State by state guide to health insurance marketplaces

Health Benefits • July 19, 2023 at 5:00 PM • Written by: Chase Charaba

The Affordable Care Act (ACA) requires every state to have a health insurance exchange or marketplace. These exchanges allow individuals and small businesses to purchase their own health insurance coverage or get financial assistance through Medicaid or premium tax credits.

While some states use the federal exchange, others established their own state-run health insurance exchanges. This means that depending on where you live, you’ll need to know which exchange to use to find coverage.

This guide to the individual health insurance marketplaces explains what the exchanges are, how they differ, and which states have their own marketplaces.

What are the state and federal health insurance marketplaces?

The health insurance marketplaces are where individuals and families can shop for health insurance plans and receive access to premium tax credits. They can also purchase dental plans. Each state has an exchange residents must use if they want to enroll in marketplace coverage. These are either state-run marketplaces, state-federal partnerships, or the federal government’s Health Insurance Marketplace.

You aren’t required to purchase health insurance coverage through the marketplaces. Some employers offer group health insurance coverage to their employees. Individuals and families can also purchase a plan from the individual market through a private exchange or work with an insurance broker.

The health insurance exchanges allow you to get a qualified health plan that covers the ACA’s essential health benefits. Many people believe marketplace coverage is only for those with low incomes. However, anyone can find a plan that fits their needs. This misconception might stem from the federal subsidies available on the exchanges, such as premium tax credits. These subsidies lower your premiums and the government bases eligibility on the federal poverty level.

Now millions of Americans can get access to affordable health insurance coverage.

When can you enroll in marketplace coverage?

You can enroll in marketplace plans during open enrollment. This runs from November 1 through January 15 in states that use HealthCare.gov. States with their own exchanges can choose different open enrollment periods. All Americans must enroll in marketplace coverage by December 15 if they want their coverage to start on January 1.

Individuals can qualify for a special enrollment period (SEP) outside of the open enrollment period if they experience a qualifying life event.

How does a state-based marketplace differ from the federal Health Insurance Marketplace?

A state-based exchange is where a state government regulates the exchange. The state controls plan eligibility, enrollment, customer support, enrollment assistance, premium tax credit eligibility, and marketing efforts. States also deal directly with health insurance carriers to determine which plans they list on the marketplace.

The federal government runs HealthCare.gov and controls these functions in places without a state-run marketplace. This eases the burden on many states that don’t have the capacity or funding to run a state-based exchange.

There are also state and federal partnerships. Some states manage their own exchanges but use the federal Health Insurance Marketplace for enrollment.

Health insurance marketplaces by state

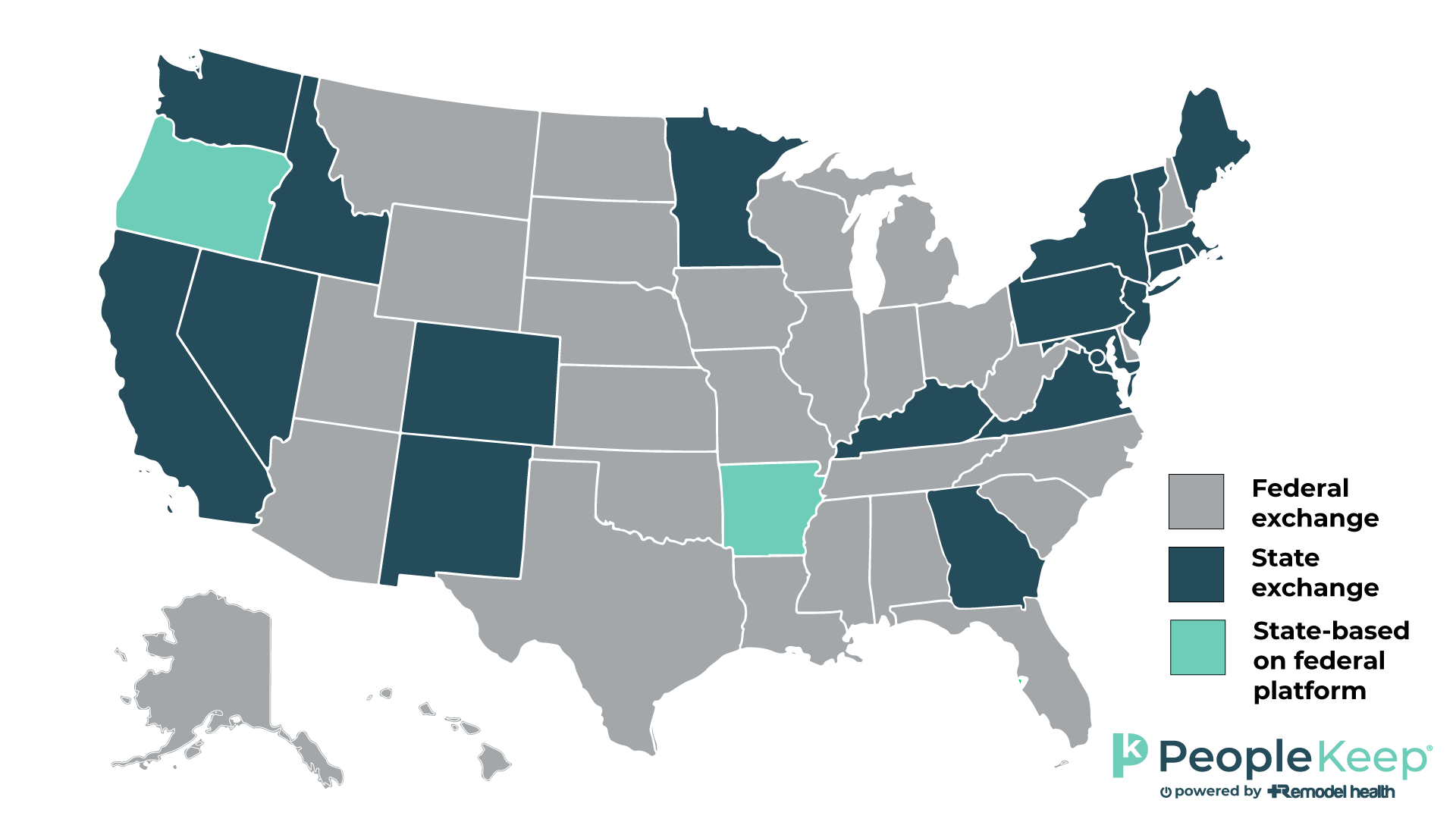

As of 2023, 18 states and D.C. have state-based marketplaces, two have a state-based marketplace that uses the federal platform, and 30 states use the federal Marketplace.

| State/District | Individual health insurance marketplace1 |

| Alabama | HealthCare.gov |

| Alaska | HealthCare.gov |

| Arizona | HealthCare.gov |

| Arkansas | My Arkansas Health Insurance Marketplace (uses HealthCare.gov for enrollment) |

| California | Covered California |

| Colorado | Connect for Health Colorado |

| Connecticut | Access Health CT |

| Delaware | HealthCare.gov |

| District of Columbia | DC Health Link |

| Florida | HealthCare.gov |

| Georgia* | HealthCare.gov |

| Hawaii** | HealthCare.gov |

| Idaho | Your Health Idaho |

| Illinois | HealthCare.gov |

| Indiana | HealthCare.gov |

| Iowa | HealthCare.gov |

| Kansas | HealthCare.gov |

| Kentucky | Kynect |

| Louisiana | HealthCare.gov |

| Maine | CoverME |

| Maryland | Maryland Health Connection |

| Massachusetts | Massachusetts Health Connector |

| Michigan | HealthCare.gov |

| Minnesota | MNsure |

| Mississippi | HealthCare.gov |

| Missouri | HealthCare.gov |

| Montana | HealthCare.gov |

| Nebraska | HealthCare.gov |

| Nevada | Nevada Health Link |

| New Hampshire | HealthCare.gov |

| New Jersey | Get Covered NJ |

| New Mexico | BeWellnm |

| New York | New York State of Health |

| North Carolina | HealthCare.gov |

| North Dakota | HealthCare.gov |

| Ohio | HealthCare.gov |

| Oklahoma | HealthCare.gov |

| Oregon | Oregon Health Insurance Marketplace (uses HealthCare.gov for enrollment) |

| Pennsylvania | Pennie |

| Rhode Island | HealthSource RI |

| South Carolina | HealthCare.gov |

| South Dakota | HealthCare.gov |

| Tennessee | HealthCare.gov |

| Texas | HealthCare.gov |

| Utah | HealthCare.gov |

| Vermont | Vermont Health Connect |

| Virginia | Virginia's Insurance Marketplace (new for 2024 open enrollment) |

| Washington | Washington Healthplanfinder |

| West Virginia | HealthCare.gov |

| Wisconsin | HealthCare.gov |

| Wyoming | HealthCare.gov |

* CMS approved Georgia's plan to launch a state-based exchange in 2024 for 2025 open enrollment.

** Hawaii previously ran a state-based marketplace called Hawaii Health Connector.

What health insurance plans are available on the marketplaces?

The plans available for individuals and families depend on your state. Some states will have more carriers and options than others. But, every exchange has plans that fit the different ACA metallic tiers of health coverage.

These plans range from bronze to platinum and cover different amounts of your healthcare costs. Catastrophic health plans are also available for those under 30. Bronze plans have lower monthly premiums but higher deductibles than other metal levels. In contrast, platinum plans have the highest monthly premiums and lowest deductibles.

The types of health insurance available2 on the marketplaces include the following:

- Exclusive provider organization (EPO)

- Health maintenance organization (HMO)

- Point of service (POS)

- Preferred provider organization (PPO)

How individual health insurance benefits employers

If you’re an employer, you may wonder how individual health insurance benefits your organization. Traditional group health insurance is expensive and complex. These plans often come with minimum participation requirements and annual rate increases that small businesses and nonprofits struggle to meet.

Instead, employers can provide a health reimbursement arrangement (HRA) to their employees. This allows employers to reimburse their employees tax-free for their qualifying medical expenses and, depending on the HRA, individual health insurance premiums. This allows employees to choose the health plan that best fits their unique needs while saving organizations time and money.

The two types of HRAs that can reimburse individual health insurance premiums are:

- The qualified small employer HRA (QSEHRA): A QSEHRA is specifically for organizations with fewer than 50 full-time equivalent employees (FTEs).

- The individual coverage HRA (ICHRA): An excellent health benefit for organizations of all sizes. Applicable large employers (ALEs) that offer an affordable allowance can use an ICHRA to satisfy the employer mandate.

When you offer an HRA, your employees will use their state or federal marketplace (or an insurance broker) to enroll in individual coverage. You’ll offer a monthly allowance to reimburse your employees for their eligible expenses, and your employees then request reimbursement for their expenses.

By administering your HRA through PeopleKeep’s employee benefits software solutions, you can save time on ensuring proper compliance. We’ll review your employees’ expenses for you and help you through every step of the process.

Conclusion

The state and federal health insurance marketplaces provide millions of Americans with access to affordable healthcare coverage. Depending on where you live, you’ll either use a state-run exchange or the federal exchange. No matter which one you must use in your state, the ACA guarantees standard levels of coverage.

By understanding which exchange your state uses you’ll be better prepared for open enrollment.

Ready to enhance your employee benefits with PeopleKeep?

Chase Charaba

Chase Charaba is the content marketing manager at PeopleKeep. He started with the company as a content marketing specialist in early 2022. Chase has written more than 350 blog posts for various companies and personal projects throughout his career. He’s worked for digital marketing agencies, in-house marketing teams, and as the editor for national award-winning high school and college newspapers. He’s also a YouTuber, landscape photographer, and small business owner.