month, including dental and vision.

This is further evidence that employees value being able to spend their allowance on a variety of individual insurance premiums rather than being lumped into a one-size-fits all group health insurance plan.

In addition, employees who were reimbursed for non-premium expenses were reimbursed for 2.89 expenses each month.

This is what makes having an HRA administration software provider like PeopleKeep so beneficial. For each expense an employee submits each month, all the employer has to do is approve the expense and pay employees their reimbursement.

PeopleKeep’s documentation review team spends time looking at the fine print and reviewing the expense to make sure it’s approved so you don’t have to.

Conclusion

In the five years since the qualified small employer HRA was first implemented by small employers, thousands of small businesses have embraced the benefit as a more affordable, flexible, and tax advantaged health benefits solution than a traditional group health insurance plan could ever be.

This report proves that with the QSEHRA, today’s small business owners can provide a comprehensive, personalized health benefit to recruit and retain top talent while saving both time and money.

When you’re ready to offer your own QSEHRA, our experts at PeopleKeep are here to help. Schedule a call with a personalized benefits advisor today to see how a QSEHRA can empower you to offer the kind of benefits your employees deserve.

Check out more resources

See these related articles

Which premiums can a QSEHRA reimburse?

Find out which premiums a QSEHRA can reimburse, including health insurance and more. Learn how employers can offer tax-free reimbursements.

What are my 2019 small business employer health insurance requirements?

Are you feeling confused about how the ACA looks in 2019? Let us help you. Our experts at PeopleKeep fill you in on the modern ACA requirements.

Unique employee benefits ideas for all budgets

Discover unique employee benefits ideas for all budgets. Learn how to boost retention and morale with creative perks that fit your business needs.