Nine reasons for rising healthcare costs

Health Benefits • October 13, 2023 at 9:16 AM • Written by: Elizabeth Walker

The average American spends a considerable amount of money on healthcare each year. Premium increases, higher deductibles and copays, and soaring prescription drug prices result in spikes in total healthcare costs.

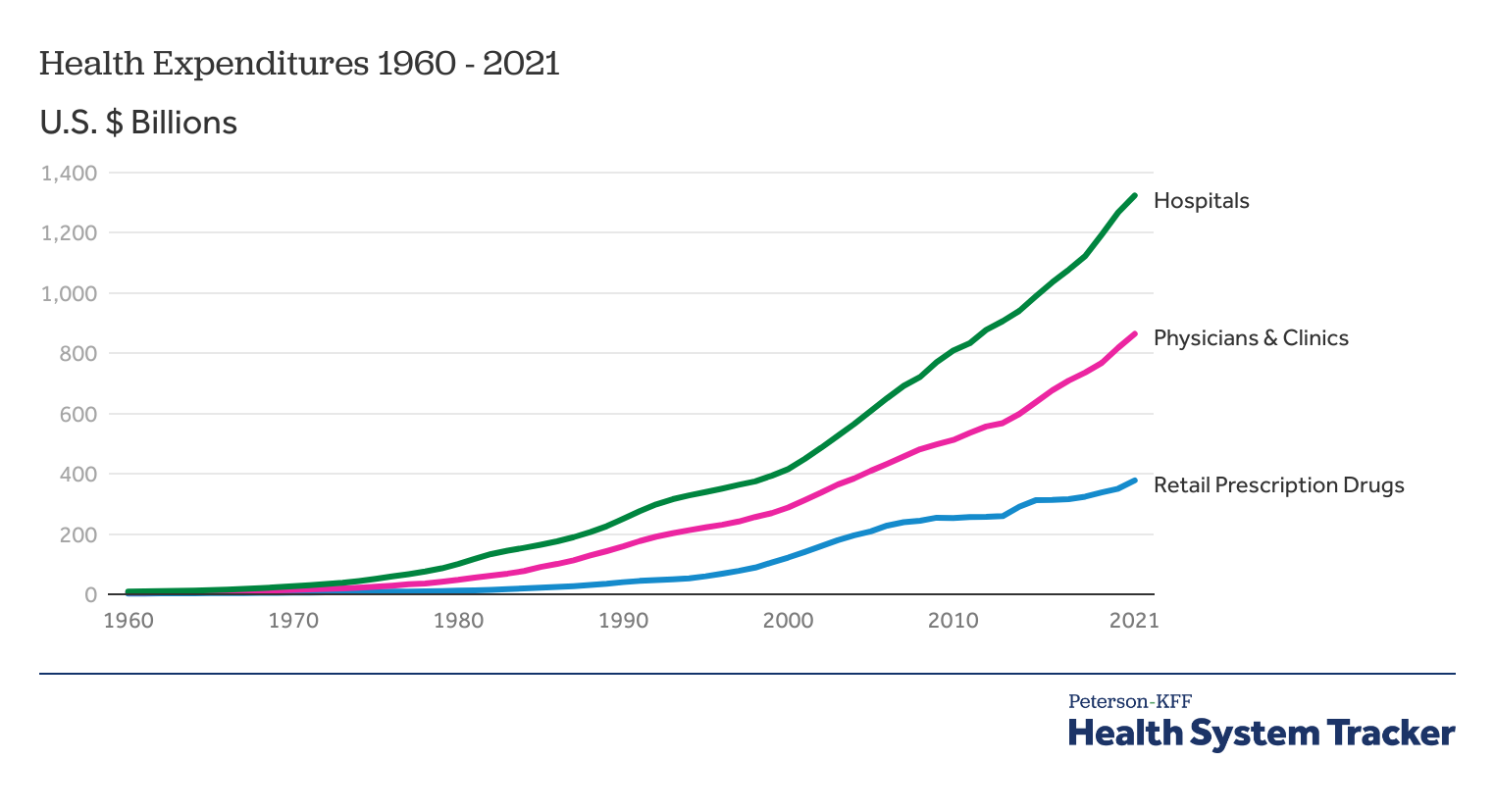

According to the Centers for Medicare & Medicaid Services (CMS)1, in 2022, healthcare costs skyrocketed to $4.4 trillion. Despite decreased health services during the COVID-19 pandemic, CMS expects national health expenditures to reach $6.8 trillion by 20302.

With no end in sight to rising health insurance costs, it’s important to understand what exactly causes these spikes in the first place. Let’s look at nine key factors for rising healthcare costs in the U.S. and how you can help your employees offset their medical expenses with a health reimbursement arrangement (HRA) or employee stipend.

Find out if an HRA or stipend is better for your organization with our comparison chart

1. Medical providers are paid for quantity, not quality

Most health insurance companies—including Medicare—pay doctors, hospitals, and other medical providers under a fee-for-service system that reimburses each test, procedure, or office visit. That means the more services they provide, the more money they receive.

This can encourage a high volume of redundant testing, overtreatment, or overprescribing—particularly for patients with a low potential for improved health outcomes.

Additionally, the U.S. healthcare system doesn’t use an integrated approach. The World Health Organization3 defines integrated health services as “the organization and management of health services so that people get the care they need, when they need it, in ways that are user-friendly, achieve the desired results, and provide value for money.”

So, what does that have to do with cost? Integrated health means providers, management, and support teams communicate with one another on a patient’s care. In an unintegrated health system, the lack of coordination can result in patients receiving duplicate tests and paying for more procedures than they truly need.

2. The U.S. population is becoming more unhealthy

According to the Centers for Disease Control and Prevention4 (CDC), six out of ten U.S. adults have at least one chronic disease, such as asthma, heart disease, high blood pressure, or diabetes, driving up health insurance costs.

Patients with chronic conditions often need long-term healthcare that’s more complex and resource-intensive than routine care. This includes more prescription drugs, emergency healthcare services, in-home medical care, and access to various support services—all of which come with a high price tag.

A staggering 90% of all U.S. healthcare costs5—roughly $3.7 trillion annually—are for treating chronic illnesses and mental health conditions. Moreover, recent data6 finds that nearly 72% of adults older than 20 in the U.S. are overweight or obese, leading to chronic diseases and inflated health spending—especially if these individuals delay medical care for a condition that could be easier and cheaper to treat early on.

As these health issues increase, the risk of insuring the average American goes up. And in turn, the higher the risk, the higher the annual premiums cost. KFF7 found that the average annual premium for family health insurance coverage rose from $15,745 to $22,463 over the past decade, an increase of 42.67%.

3. Newer healthcare technology is more expensive

Medical advances can improve our health and extend our lives. But, reliance on these upgraded systems and tools can also lead to increased medical spending and overutilization of expensive technology.

Many individuals associate more advanced technology and newer procedures with better healthcare. While this can be the case, there’s one thing for sure—it’s more expensive.

When patients and doctors demand the newest treatments and machinery available, overall healthcare costs rise for all Americans to cover the expense—even if some individuals choose not to support the latest technology.

4. Many Americans don’t choose their own healthcare plan

About 159 million American workers get their health insurance through their employer. But, employers typically don’t consult their employees when choosing their group health plan. Employers often decide their health insurance policy based on their company’s budget, available insurers, location, and administrative burden.

That means nearly half of Americans don’t make any consumer decisions about the cost of their insurance because their employer has already determined it.

In 2022, the average monthly premium for individuals with employer-sponsored health insurance was $659 for self-only coverage and $1,871 for family coverage. In addition to monthly premiums, each plan has an annual deductible, coinsurance, copayments, and other expenses that can increase out-of-pocket costs.

While organizations receive incentives to purchase more expensive health insurance plans for tax reasons, they may leave employees in a financial bind. Even low- or no-deductible health plans with small copay amounts can encourage overuse of care, driving up demand and cost.

5. There’s a lack of information about medical care and its costs

Despite the wealth of information at our fingertips online, there’s no uniform or quick way to understand treatment options and the cost of care. We’d never buy a car without comparing models, features, gas mileage, out-of-pocket cost, and payment options—yet this is how we buy healthcare.

According to the Milkin Institute8, only 12% of the U.S. population is proficiently health literate. Health literacy is the degree to which individuals can process and understand basic health information and services they need to make appropriate health decisions. This lack of understanding can lead people to make the wrong choices when choosing medical care, which can result in costly mistakes.

But even when hospitals make their service prices available, they’re often challenging to navigate and understand. To mitigate this lack of transparency, Congress passed the No Surprises Act in January 2022.

The Act aims to reduce surprise medical bills under private health insurance plans and create better pricing transparency to improve the patient experience, control costs of expensive health conditions, protect against balance billing, and provide individuals with Good Faith Estimates.

6. Hospitals and providers are well-positioned to demand higher prices

According to the American Hospital Association9, mergers and partnerships between medical providers and private insurers are some of the more prominent trends in America’s healthcare system.

These partnerships allow hospitals to expand service offerings, broaden networks, increase access to specialists, and better serve patients with high-quality care. But it’s also reduced individual market competitiveness. Without this competition, these near-monopolies have providers and insurers in a position where they can drive up their prices unopposed.

For example, one study10 analyzed several metropolis areas with high hospital consolidations for three years. In most areas, the average hospital stay increased between 11% and 54% during the given period.

Consolidated private insurance companies can secure lower prices from healthcare providers because they have more bargaining power. But even so, studies have found that lower provider prices don’t necessarily translate to lower premium prices for consumers.

7. Fear of malpractice lawsuits

Frequently called “defensive medicine,” some doctors will prescribe unnecessary tests or treatment out of fear of facing a lawsuit.

The price for these treatments increases over time—a study has shown11 that the total cost of defensive medicine is around $46 to $300 billion yearly, almost 3% of national healthcare spending. This isn’t surprising, given that our current regulatory system is designed to support the fee-for-service healthcare delivery and payment model.

Almost 77% of U.S. surgeons12 have been subject to a lawsuit by a patient during their career. To avoid this, some surgeons and medical providers perform unnecessary tests to cover all their bases, which leads to wasteful spending.

8. Inflation’s impact on the economy

Healthcare inflation has increased due to patients returning to doctor’s offices after canceling necessary services during the COVID-19 pandemic. Inflation affects the costs of operations, supplies, administration, and facilities. Additionally, healthcare facilities have taken a hit due to staff shortages and lower annual incomes for staff members.

As of June 202313, overall inflation prices had grown by 3% from the previous year. But, medical prices only increased by 0.1% during the same time frame. Even though healthcare inflation hasn’t outpaced general inflation, some medical services and items saw increased costs.

Annual costs for hospital services and equipment—including inpatient (3.7%), outpatient (5.7%), nursing care facilities (3.3%), and medical equipment (9.7%)—rose the most. Prescription drugs and physician services had lower price increases (3.1% and .5%, respectively).

Many individuals worry that healthcare inflation will eventually overtake any increase in their annual income, so they decide to cancel or postpone their care until they can get their financial situation under control.

But, due to the delayed effect of inflation in healthcare, patients should get their healthcare needs fulfilled sooner rather than later, especially if they have chronic conditions.

9. The U.S. population is growing older

Baby Boomers make up almost 21%14 of the U.S. population—and they’re quickly reaching retirement age. According to the U.S. Census Bureau, Americans aged 65 and older will comprise nearly 25% of the population by 206015. This means the U.S. healthcare system will have more Medicare enrollees than ever before.

Because Medicare is a federal government program, a rise in enrollees will impact national healthcare costs for everyone. The U.S. spent $900.8 billion16 on Medicare in 2021, and CMS projects that Medicare costs will rise by 7.6% every year until 2028 to meet the increase of future enrollees17.

In addition to Medicare strains, older individuals tend to spend more on healthcare than younger people. They often require frequent primary care physician visits, medical services, prescription medication, or ongoing treatment for a chronic condition, contributing to overall spending and rising medical costs.

How an HRA or stipend can alleviate rising healthcare costs

As healthcare spending continues to climb, there’s never been a better time to offer your employees a personalized health benefit, like an HRA or stipend.

With an HRA, you can reimburse your employees, tax-free, for their monthly individual health insurance premiums and out-of-pocket medical costs. HRAs help you better control your health benefits budget, avoid unexpected rate increases, create customized plan designs, and give your employees more control over health spending, no matter their current health status.

There are two types of HRAs you can offer as an alternative to group health insurance:

- The qualified small employer HRA (QSEHRA), which is for small businesses with fewer than 50 full-time equivalent employees (FTEs).

- The individual coverage HRA (ICHRA), which is for organizations of all sizes.

If you already have a group plan, there’s an HRA for you. Integrated HRAs, or group coverage HRAs, are for employers of all sizes looking to supplement their group health insurance policy by reimbursing employees for out-of-pocket medical expenses the group plan doesn’t fully cover, like deductibles, coinsurance, and copays.

Integrated HRAs work with any group health plan. But you can save even more by using a high-deductible health plan (HDHP) with an integrated HRA. You and your employees can save money on your monthly premiums with an HDHP, and the HRA will cover out-of-pocket costs and health services that the lower-tier plan may not cover.

In addition to an HRA, you can offer your employees a health or wellness stipend for even greater coverage. With a health stipend, employees receive a fixed, taxable amount of money (typically added directly to their paycheck) to spend on out-of-pocket medical bills, including insurance premiums.

If you want to encourage preventive health habits, reduce the likelihood of chronic health conditions, and improve morale, you can also offer a wellness stipend to reimburse employees for expenses like gym memberships, fitness apps, mental health counseling, and more.

Unlike HRAs, the IRS doesn’t consider stipends as formal health benefits, so they have fewer government regulations. Your employees can spend their money on whatever they choose, and you can’t ask them to prove they purchased medical care or require them to provide you with medical receipts.

Conclusion

While there’s no single reason to blame for rising health costs or a premium hike, understanding a few critical factors can help inform you of your options so you can make educated and financially strong healthcare decisions for yourself, your business, and your employees.

If you’re an employer with a group health insurance plan, an integrated HRA or a stipend are excellent ways to keep your health benefit and administrative costs low while offering your employees an affordable health benefit with greater coverage.

Get an integrated HRA or employee stipend through PeopleKeep by scheduling a call with a personalized benefits advisor today.This article was originally published on May 9, 2014. It was last updated on October 13, 2023.

- https://www.cms.gov/files/document/nhe-projections-forecast-summary.pdf

- https://www.cms.gov/newsroom/press-releases/cms-office-actuary-releases-2021-2030-projections-national-health-expenditures

- https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7880002/

- https://www.cdc.gov/chronicdisease/index.htm

- https://www.cdc.gov/chronicdisease/about/costs/index.htm

- https://www.singlecare.com/blog/news/obesity-statistics/#:~:text=What%20percentage%20of%20Americans%20are,of%20Public%20Health%2C%202020

- https://www.kff.org/report-section/ehbs-2022-summary-of-findings/

- https://milkeninstitute.org/sites/default/files/2022-05/Health_Literacy_United_States_Final_Report.pdf

- https://www.aha.org/fact-sheets/2023-03-16-fact-sheet-hospital-mergers-and-acquisitions-can-expand-and-preserve-access-care

- https://www.kff.org/health-costs/issue-brief/what-we-know-about-provider-consolidation/

- https://www.ncbi.nlm.nih.gov/pmc/articles/PMC9210603/

- https://www.medscape.com/viewarticle/967858?form=fpf

- https://www.healthsystemtracker.org/brief/how-does-medical-inflation-compare-to-inflation-in-the-rest-of-the-economy/

- https://www.statista.com/statistics/296974/us-population-share-by-generation/

- https://www.census.gov/content/dam/Census/library/publications/2020/demo/p25-1144.pdf

- https://www.cms.gov/data-research/statistics-trends-and-reports/national-health-expenditure-data/nhe-fact-sheet

- https://www.cms.gov/files/document/nhe-projections-2019-2028-forecast-summary.pdf

Ready to enhance your employee benefits with PeopleKeep?

Elizabeth Walker

Elizabeth Walker is a content marketing specialist at PeopleKeep. She has worked for the company since April 2021. Elizabeth has been a writer for more than 20 years and has written several poems and short stories, in addition to publishing two children’s books in 2019 and 2021. Her background as a musician and love of the arts continues to inspire her writing and strengthens her ability to be creative.